This time, with better math!

A little while ago I wrote that, as a fiduciary, I worried about the sustainability of endowments and retiree portfolios, which traditionally have drawn 5% and 4% respectively from assets per year, in the conventional belief that this is ‘sustainable.’

These 4% and 5% rules of thumb for the past 50 years guided fiduciaries and retirees that live off of savings, or endowment managers who parcel out funds annually to run non-profits such as schools and hospitals.

My argument was admittedly simplistic – basically, that with bond yields as low as they are (2% on 10-year bonds) nobody has a prayer at financial sustainability without going far out on the risk spectrum – essentially all stocks, or all risky assets – just to break even with a 4% or 5% draw. I specifically did not consider forward-looking projections when arguing for the unsustainability of current endowment or retiree practices.

We can’t see the future, I said, so I can’t predict. All I can know is that you’ve got to take a lot of risk if you want to stay sustainable, and that’s not very comfortable for most of us.

I was pleased to see a more sophisticated presentation of this idea, which actually makes a mathematical and credible case for low future return expectations.

Basically, their conclusion is the same, only their math is better.

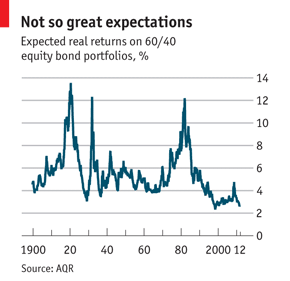

The embedded picture is explained best by the Economist, but I’ll try to express it as well, to save you the click-through.

A quantitative strategist at hedge fund AQR Group built this picture, which purports to show the expected real return of a 60/40 stock/bond portfolio available today.

Equity returns are calculated by averaging:

1. The Earnings/Price ratio of a broad basket of stocks[1] and

2. Dividend yield plus 1.5% (to allow for long-run growth.)

Bond returns are calculated as the difference between 10 year US Treasury bond yields and inflation expectations.

All of these are totally reasonable ways of calculating expected future real returns based on a 60/40 stock/bond mix. The picture we get, according to AQR, is that real return on assets may be reasonably projected as the lowest in over 100 years, at somewhere below 3%.

I’m left pretty worried for retirees and endowment managers drawing 4% and 5% from their principal every year.

Post read (7395) times.