Why is Jon Corzine still a free man?

Why is Jon Corzine still a free man?

As the WSJ points out, investigators still have not located $1.6 Billion of supposedly segregated customer money that disappeared three days before the firm declared bankruptcy October 31 2011.

In the history of CEO falls from grace, Corzine’s MF Global debacle ranks far worse than Lehman’s Dick Fuld or Bear Stearns’ Jimmy Cayne. In the latter case, Fuld and Cayne stand guilty of poor risk management combined with horrific timing. Their worst crime was failing to reverse course in the face of a financial storm, which frankly, most executives in their position also failed to anticipate properly. Fittingly, Fuld and Cayne and their cohorts suffered a significant financial setback and some brutal whipping of their reputations in the public square.

To my knowledge, however, Bear Stearns and Lehman never misplaced customer money, the primary and original fiduciary sin. In the disorderly chaos of March 2008 (Bear’s shotgun purchase by JP Morgan) and September 2008 (Lehman’s Bankruptcy) managers properly segregated customer money, which was later returned to customers in due course.

Not so for MF Global customers, who still await word on the fate of $1.6 Billion of their money, originally held in custody by the now bankrupt firm.

At this point the proper CEO comparison with Corzine’s failure, unfortunately, is not Fuld and Cayne but Stanford and Madoff.

I should back up from my heavy condemnation here and explain what I mean. Corzine ran Goldman in the early years I worked there. While many or most fault him for having an outsized appetite for trading risk,[1] nobody has accused him in his career of actively seeking to defraud customers like Stanford and Madoff.

In my wildest paranoid fantasies I do not believe Corzine meant to permanently abscond with $1.6 Billion of customer money.

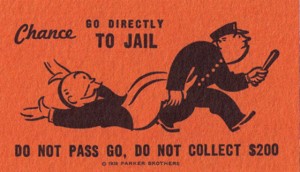

But – and this is why he should be in jail – I do believe that in a moment of weakness he knew (he knew and authorized!) MF Global’s teensy tiny borrowing of customer money to satisfy (just temporarily, I promise!) margin requirements (just for few hours only!) from creditors demanding margin call money immediately. In that scenario, Corzine most likely believed, and caused his employee[2] to believe, that a one-day use of customer funds would save a lot of hassle on margin requirements.

The obvious penalty for improperly using customer money is jail. Which is why I simply do not believe a treasury officer at MF Global would have made an unauthorized transfer without running it by the head of the firm. Corzine undoubtedly had a plan for a sale or recapitalization that would have made all the MF Global liquidity-squeeze problems go away, if he could just get a brief respite from the margin calls. In the end, a suitable suitor could not account for all of the firm’s capital and customer money, the rescue failed, and MF Global declared bankruptcy.

I believe it is right and proper that equity investors in Lehman, Bear and MF Global suffer losses, as they took a calculated risk in the hopes of profit. We forgive the capitalist who invests for a profit but suffers a loss.

But the vanishing of customer money held by a fiduciary is unforgiveable. It’s the ultimate financial sin, for which heads must roll. Corzine was the head and I’m afraid should not be a free man.

At least Madoff had the decency to turn himself in.

Please also see: Another Corzine Rant

and Update on Jon Corzine from the MF Global Trustee

[1] For which he was pushed aside by his executive team of Hank Paulson, John Thain and John Thornton in the Fall of 1998. The parallels with Corzine’s 1994 fixed income losses as the head of Goldman’s bond trading department, and his limitless trading appetite during the 1998 Long Term Capital Management episode, are obvious. With that kind of history, the MF Global trading debacle brought on by Corzine’s European bond trades is not surprising at all.

[2] Whoever actually entered the transfer request

Post read (3682) times.