Jake Taylor interviewed Wall Street Journal columnist Jason Zweig, who recently published The Devil’s Financial Dictionary and asked him “Five Good Questions”

Jake Taylor interviewed Wall Street Journal columnist Jason Zweig, who recently published The Devil’s Financial Dictionary and asked him “Five Good Questions”

Q1: What inspired him to write this book?

Zweig says he needed something to update on his website that didn’t give readers an ‘action-item’ in response to market conditions, since that doesn’t tend to be terribly useful.

So instead of a ‘buy this’ or ‘sell this’ Zweig just started posting a humorous definition or two to have fresh blog material. After a while of doing that, he had material for a book.

Frankly I’m jealous of that Zweig came up with that plan. Blog freshness ain’t easy.

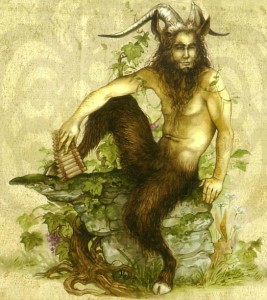

Q2: Taylor asked Zweig to explore the linkages between ‘Market Panic’ and The Greek God ‘Pan’

Zweig mentions the obvious link, with Pan as the ‘trickster.’

More interesting, he recalls that Pan is a fertility god, and suggests that the market destruction of a Panic also creates opportunity for growth, at lower prices. That’s a theme with which I concur.

Q3. Where does Zweig see his preferred investment style on the intersecting continuum of: “Diversification” vs. “High Concentration,” as well as maybe the alternate intersecting axis of “Be fully Invested Always” vs. “Stay in cash and opportunistic”

Zweig splits the Solomanaic baby, describing himself as preferring a mostly (70%?) diversified Total Stock Index, plus 10% cash, plus 20% concentrated positions, while also saying he’s highly restricted in what he can do in practice, because of his role at the Wall Street Journal.

Personally, I advocate the “100% diversified, 100% be fully invested” corner of the XY Axis.

Q4: Are the markets legalized gambling? Or do they serve a purpose of allocating capital?

Zweig answers that investors who figure out their own game are not subject to somebody else’s casino’s rules.

I have my own take on this question, which I wrote about here.

Q5: What quality should people cultivate be a good investor?

Zwieg’s answer is that investing success could plausibly derive from three sources

- Outwork everyone

- Be smarter

- Have emotional intelligence, self-knowledge and self-control

Of these, Zwieg says, the third is probably the most useful. Especially if this leads to cultivating patience.

I have answered this one in my own way, by saying that controlling your own investing behavior matters more than anything.

Near the end of the interview, Zweig quotes from his The Devil’s Financial Dictionary with two paired definitions:

Long Term – (adj) “On Wall Street a phrase used to describe a period that begins approximately 30 seconds from now and ends, at most, a few weeks from now.”

Short Term – (adj) “On Wall Street, 30 seconds or less. As opposed to Long Term, which is 30 seconds or more.”

Anyway, it all made me want to order The Devil’s Financial Dictionary, so I did.

Please see related posts:

Volatility in Stocks is a Good Thing

Behavior Matters More Than Anything

Post read (171) times.