A version of this post ran in the San Antonio Express News.

Please see related posts: LOTR Part I – One Rate To Rule Them All,

and LOTR Part II – How Money Is Born

and LOTR Part IV – Consumer rates

Three rates for mortgage brokers under the sky…

One for the Yellen on her dark throne

In the land of FOMC where the money’s born

The mortgage bond market sets the major interest rates we experience as real estate purchasers and mortgage borrowers. Because these rates are market-driven, they change from one day to the next, even from one moment to the next.

In my Lord of The Rates narrative from an earlier post the High Elves of the Mortgage Market own the 3 Mortgage Rates of Power, setting 30yr, 15yr, and short-term adjustable-rate mortgage (ARM) rates.

In an Earlier Age, I worked with those High Elves on the Goldman mortgage bond sales desk.

“Bid $1 Billion Fannie Mae 30year 5% in June”

“100-23+”

“Done.”

“Done.”

As fast as it took to read that, a mortgage-originating bank like Wells Fargo or Bank of America would promise to deliver a billion dollars worth of a diversified bundle of 30-year home mortgages, all with the same interest rate, two months from now, to Goldman’s mortgage bond structuring department. And the buyer responded with how much over face value they’d pay

The price Goldman paid for that bundle depended on an expectation of what price end-user bond buyers would pay for mortgage bonds, two months ahead.

Using Elven magic – known as securitization – our team at Rivendell would weave the dross of three thousand or so home mortgages into shimmering golden threads of valuable bonds, desired by investors all throughout Middle Earth.

That price paid – which again, fluctuated from moment to moment with the interest rate markets – ultimately drove the rate a home-buyer could lock in today.

The Fed funds rate – The One Rate To Rule Them All – anchors the interest rates that mortgage bond investors are willing to accept. And that One Rate To Rule Them All is about to go up.

Higher Rates Coming

When the Fed dropped the Fed funds rate in surprise moves in 2001, and again in 2008, mortgage bond investors accepted lower interest rates on their mortgage bonds. That lower rate allowed mortgage borrowers to save money, either by locking in new, cheaper, mortgage loans or through refinancing their existing mortgages.

Unfortunately, for home owners and buyers, we’re going the other way now.

Unfortunately, for home owners and buyers, we’re going the other way now.

When the Fed resets to a higher Fed funds rate – which it will do in either June or September this year – the bond investors of Middle Earth react by demanding higher returns on their bonds.

That demand for a higher return by bond buyers means mortgage originators will require future homebuyers to lock in higher rates on their mortgages. In addition, fewer borrowers will want to refinance, since they can’t save money that way.

Of course, I’m simplifying the timing. All interest rate markets are forward-looking, meaning that the probability of higher interest rates in the near term gets ‘priced in’ to interest rates throughout the mortgage system.

What I mean is this: The High Elves of Rivendell concern themselves with the future, even before it comes to pass. Professional mortgage bond investors already know rates will go up soon, so they’ve already begun to demand higher mortgage rates ahead of the FOMC’s move.

Still, higher rates will certainly affect real estate prices in the future.

Rates effect RE prices

At the risk of stating the obvious, higher mortgage rates tend to dampen the price of real estate.

With higher mortgage borrowing costs, home-buyers (as well as commercial real-estate buyers) typically can afford to buy less real estate for their money. So prices go down, or stay down, to match the newly-limited demand.

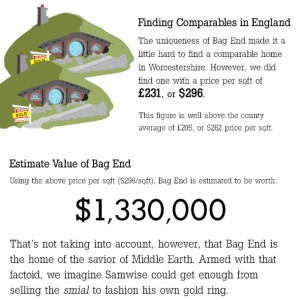

To give a quick example: A hobbit of Bag End with a $200,000 mortgage at 4% for 30 years on his burrow could expect to pay $956 per month.

That same hobbit, asked to lock in a 5% mortgage six months later – following an interest rate hike – would need to pay $1,075 per month. The $120 extra per month might be the difference between being able to afford the monthly cost of a new burrow – or not.

Since the real estate market – residential, commercial, and raw land alike – depends on borrowed money, the demand for real estate is very sensitive to interest rate changes like this.

Of course this was a huge reason why policy-makers desperately sought to keep rates low following the 2008 Credit debacle. Low interest rates provide a huge boost to real estate demand and therefore prices.

This in turn allowed the Sackville-Bagginses, in danger of foreclosure, the chance to work out their problems, sell at less of a loss, or deleverage their burrows less desperately.

This in turn allowed the Sackville-Bagginses, in danger of foreclosure, the chance to work out their problems, sell at less of a loss, or deleverage their burrows less desperately.

Hopefully the Sackville-Bagginses have already locked in a low mortgage rate on their burrow, because it gets harder to afford real ownership once rates go up.

When the One Rate To Rule Them All jumps this year, the mortgage and real estate markets will be among the first to feel it.

Please see related posts:

The LOTR – The One Rate To Rule Them All

And The LOTR – Fed Funds effect on Consumer Rates

Post read (1249) times.