A version of this post appeared in the San Antonio Express News.

I read with much interest the story last week of the San Antonio City Council approving a direct investment of $1.75 million in city funds to move three startup medical device manufacturing companies to San Antonio.

And by “much interest” I mean the story made me want to stab my own hand with a sharp pencil.

I hate this sort of thing.

Not because of straight up corruption

Let’s leave aside the obvious problem of ‘economic development’ schemes like this, in which public entities give targeted incentives to a specific, private company: You know, because private individuals who benefit may feel quite ‘grateful’ to their public sponsors. Public sponsors in turn – elected and appointed officials – may then have an incentive to direct public funds to private beneficiaries to keep the ‘gratefulness’ cycle going.

That’s all obviously just straight up corruption and not really what I’m aiming for here in my critique of city-directed ‘economic incentives’ for private companies. [1]

What I really hate about this is something quite different, having to do with three business concepts: selection bias, market efficiency, and the structural short-run conflict between entrepreneurial goals and public policy goals.

Taken together, they greatly reduce the odds that this type of economic development works out for the public good in the long run.

I’ll address these in order.

- Selection bias

Would you like your city (or state, or county) to grow companies focused on wooing public investment and public ‘economic development’ incentives? Or would you like your city to grow companies that focus on profitability without a public subsidy or public investment? Because the way you attract companies to your city (or state, or county) introduces a real selection bias to the pool of companies you end up with.

In my experience, the kind of startup company that takes public money – with all the attendant scrutiny, ‘job creation’ requirements and ‘salary’ minimums – is a different sort of company than one that achieves sustainability without that public money.

- Market Efficiency

Private investors constantly scour the market for small but growing companies that provide a reasonable chance at future profits.

Small but growing companies in turn often seek direct investments from private investors known as ‘angel’ or ‘venture’ capitalists.

It’s not a perfect system, and market inefficiencies occasionally arise.

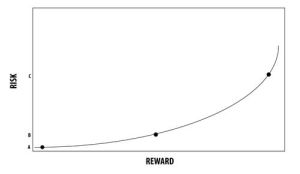

But when a company turns to public funds like this, what that signals to me is that private capital sources – the professional angel and venture capitalists – have already declined to invest in the growth of this company. That’s typically because professional angel and venture capitalists do not find the risk/reward profile of that investment sufficiently compelling.

Now, professional investors may be wrong to have overlooked the growth and profitability potential of these medical device companies.

The angel investing market may be inefficient.

Who knows? Maybe the City of San Antonio Economic Development team may have a market-beating strategy for identifying a positive risk/reward formula that private investors have declined to take. I mean, it could happen, right?

But I doubt it. And I would never bet on it.

- The short-run conflict between entrepreneurship and public policy goals.

Look, here’s the biggest problem.

Public officials want to be seen to create “jobs.” At “good salaries.” That’s fine.

But entrepreneurs don’t seek to create jobs. At any salary.

Entrepreneurs, at least the good ones, want to create the least number of jobs possible. I’m not saying this because entrepreneurs are inherently mean-spirited, but rather, because hiring people is expensive.

Successful small companies – and big ones too – have to constantly try to eliminate jobs to make a company financially sustainable. The market is too darned competitive to survive when you’re burdened with too many people on the payroll. If public officials get the chance to dictate the number of jobs, and the salary minimums of jobs, I guess I have my doubts about how that business is being run.

You show me an entrepreneur willing to be told by a city entity how many people to hire, when to hire them, and what to pay them, then I will show you an entrepreneur who isn’t going to make it in the long run.

A tangential, but I think illustrative, note: The biggest joke of Mitt Romney’s 2012 presidential candidacy was his claim to be a ‘job creator.’ Romney was no ‘job creator.’ On the contrary, he was one of the most successful job destroyers of all time.

Because that’s what Romney’s firm Bain Capital is good at. They buy a company, wring out expensive costs (all those “good salary” jobs!) and then resell. In the short run, the more jobs you eliminate, the better. I’m not saying this to besmirch Romney’s record. I’m sure he was a fantastic capitalist. Cutting costs is what capitalists, and entrepreneurs do, and often that means eliminating jobs. But Romney as “job creator?” Give me a break.

I mention this to illustrate the short-run differences in goals between entrepreneurs and public policy officials

Ok, now back to San Antonio.

I hope I’m wrong

I hope to be completely wrong about this $1.75 million direct investment. Despite my misgivings, I will be thrilled when these three startup medical device companies spur innovation, trigger job growth, add to the ‘entrepreneurial ecosystem’ and even generate a positive return on public capital.

It could happen! I hope it happens!

But I would never, ever, choose to bet on it with my own money. And I’m sorry when the city chooses this for me.

Please see related posts on:

The “Economic Development” Catastrophe of Curt Schilling

The “Economic Development” deal with Nexelon Solar manufacturing

[1] That kind of obvious corruption is what the New York Times had in mind in pointing out in 2012 that Dallas-based tax consultant G. Brint Ryan worked to secure tax breaks for private corporations in Texas while personally donating $250,000 and $150,000 for the Governor and Lieutenant Governor respectively. I don’t mean all that, since it’s all too obvious how each group benefits there at the expense of the public good. I mean, who could deny it with a straight face?

Post read (1577) times.