We’ve been doing this health savings account thing wrong for a while. I’ll tell you about what we have been doing, but then also what I learned about that I wish I could have been doing.

I realized all this recently when it came time to pay for my 14 year-old’s braces.

Our FSA account

Fortunately, I thought, we had some money contributed to my wife’s employer-sponsored flexible savings account.

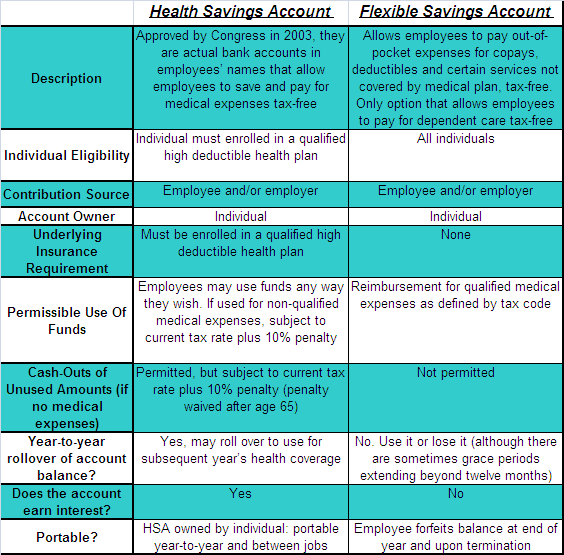

The nice thing about the flexible savings account (FSA) is that we contribute pre-tax money to the account, which ends up reducing our family’s income tax bill. As the employer website explains, “In most cases you save about 30% on your Federal taxes. The average tax savings for a person earning $50,000 who contributes $2,000 into an FSA is approximately $600.” Now, $600 is cool.

But then there’s the not-so-cool thing.

This account is labeled “use it or lose it.” That means we have to spend it within a year, or the money is permanently lost. As the plan says “Any amounts you do not use throughout the plan year…will be forfeited.” That is…not cool.

Since we knew we had multi-thousand dollar orthodontist expenses on the horizon, it made sense to contribute to the FSA account this past year. Without that, or some other known multi-thousand dollar expense, it would be hard to recommend the FSA.

This is the kind of complexity only bureaucrats locked in a room who never see the light of day, or the way actual people think about money, would appreciate.

“Use it or lose it” is a terrible way to save money and I highly doubt we’ll go back to the FSA after this year, except I suppose in the year when daughter number two needs her weird teeth fixed as well.

For the curious, I learned the reason for ‘use it or lose it.’ Employers keep unused FSA funds to supplement occasional losses they incur when employees pay for health expenses but then leave their employment before fully repaying money spent. But even though I understand it, I don’t have to like it.

But in the course of learning about our not-so-great FSA plan, I got to learn about why sophisticated finance people swear by a different kind of tax-advantaged account used for health care costs.

The Account For Super Savers: HSA

Wise financial folks – especially a category we could call “super-savers,” consider the Health Savings Account (HSA) a powerful tax-advantaged savings tool, up there on par in the priority list for tax-efficiency with things like Roth IRAs. I hadn’t previously understood why, but now I know. Here’s what I learned.

For starters, you may only be eligible for an HSA with a high-deductible health insurance policy. If you are eligible, you could contribute up to $3,500 yourself, or $7,000 for your entire family, per year. Contributions are considered “pre-tax,” meaning the up-to $7,000 reduces your taxable income by that amount in the year you contributed. Not only that, but in the fine print of HSAs you learn you get to save on FICA taxes (Social Security and Medicare) as well for your contributions, which you can’t do with IRAs contributions. So in that way at least it’s more tax-efficient than a traditional IRA.

Contributed funds can be invested in a way similar to the way IRAs can be invested. Like stocks and mutual funds and things like that.

But here’s where HSAs become more powerful than expected, because of two rules. First, there’s no time limit on when you withdraw the money. If you’re lucky and healthy and don’t need to withdraw funds for years or even decades, it theoretically grows in your tax-protected account for all that time. You can decide to pay for medical stuff this year, or you can instead elect to pay for medical stuff with cash and allow your HSA balances to grow. Just keep your receipts for later. You’ll see why that’s something to consider, in just a moment.

Second, when you finally do withdraw funds for a medical expense, withdrawn money is tax free again. This is big. That’s not how retirement accounts like traditional IRAs work. With retirement accounts you pay taxes either on the way in or on the way out. With HSAs, for qualified medical expenses, you don’t pay any taxes on the way in or on the way out. That tax advantage alone makes the HSAs, in their own small way, cooler than regular retirement accounts.

Now, we can safely assume that we all have some medical expenses in our elderly future, so we will likely be able to use the money in the account some day.

A Hidden Retirement Account, But Better

But even if you don’t have many medical expenses, there are even more goodies. The HSA actually is a hidden retirement account. That’s because after age 65, you can withdraw funds for any reason at all, without penalty. You might want to just go back and read that phrase again. Any reason at all. So, after age 65, it is just like a traditional IRA. And if you withdraw after age 65 for medical expenses, it’s better than an IRA. What’s the downside? Basically none, except tracking medical receipts to match up account withdrawals with qualified expenses.

For super-savers, people who have plenty of income and want to take full advantage of eligible tax reduction strategies, this is the way they do it: They contribute the maximum amount to their HSAs, investing money for the long run. As health costs come up, they pay out of pocket and accumulate the receipts for expenses. Years later, even decades later in retirement, they decide to make payments on the old receipts out of the HSA. Remember, those withdrawals are tax free.

This HSA is triple tax free – tax-free on the way in, tax-free growth for years, and tax-free on the way out. The more you contribute and accumulate medical expenses that can be reimbursed, the more that lump sum of money upon withdrawal can be a clever tax-reduction strategy for retirement. For this reason, super savers believe you should maximize your HSA before you maximize your 401(k) or 403(b) plan.

The HSA is a super-charged tax-advantaged account, not just for health, but for retirement as well.

It turns out, my wife’s employer does not have a high-deductible health insurance plan, so we have not been eligible for an HSA this whole time. But if you’re eligible, now you know what to do.

A version of this post previously ran in the San Antonio Express News and Houston Chronicle.

Post read (1103) times.