This post features obscure business tax accounting rules you’ve never heard of and (hopefully) will never encounter.

This post features obscure business tax accounting rules you’ve never heard of and (hopefully) will never encounter.

(Do I know how to write a blogpost lede, or what?) And pot. It’s about pot. Did I forget to mention that?

Ok, nobody thinks they want to know about obscure accounting rules but maybe – like me – you get a kick out of learning the unexpected consequences of imperfect regulatory and taxation systems? Come along with me, this will be fun, I promise.

Business Opportunity

My high school buddy Brian sent me an email about a month ago with an intriguing business investment opportunity. Would I like to invest in his licensed medical cannabis farm in New Mexico?

He has acquired – through an expensive upfront investment and a rigorous application process – one of only 35 licenses to operate a medical marijuana operation in his state. His business is expanding like a weed (heh) to grow his full allotment of 450 plants on a 16-acre farm, meeting the demand of an estimated 20,000 licensed New Mexicans with medically-approved conditions for marijuana consumption.

My literal answer to his query was “no.” On the other hand, I do love learning about startups, especially in a fast-growing, complicated, business like his. So we talked.

Marijuana, Officially

If you haven’t been paying much attention to the slow rollout of legal marijuana in the United States, here’s your quick update, before telling you about my buddy’s obscure business tax problem.

The federal government considers marijuana – alongside heroin, LSD, and Ecstasy – as a “Schedule I” substance, meaning it’s classified as one of the most dangerous of all drugs, with a high potential for abuse, and no currently accepted medical use.

Meanwhile, between 2012 and now, five geographies declared marijuana legal to produce and consume in a highly taxed and regulated way: Colorado, Washington, Alaska, Oregon, and Washington DC. Another 36 states, including New Mexico and Texas, have opened up legislative windows for some legal, medically-approved, use.

Even Texas?

Legalization, for example, is coming to Texas faster than you expect. As reported in the San Antonio Express News the law passed last year and signed by Governor Abbot created conditions for approving the use of non-intoxicating cannabis oil for epileptic patients. Entrepreneurs are already gearing up to apply for licenses and provide product. That looks to me like “gateway” legislation that will lead to heavier legalization in the future.

Specific challenges

Entrepreneurs navigating this emerging industry – like my friend Brian in New Mexico – face a unique set of problems.

The state auditing of everything is enormous. In some states, banks essentially refuse to engage with marijuana businesses. Licensing imposes severe restrictions. Like, The Man is making it tough all over, man.

Then we got to talking about obscure tax codes and my ears perked up.

As Brian explained to me, the fear of prosecution for underpayment of income taxes is a serious business hazard specific to his industry.

Don’t be Al Capone

One of the most interesting problems of producing and selling a product the federal government considers illegal – a “Schedule I” drug – is that even while the federal government considers your business illegal you still owe taxes on any illegal income.

Remember how Prohibition-era gangster Al Capone famously wasn’t convicted of murder and extortion, but rather, tax evasion?

When you make money illegally, you still need to pay taxes on your income. In fact you need to pay more than your usual share of taxes.

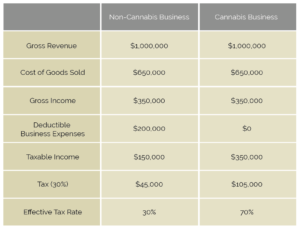

In the 1980s the IRS helpfully created tax code 280E to clarify how federally illegal businesses can – and cannot – account for expenses. The effect of the code is to dramatically raise the effective tax rate on illegal businesses. Or in this case, businesses legal in their own states, but illegal and liable for taxes at the federal level. I know, it’s awkward.

Limited “business expensing”

Under 280E, marijuana producers may not deduct ordinary expenses available to other businesses, like marketing, rent, packaging, transportation, and service providers like your attorney and accountant, not to mention such typical business expenses as travel and entertainment.

Marijuana producers may deduct a limited number of expenses related exclusively to the production of their specific product – what an accountant would describe as the “cost of goods sold” – such as seeds, electricity, and some labor. The IRS forbids any other expenses to offset marijuana revenues.

The effect of 280E is that marijuana businesses pay a much higher effective federal tax rate than other businesses.

How big is 280E?

In a fast-moving industry spreading from state-to-state, we can only guess, and maybe your guess is as good as mine.

The industry should generate more than $6 Billion in legal retail sales in 2016.

Will the businesses, in aggregate, generate a 10 percent profit, or $600 million in legal taxable income? That’s probably conservative, but stick with me a moment here.

I spoke with Taylor West, Deputy Director of the National Cannabis Industry Association who estimates that legal marijuana businesses pay effective corporate income tax rates ranging from 50% to 85%, compared to 15 to 35% for traditional businesses.

Let’s keep the math easy and say they pay an average of 20% more in income taxes than a traditional corporation, or an extra $120 million over what businesses pay in other industries.

I ran my $120 million estimate past West, who told me she’s unaware of any other estimates. I have no particular confidence that I’m right about my estimate, except I am confident about the following statement:

The single largest financial beneficiary of the burgeoning marijuana business is the federal government itself, through this extra federal income tax paid for illegal businesses.

I’m not sure what Alanis Morissette would say about that, but I’d call that ironic.

And that one statement is what I wanted you to know about obscure tax codes and the unintended consequences of an imperfect tax and regulatory system as it affects a fast-developing industry.

A version of this appeared in the San Antonio Express News:

Please see related post:

Why States Will Legalize Pot – The Money Reason

Post read (128) times.