Nominations are still open for the craziest frothy finance stories of 2021. Strong cases can be made (and I have made them!) for bitcoin and RedditBro GameStop short-squeezes. But maybe the uber example of frothy finances this year are SPACs.

Special Purpose Acquisition Companies (SPACs) existed before this current era, but really on the fringy margins of Wall Street. Now they are front and center.

SPACs are known as “blank-check” companies. You buy shares in a company that is just an empty shell. The shell sells 100 million shares for, say $10, raising a billion dollars. In the future – specifically, typically by next year – the managers of the SPAC promise to purchase a private company. At that point you find out what you, the shareholder, own!

Now, owning shares in a pile of cash worth approximately the pile of cash is ok, I guess.

You’re really trusting in the SPAC management’s private-company-purchasing skill. For that reason, SPAC managers like to put famous people on their team to build this trust. Former House Speaker Paul Ryan recently joined the management team of a SPAC run by Mitt Romney’s son. I have strong feelings about the trustworthiness of Paul Ryan, but that’s an earlier column.

The weird thing that’s been happening sometimes lately is the fact that shares go up when they are just a pile of cash, without any company purchased yet. Sometimes they go up a little, which is ok if you really believe in the Paul Ryans of the world and their ability to buy undervalued private companies.

But sometimes they go up a lot. Which is nuts. A SPAC that just bought an electric vehicle startup Lucid Motors in mid-February – a company that incidentally has never delivered a single vehicle to a customer – briefly climbed from $10 a share to above $50 a share. The Venn diagram of overlapping investors who like speculative electric vehicle startups and blank check companies apparently produced this briefly delightful mad rush to own the SPAC at $50 per share, when the cash value of the empty shell was still $10 per share. (They should have put the name bitcoin in there somewhere so that shares would reach $90.)

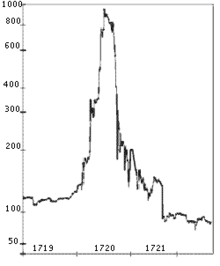

For historians reviewing the South Sea Bubble era, a classic headslapper description of a proposed venture was that it was “an undertaking of great advantage, but nobody to know what it is.” Haha that’s always a great laugh for financial historians – and the description is possibly apocryphal – but it is also a true and precise definition of exactly what is a SPAC.

While SPACs are not entirely new, they are definitely the new new hotness on Wall Street this year. SPACInsider.com reports a total of 226 SPAC transactions in the eleven years between 2009 and 2019. It’s been a slow build, with the years 2016 to 2019 seeing upticks of 13, 34, 46, and 59 SPAC transactions per year, respectively.

In 2020, we saw 255 SPACs announced.

2021 is shaping up as the year of the SPAC, with 348 total announced in just the first two months of the year.

On February 26 2021, the final trading day of the month, 13 SPACs launched. That’s as many in one day last week as we saw in all of 2016. In 2021, everybody loves backing blank check companies, undertakings of great advantage but nobody to know what they are!

The interesting feature of the South Sea Bubbles of 1720 was that the English press of the time understood that many of the new speculative schemes were somewhere between frauds and lottery tickets. The investing crowd in its wisdom did not seem to care what the press thought. Can you blame them? There was too much money to be made.

From 2004 to 2007 a lot of smart guys enjoyed buying condos in Florida “on spec.” Not to live in, but to flip to another buyer. Sometimes these condos hadn’t even been built or finished yet, so a $25 thousand deposit got you the right to pay $400 thousand for the finished condo. But then those smart guys would flip their purchase option rights for $75 thousand and keep the quick profit because the end price of the unbuilt condo was upped to $450 thousand, and there was no need to wait for the condo to be built in order to cash in. Anyway, some people made money doing this for a while.

In the dotcom bubble of 2000 or the housing bubble of 2008 it is simply not true that people did not find the market ridiculous. On the contrary, people thought that Pets.com was stupid in 2000, as was flipping unbuilt Florida spec condos in early 2008. It doesn’t matter. Other people were making money on it. Up until the point when they didn’t make money anymore.

Now, some froth at the creative end of capitalism is arguably good. If we collectively torch $1 trillion in investment capital on electric vehicles but end up also igniting a technological revolution that slows climate change, that’s maybe fine, even if it is painful for the folks who backed the wrong SPAC. (Incidentally, “Backed The Wrong SPAC” is the title of the first poem in my new book of financial slam poetry/rap that I just started working on right now, today.)

The internet boom of 1999 and 2000 ended in tears for many, including backers of Pets.com and Webvan, but overall that episode of financial frothiness probably helped raise buckets of useful capital for scrappy startups like Amazon and Google.

The same capital obliterated by telecom failures WorldCom and Global Crossing may have helped spur a lot of excessive investment in fiber optic cable. That bandwidth is essential to watching the massive volume of cute cat videos on Reddit that we all now consume.

SPACs are ridiculous investments, but sometimes you have to wait and see whether some financial ridiculousness and tragedy for speculators ends up with a silver lining for the broader economy and society.

And by the way, please do not misinterpret me. Do I mean you should sell your stocks because everything is going to crash? Of course not, never sell. Take the multi-decade view.

But also, please, please don’t buy stupid things.

A version of this post ran in the San Antonio Express News.

Please see related posts:

Bitcoin (hopefully for the last time)

Post read (252) times.