The Build Back Better Act pushed by the Biden administration and passed by the House last week contains a provision to raise the SALT cap from $10 thousand to $80 thousand.

This, for me, is peak irony. Like, Alanis Morissette should henceforth substitute her “It’s like a black fly in your Chardonnay” lyric to instead croon “It’s like SAaaaaaaaLT in Biden’s BBB!” That’s the level of high irony we’re talking about here.

First, some explanation of the SALT cap, which stands for State And Local Taxes deductions cap. Before Trump’s 2017 Tax Cuts and Jobs Act, which is understood correctly as a tremendous tax cut for the wealthy, taxpayers could itemize state and local taxes that they had already paid, and have them deducted from their federal income.

One of the only tax hikes of the 2017 reform was a cap on SALT deductions at $10,000. Before the cap, for example, if a taxpayer had already paid $30,000 in a combination of property and state income taxes, then their federal income would be considered $30,000 lower, for tax purposes. Limiting the SALT deduction at $10,000 would effectively mean that taxpayer owed taxes on $20,000 more dollars. The difference between $30,000 and the $10,000 cap.

Owning the Libs

This was widely perceived at the time as a fiendishly clever way to both raise revenue while simultaneously owning the libs. The libs, the thinking went, pay high property taxes and high state and local income taxes in places like California, New York, New Jersey, and Connecticut. This cap on tax exemptions seemed highly targeted to blue states. Many people’s taxes – particularly affluent libs who pay alot of state and local income tax and property taxes – went up by a lot, starting in 2018.

Now that Democrats run the House, Senate, and White House, they get to write tax policy in 2021. And while the BBB is described as a social spending bill, it is primarily a tax policy document.

The BBB seeks anti-poverty, equality, and climate goals largely through tax policy. Spending on climate is largely through tax breaks for clean energy. Spending on reducing child poverty is through an expansion and changed criteria of the earned income tax credit and the child tax credit. A drive for equality comes through expanding taxes on upper 1 percent and 0.1 percent earners. It’s a tax law through and through.

Not surprisingly, one of the key priorities for Democratic representatives from California, New York, New Jersey, and Connecticut was repealing the SALT cap. It’s not a thing they shouted from the rooftops. But certain key constituents made it clear this needed to get done. Now that BBB passed the House, Republican representatives are shouting it from the rooftops, and they will continue to do so.

This all matters – as most tax issues do – more to higher income and higher wealth people.

If the SALT deduction is lifted from $10 thousand to $80 thousand in the final BBB legislation (all of this is pending a Senate vote) blue-state Congresspeople are happy because every single donor who matters will be affected. They will have delivered for their people.

But we can see a few ironies piling up about the SALT Cap hike.

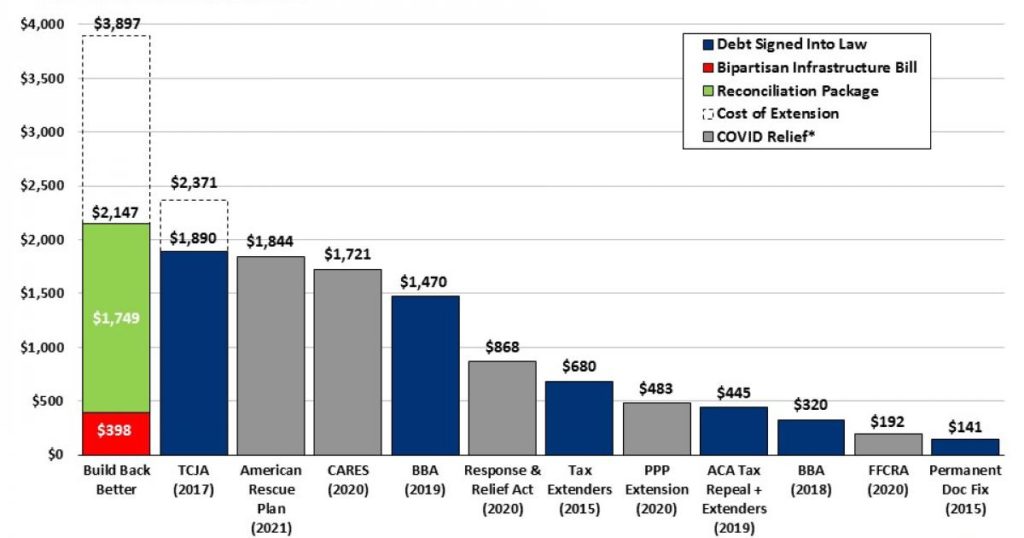

The bottom line of repealing the SALT cap is that it would be a very big benefit to the wealthy. Substantively, it will cost $85 billion a year in tax revenue. The top 1 percent of taxpayers will get about half this benefit, while the next ten percent will enjoy 35 percent of the benefit. This is all extremely off-brand for the Democratic Party in 2021. It makes an easy attack line for Republicans. Texas Representative Kevin Brady – the ranking Republican on the House Ways and Means Committee and therefore GOP point person for tax policy – immediately began hammering BBB for the SALT cap benefits to the wealthy.

But in Red States Like Texas…

Let’s go further, however, into the ironies. Unmentioned in the critiques of the SALT cap boost are how this will affect Texans for example.

Texas is a very high property-tax rate state, because of the absence of state income tax. In my county, for example, I pay 2.7 percent of market value for my home every year. That means anyone who owns a home worth more than $370 thousand has filled their SALT exemption on property taxes alone. With median home prices now above $300 thousand in my not-particularly-wealthy county, the SALT cap hits a lot of people. A lot of Texas homeowners. While there is not a majority of homeowners who are affected, there will be a large plurality.

All of this is to say that every Texas donor of means to Kevin Brady is also massively affected by the SALT cap. They are in that sense hoist upon their own petard. You just won’t hear Brady talking about it.

The SALT cap jockeying lays bare an uncomfortable fact of democracy. Namely, there’s a wide gulf between the “voter class” and the “donor class.” Lower income people, even in blue states, are not much affected by SALT caps. Higher income people and people who own valuable property, even in red states, are very affected by SALT.

For my part – my own valuable house and my hefty 2.7 percent property tax rate means I’m very affected. Even though the SALT cap hike is in that sense “fair to me” personally, I still think House Democrats should not have given me this tax break in the BBB.

Even if you revel in the “owning the libs” aspect of the SALT cap, there are further nuances at play. Namely, federalism.

Federalism

In the abstract, Republicans profess to believe more strongly in devolving power to states, versus Democrats who often seek to strengthen the central government at the expense of “states’ rights.” State and local taxation, however, is a key way in which citizens of a state exercise choice, engaging in the “50 laboratories of democracy” aspect of our federal system. When citizens of a state (small d) democratically choose higher taxes in order to, for example, improve health care access, that’s a valid choice. In the broadest sense, the SALT deduction serves as a mechanism for shifting spending and taxation power down to the state level. This again puts Democrats and Republicans in this SALT fight on the opposite side of where they usually land.

It’s just another ironic twist in the upside-down roles of SALT caps.

What happens next? A couple of Senators, Bernie Sanders (VT) and Robert Menendez (NJ), do not like the wealthy skew of the House SALT cap increase, and have plans to limit the benefits to those making less than $400,000 per year. I’m hoping Bernie saves the day.

Post read (127) times.