The two biggest macroeconomic worries in the US right now are burgeoning inflation and supply chain issues. A plausible narrative for both is that the rolling global COVID pandemic has disrupted our ability to efficiently move products to markets, while loose money policies have ignited inflation.

These both sound bad. But with markets, sometimes good or bad results depend on who you are. A disrupted supply chain for one business is an opportunity for another business. And high prices? Well, in recycling commodity markets for example, it’s the best market they’ve seen in the last ten years.

What does this mean? Recycled materials – in the big four categories of paper, metal, glass and plastic – all have secondary markets. The business goal of a recycling provider is to sort, package, and sell as cleanly as possible these four types of materials to the end user.

“Cardboard and paper prices are both on the rise. Plastic prices have skyrocketed compared to what they were, let’s say, five years ago,” Josephine Valencia, Deputy Director at the City of San Antonio Solid Waste Department, tells me. Her explanation points to the same macro trends we’re all worried about.

Valencia continues explaining high prices of recycled commodities, “In the past two years, and this is just my guess, it’s COVID-related supply shortages. There’s a shortage of just about everything these days. And I think that has really driven up the price of certain [recycled] commodities.”

So if you’re in the recycling business, these are the best of times.

If your personal subscription to the online newsletter “Resource Recycling” has recently lapsed, allow me to quote a few price changes for you.

Baled steel cans have risen from $78 per ton last year to $250 per ton.

Baled aluminum cans jumped from $0.45 a pound last year to $0.77 a pound last year.

On the paper side, corrugated containers trade for $171 per ton, up from $60 per ton last year. Another paper product, sorted residential paper, sells for $117 per ton compared to $38 per ton a year ago.

As the band Chic used to sing back in 1979, These. Are. The. Good. Times.

If you were hoping to have a disco-era earworm stuck in your head for the rest of the day, dating back to the last time we saw high inflation, you’re welcome.

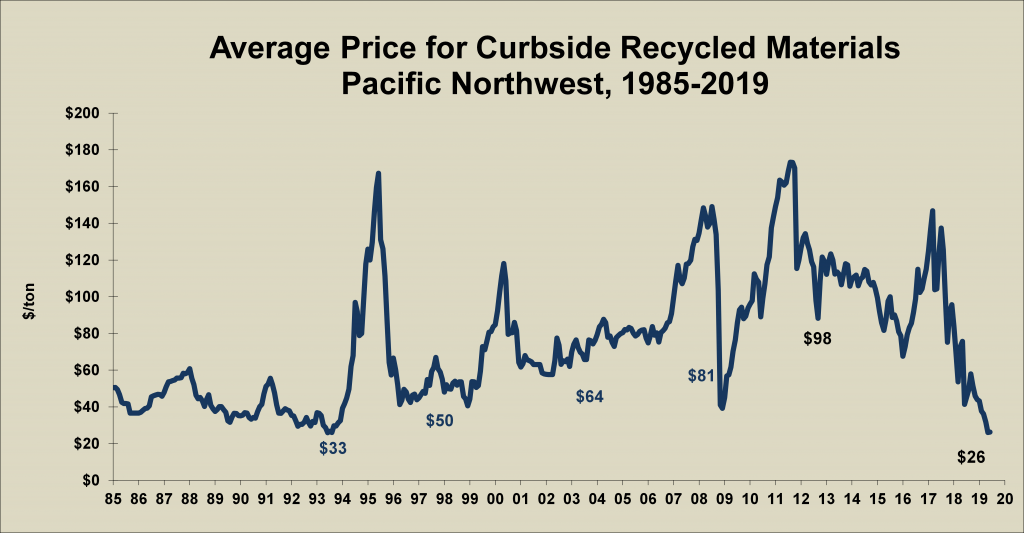

When last I checked in with the recycling markets in 2019, a few trends were made clear to me.

First, glass is infinitely recyclable but generally a money loser for recyclers unless it can be sorted by color and delivered to a nearby glass recycling operation. Second, paper and cardboard was in a multi-year decline because of the lack of demand for newsprint (RIP the newspaper industry!) and the awkward adjustment to a world in which ubiquitous Amazon cardboard didn’t fit traditional cardboard-sorting machines. Third, plastic prices were in freefall because China had begun refusing most deliveries. Fourth, metal was the only reliable money-maker.

But high prices in 2021 have swung recycling programs from losses two years ago back to a money maker. Things are a lot better now in San Antonio, for example, says Valencia.

I’m going to simplify the math a bit, but here’s the basic deal in my city. We pay approximately $50 a ton to dump recycled bins with the city’s provider, which currently is the large waste processor Republic Services. Republic sorts and processes the stuff, and then sells it in the secondary commodities market, and agrees to share half the resulting revenue with the city. If the revenue from sales generates $120 per ton, the city makes $60, and can count a “profit” of $10 per ton. That’s approximately the economics – admittedly simplified – right now.

In a bad year like 2019, the revenue share didn’t quite cover the upfront $50 cost to deliver, so the city had a “loss.” A bunch of other factors makes my explanation overly simple – they average out prices, contaminated commodities change the final revenue-sharing formula, losses can be carried forward – but Valencia endorsed my explanation as basically approximately true.

A factor which tempers the celebration of 2021 recycling profit is that – just like any business – the city’s costs are also affected by inflation. In the past year, the cost of purchasing new plastic household bins has increased from roughly $50 a barrel to $75 a barrel. Because they are made of plastic and plastic prices are way up. With a million barrels in circulation right now, that price increase affects the annual budget in a real way. And just as the price of new and used cars has increased, so too has the price of garbage trucks. In that past year, that’s gone up from $365 thousand per truck to $425 thousand per truck, says Valencia. Because of course trucks are made up of steel and plastic, all of which costs more now than last year.

“On the one side I can say, I’m excited as the city recycling revenues have gone up, so we’re making money. But on the other side, at the end of the day, we’re not sitting on a windfall because even though our revenues went up all our expenses went up as well,” continued Valencia.

Like any volatile financial market, hindsight is 20/20 and past performance is no guarantee of future results, included for recycled commodities. We don’t know what happens next.

By the way, the multi-generational fix that recycling experts would ideally have us do remains the same: Wean us off the big blue unsorted barrel of mixed commodity waste. We should all be sorting the multiple waste streams in our households into many different smaller homogenous-material barrels. Civilized countries (and by “civilized” I explicitly exclude here both the United States and the Republic of Texas) have figured out how to do this basic sorting at home. Everyone would recycle more stuff and make more money.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts

Recycling Markets were broken in 2019 – Part I

Post read (90) times.