The Dow Jones Industrial Average (DJIA) hit an all-time high last week, an event as inevitable as it is fundamentally meaningless to everyone not currently employed by Rupert Murdoch’s News Corporation, the owner of the Dow Jones & Co, inventor and keeper of the DJIA flame.

The Dow Jones Industrial Average (DJIA) hit an all-time high last week, an event as inevitable as it is fundamentally meaningless to everyone not currently employed by Rupert Murdoch’s News Corporation, the owner of the Dow Jones & Co, inventor and keeper of the DJIA flame.

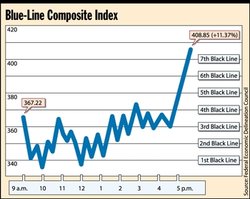

Remember, first of all, the Dow is a marketing tool

That is to say, I don’t blame the Wall Street Journal for crowing about a new arbitrary number on their Index, as the Dow is, after all, all about marketing. The Dow Jones’ upward move provides a marketing opportunity for the News Corporation’s media property and its media affiliates. No criticism there.

What is a shame, however, is that the plurality of the investing public who follow the market may not realize that the new high on the Dow means as much as an Onion article about

1. What really happened historically in the stock market,

2. What’s going to happen in the future, and

3. What you should do, investing-wise, about it.

Fortunately, you have your best friend, me, to give you the answers to these three questions, one at a time.

What really happened historically in the stock market

The recovery of broad stock indices to their previous highs of 2007 was inevitable, following the crash of 2008 and early 2009. I do not mean to claim that I could have told you at the lows of four years ago – March 2009 – whether the recovery of broad stock indices would happen by 2011 or 2015. Just like you, I had no idea, and I’m still agnostic about the short term direction of stocks now.[1]

What I really mean is that to assume anything other than inevitable growth in the nominal value of a broad stock index – over the medium to long run – is to assume a far-out scenario that has never yet occurred in modern times.

And to assume it’s anything other than inevitable is to place your tin hat firmly upon your pointy head and shut down your sensory gatherers to the data inputs of real life.

In the past one hundred years we’ve seen two World Wars, Depressions, small recessions, Great Recessions, Holocausts, Genocides, Earthquakes, Tsunamis, and the rise of Renée Zellweger as a bona fide movie star. Any one of these alone should have been enough to knock the equity markets permanently sideways, if such a thing were possible.

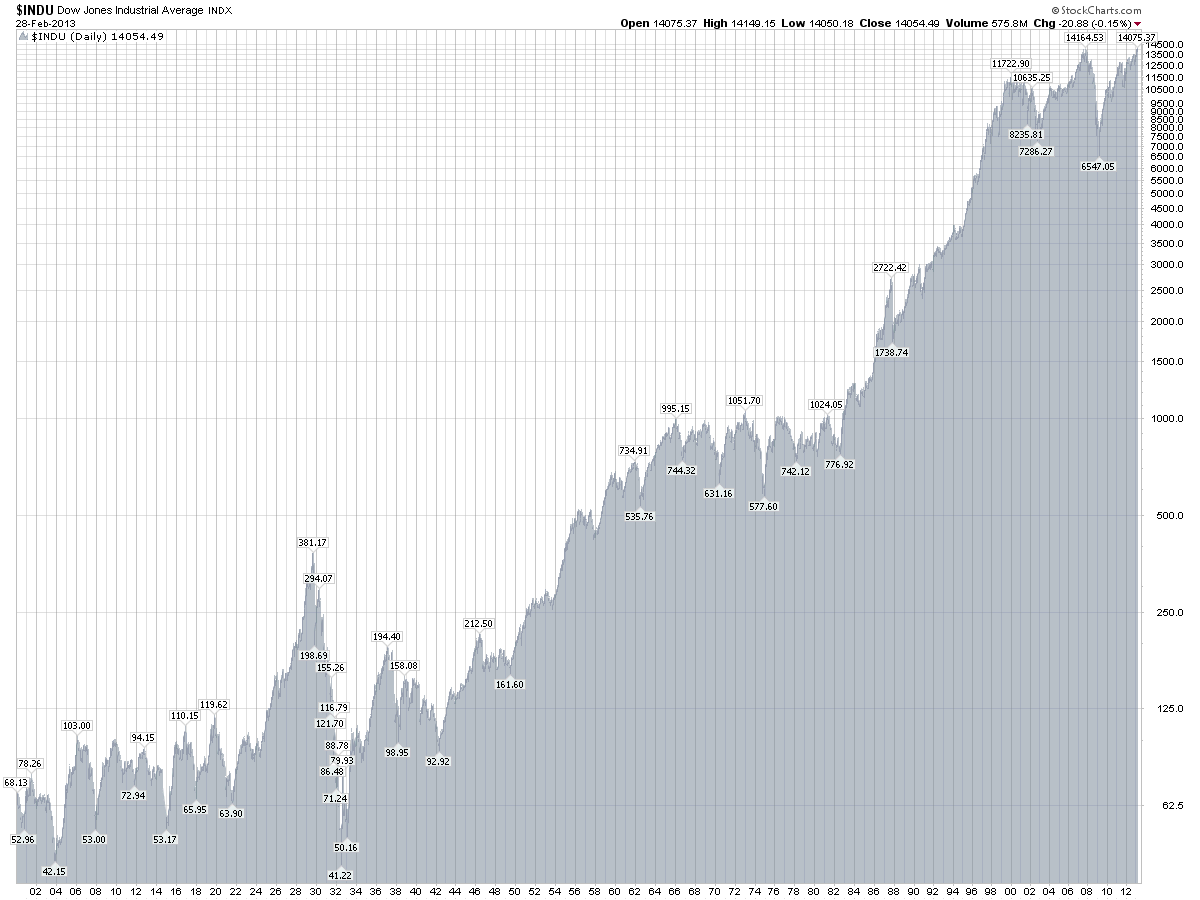

The fact is all of these occurred and the Dow moved from a high of 94 in 1913 to break new highs above 14,254 last week, one hundred years later.

The point is not to notice the new highs – although that’s what the Financial Infotainment Industrial Complex wants us to notice – but rather to notice that an index proxy for large stocks returned 15,000%[2] over a period of just a hundred years.

To choose a shorter 40 year time-frame – approximately the investing lifetime of today’s retirees – equity indices like the Dow nominally returned over 1,400%+ in that stretch. A stretch that included the tail end of Vietnam, Mid-East energy crises, Stagflation, the Cold War, 9/11, two Mid-East Wars, two separate decades of treading-water equity markets (1972-1982, 2000-2010), and of course the rise of Justin Bieber.

Any of those events alone appeared at the time to be reasons to sell and take all of one’s money away from any type of risky equities, or so the Financial Infotainment Industrial Complex would have us believe at the time. Throughout the last 40 years, the Dow moved from 900 to above 14,000. The lesson: It’s awfully hard to keep a diverse pool of public market corporations down for very long.

Like I said, I have no idea what’s happening in the short run and medium run, and I really don’t care. I also have no particular strongly held belief in any one company or any one industry, as I’m really not a stock market guy at all. In the long run, however, I know the rise of broad market equity indices to be inevitable.

Please see the next related post:

New Highs in the Dow Part II – What’s going to happen in the future?

and

New Highs in the Dow Part III – What should I do about it?

Also – This logorithmically adjusted picture of the DJIA since 1900 is cool. Clicking on it allows you to see it in all its glory.

[1] Although it was clear enough just a few months ago that base-case momentum would likely lead us to some medium-term ‘recovery’ mode, which made me lament, in anticipation, the passing of the Great Recession.

[2] Or 150X your original amount, depending on how you like your percentage-growth-over-time presented.

Post read (9452) times.