Or, why everyone needs to know this, beyond getting rich or avoiding poverty.

Or, why everyone needs to know this, beyond getting rich or avoiding poverty.

Please see my earlier posts

Part I – Why don’t they teach this in school?,

Part II – Compound Interest and Wealth

Part III – Compound Interest and Consumer Debt

Part IV – Discounted cash flows – Pension Buyout Example

Part V – Discounted cash flows – Annuity Example

A further reason why we need to learn discounted cash flows as a society

Are the US government’s assumptions about future social security obligations reasonable? Or are they instead unrealistic, or based on a Ponzi Scheme, as Peter Schiff and Ron Paul claim?

If you could do discounted cash flow calculations you could begin to form an answer. You can see how the federal government would calculate exactly what the present value of those obligations is.

But “discounted cash flows” sound so esoteric to the average citizen – since we never learned it in junior high – that pundits and politicians with conspiracy theories who casually throw around words like “Madoff” and “Ponzi” begin to sound reasonable in comparison. Which is really not a helpful direction for us to go in, as a society.

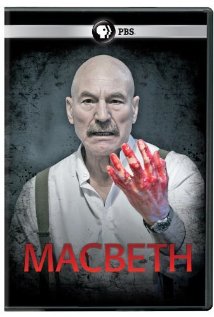

It is a tale

Told by an idiot, full of sound and fury,

Signifying nothing.

Conclusion

I would love for Bankers Anonymous readers to explain to me[1] why the most powerful mathematical formulas in the universe, compound interest and discounted cash flows, never get taught to junior high students, then high school students, then college students. And then again to anyone applying for a credit card, or mortgage, or car loan, or annuity, or pension, or saving for retirement. Or arguing about the growth of federal debt – or the rise of future social safety-net obligations.

We’re blind people stabbing each other in the dark without these formulas.

All of the consumer financial protection bureaus in the world can’t help if consumers have no tools to do their own thinking.

All the fiscal cliff negotiations and partisan point-scoring amount to a tale told by an idiot, full of sound and fury, signifying nothing, if we as citizens cannot see how money grows in the future or how future obligations get valued today.

“Tomorrow and tomorrow and tomorrow,

Creeps in this petty pace from day to day

To the last syllable of recorded time,

And all our yesterdays have lighted fools

The way to dusty death. Out, out, brief candle!

Life’s but a walking shadow, a poor player

That struts and frets his hour upon the stage

And then is heard no more: it is a tale

Told by an idiot, full of sound and fury,

Signifying nothing.”

–Macbeth, Act V, Scene 5

Part I – Why don’t they teach this in school?,

Part II – Compound Interest and Wealth

Part III – Compound Interest and Consumer Debt

Part IV – Discounted cash flows – Pension Buyout Example

Part V – Discounted cash flows – Annuity Example

Video Post: Compound Interest Metaphor – The Rainbow Bridge

Video Post: Time Value of Money Explained

[1] I’m searching for some explanation better than 1. Math teachers don’t get it and 2. The Financial Infotainment Industrial Complex doesn’t want you to know about it. And by the way, I don’t really ‘blame’ math teachers, just like I don’t necessarily think there’s a vast conspiracy of the “Financial Infotainment Industrial Complex.” But I do like saying that phrase, as it sums up nicely the financial crap we get inundated with all day long.

Post read (12318) times.