Where is the fiscal conservative voice to cut federal defense spending?

I’m on the fiscal conservative team. By that, I mean that I believe responsible government expenditure includes a plan for paying government obligations. Sometimes that means cutting spending. Sometimes that means raising taxes.

I’m on the fiscal conservative team. By that, I mean that I believe responsible government expenditure includes a plan for paying government obligations. Sometimes that means cutting spending. Sometimes that means raising taxes.

If you’re a fiscal conservative in Congress and you voted this month to increase the federal debt by “only” $1 trillion over the next ten years through tax cuts targeted to business owners, you’re not playing for my team this year. You’re benched.

But more importantly, if you cut taxes to increase the deficit and you don’t even consider cutting our massive defense spending, then I’m sorry, you’re not a fiscal conservative. You’re off my team permanently. Hit the showers. Just leave your uniform by your locker, you won’t need it anymore.

The problem is nobody even shows up for my team anymore, Democrat or Republican.

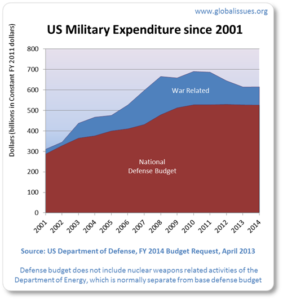

Where is the anti defense-spending wing of Congress? Does it even exist? Ever since 9/11, Democrats and Republicans have fallen all over themselves to shovel money at our military. I wrote recently about the waste, fraud, and abuse of our unending commitment to rebuilding Afghanistan. The bigger fiscal issue is our extraordinary commitment to wars since 9/11.

Here are some facts that matter for a discussion on federal fiscal responsibility.

Net federal debt stands at about $14.8 trillion.

Only 3 big areas really count when it comes to controlling federal spending. One is “discretionary,” and two are “non-discretionary,” otherwise known as “entitlements.” These two latter categories are made up largely of Social Security/Welfare and Medicare/Health Care costs.

The US spends roughly $600 billion per year directly on our Department of Defense, a larger amount than the next 8 countries combined: China, Russia, Saudi Arabia, UK, India, France, Japan, and Germany.

The Department of Defense budget makes up 54 percent of “discretionary” spending in the federal budget, meaning Congress has a choice of what to spend each year. If fiscal conservatives aren’t talking about this spending, they’re not addressing the single biggest use of resources over which Congress has control.

Some of you paying very close attention now want to talk to me about entitlements spending. Fine. Just gimme a second to finish some thoughts on defense spending and I’ll get back to entitlements in a moment. I promise.

Leaders in our discussion about the impending tax breaks like to talk about the theoretical average savings for a middle class family after tax cuts. We hear a number like $1,182 (from House Speaker Paul Ryan). While overly simple, perhaps we should understand our wars since 2001 in such basic per-household terms as well.

There’s both the narrow view and there’s the more complete view of what these wars cost each household.

The Department of Defense (DoD) takes a narrow view of accounting for the cost of spending on Iraq/Syria and Afghanistan/Pakistan – what are called Overseas Contingency Operations (OCO). This cost totals $1.75 trillion between 2001 and 2018, according to the DoD. The DoD then breaks down that $1.75 trillion into “cost per taxpayer,” at $7,740.

We don’t normally think of reducing military expenses as the way to make every taxpayer $7,740 richer, but it’s a legitimate a way to think of it, in my view.

Probably, however, the DoD’s estimates of war-cost-per-taxpayer come in way too low, according to Boston University professor Neta Crawford, author of the recently updated article “The Costs of War.”

Taking into fuller consideration the increased State, Homeland Security, and Veteran Administration’s costs, plus the increase in a baseline budget for the DoD on a war footing, Crawford estimates the Global War on Terror since 2001 has cost the country approximately $5 trillion.

As Crawford argues, this $5 trillion price tag actually skews conservative, as it does not include huge categories of costs such as state and local expenditures, many non-federal forms of veteran’s care, and costs externalized to families. Crawford’s conservative estimate means the wars since 9/11 have cost $23,386 per taxpayer. Personally, I’d like to be $23,386 richer.

As Crawford argues, this $5 trillion price tag actually skews conservative, as it does not include huge categories of costs such as state and local expenditures, many non-federal forms of veteran’s care, and costs externalized to families. Crawford’s conservative estimate means the wars since 9/11 have cost $23,386 per taxpayer. Personally, I’d like to be $23,386 richer.

I’m not mentioning the even more important human costs of war like death and injury and misery, since this is a financial column, but yes, those are even more important than the dollars and cents. I’m also not saying, obviously, that we need to eliminate the military. I’m saying that if you’re a real fiscal conservative, you have to be talking about winding down the wars and cutting military spending to a more sustainable level.

Now you want to talk about entitlements spending on Social Security, welfare, Medicare. Ok fine, let’s do that.

“Entitlements” is an apparently confusing word that sounds either moralistic, or somehow immoral, depending on if you like entitlements-spending or not. But that’s missing what the technical term means. It means instead that the federal government adopts a certain set of criteria for payments, and that it is then obligated to make those payments, regardless of budgetary decision-making by Congress. It means we essentially don’t budget for entitlements. The payments get made according to pre-set criteria and we deal with the financial consequences once payments are made.

And sure, we shouldn’t forget about entitlements spending either. But these issues are already part of active political debate daily: ACA repeal, Medicaid cuts, Social Security reform. As a fiscal conservative, I am quite confident that a significant group of powerful people is working to limit two of the three big expenses of government: healthcare and Social Security. Entitlements spending isn’t likely to get out of control with such hawk-eyed defenders of our financial situation. But I keep looking and I can’t find a fiscal conservative wing fighting to limit the one thing Congress can control each year – our war spending.

And sure, we shouldn’t forget about entitlements spending either. But these issues are already part of active political debate daily: ACA repeal, Medicaid cuts, Social Security reform. As a fiscal conservative, I am quite confident that a significant group of powerful people is working to limit two of the three big expenses of government: healthcare and Social Security. Entitlements spending isn’t likely to get out of control with such hawk-eyed defenders of our financial situation. But I keep looking and I can’t find a fiscal conservative wing fighting to limit the one thing Congress can control each year – our war spending.

Can we end these wars and balance our budget? I don’t need my tax break as badly as I want my peace dividend.

Please see related post:

SIGAR and Afghanistan Waste

Post read (253) times.