Psst: Do you want to hear about a neat investing trick a family friend showed me? She started with $250. Through alchemical magic – well, a mixture of time, compound interest, and an important dash of negligence – she turned that $250 into an investment today worth $135,000. She still owns it, so results may vary in the future, but her gains are amazing.

I imagine you’d like to learn her trick. How ever did she do it? What financial wizardry did she employ? It was probably Bitcoin, right? Or some lesser known cryptocurrency? Or a hot commodity tip?

My friend requested I not identify her. I’m going to call her Ruth, although that’s not her real name. That’s her mom’s name.

The story starts in 1965. Ruth was newly married. As much as possible, I’ll let her tell it:

“I lived in the State of Washington, and my grandmother used to buy stocks, even though she was a middle-class person. She thought it was good to buy local, and Seattle was dominated by Boeing Co (BA).”

“At that time people thought you were supposed to buy 100 shares of everything. I didn’t have enough to buy that amount, so I bought less than that initially.

I invested around $250 at the time…It was probably 20 shares, no more than 40. I remember the broker criticized me for not buying 100 shares.”

Ok, that’s the beginning of Ruth story. Are you ready for the magical part? Then Ruth did nothing for 53 years. That’s it. That’s the whole magic.

Ok, that’s the beginning of Ruth story. Are you ready for the magical part? Then Ruth did nothing for 53 years. That’s it. That’s the whole magic.

Never sell.

In 2018, her initial $250 investment in “20 or 40” shares of her local company Boeing has turned into 400 shares through stock splits and the reinvestment of dividends. Her initial investment is worth, at the time of this writing, $134,800. Through Ruth’s benign neglect. The dividends alone on her shares pay around $2,700 per year, or more than 10 times her original investment.

At least three important lessons and clarifications of the lessons of Ruth’s story are necessary.

First, this is the story of a particular investment in Boeing that happened to be headquartered in Ruth home state, but you could substitute hundreds of successful companies from 1965 into that same story, with similar results. The point is not “I wish I’d bought Boeing in 1965,” but rather “I wish I’d bought a tiny amount of shares of any number of successful companies, and then done nothing further, for 53 years.”

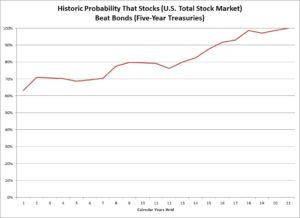

Second, I was kidding earlier about magic, just to get your attention. This is actually the most normal thing in the world. Turning $250 into $134,500 over 53 years is not magical at all, but rather a mathematical result of time and compound returns. To be precise, Ruth’s initial investment – through reinvestment of dividends, splits, and stock price gains, grew on average 12.6 percent per year for 53 years, from 1965 to 2018. And that’s a good return. It’s above average.

But it’s not ridiculous for a successful US multinational company from that period to today. The annualized return from the S&P500 since 1965, including reinvestment of dividends, was 9.87 percent. If it had been technically feasible to invest $250 in the S&P500 in 1965 (note: it wasn’t realistically possible then) and then let it compound for 53 years, the stake would be worth $36,689. That’s not as cool as Ruth’s $134,800, but it ain’t nothing either.

Third, Ruth is no genius investor. She’s pretty typical. The really funny thing is that while she told me her story, she continuously bemoaned her lack of investment savvy.

“I feel embarrassed talking about Boeing because I could tell you about a lot of mistakes, and even stocks that went to zero.” Which is charming, and no doubt true, but doesn’t negate her success. Remember: She turned $250 into $134,800. (Psst.If you are still in your twenties, so could you. Start with $250. Then do absolutely nothing for 50 years or so. That’s the hard part.)

Also, the part of the story I didn’t tell you yet is our whole conversation started because Ruth had initially described to me selling 500 shares of Boeing in the beginning of 2017. She’d bought those particular 500 shares at some point in the 2008 crisis. She saw a market price of $175 per share in February 2017 and thought to herself: “That can’t go any higher.” Nearly a year later the price has almost doubled. Ruth was kicking herself in the initial part of our conversation for that sale a year ago.

“I know I’m doing it wrong, when the price goes up and I’ve already sold, and I could have sold at a higher price. It’s not the first time it’s happened…It’s hard to know how to time a sale.”

She wanted to know when was the right time to sell. She felt like she blew it as an investor.

Also, she’d been tempted to sell a lot earlier.

Also, she’d been tempted to sell a lot earlier.

“Sometime a few decades ago my husband and I talked about selling our stake in Boeing, taking the money out and building a swimming pool. Our whole stake was worth $30,000 and we thought it couldn’t go any higher.”

“How do I know when to sell?” she asked me, probably four or five times in our conversation. “Never,” I answered each time, or some variation on “never.” But still Ruth wanted to figure out how to properly time the market. Which is impossible. Ruth feels like she gets a lot of things wrong with her investing.

It’s better to be lucky than good we always say on Wall Street, and of course Ruth got lucky buying a small amount of the world-class stock from her home town. But she was also good, in that she didn’t sell that stock for over 50 years.

Stock Disclosure: I own zero Boeing stock, and zero individual stocks for that matter, preferring to invest in equity index mutual funds. And so should you, for that matter.

Please see related posts:

Never Sell! as Churchill would say, if he were a stock investor

The magic of compound interest

Video: Compound Interest – A Deeper Dive

Post read (609) times.