I’m only writing this for the 99 percent of people who are not yet wealthy.

I’m only writing this for the 99 percent of people who are not yet wealthy.

If you are already wealthy, you can choose to ignore this advice, or follow it or whatever, but I realize you have other choices. If you are not already wealthy, however, ignore the following advice at a high risk to your wealth prospects.

Before I tell you my advice, however, I should mention that it stems from this First Principle: The only way to (legally) achieve wealth in your lifetime is to own (a) profitable business(es).

For people who already own a business – whether startup entrepreneurs, partners in a law firm, or inheritors of Daddy’s machine shop – you’ve already got your business ownership. You own your ticket to wealth already. My advice applies less well to you.

For the rest of us not yet wealthy types, we need to buy pieces of other people’s businesses to get there. The easiest place – not the only place, but the easiest – to buy these little pieces is in the stock market.

100% Stocks?

Ok, from that first principal, I can now get around to the point of this post, which is to answer the frequently pondered question: “What percentage of my retirement funds should I dedicate to stocks, instead of bonds?”

My answer: 100 percent.

You may now be tempted to ask me if I say 100 percent stocks because I ‘like the market here.’ Or, aren’t I worried about current market levels and the coming correction? No. I don’t mean that at all. This has nothing to do with any current views of stocks. I have zero opinion about all that. That’s all irrelevant daily noise generated by the Financial Infotainment Industrial Complex.

You may now be tempted to ask me if I say 100 percent stocks because I ‘like the market here.’ Or, aren’t I worried about current market levels and the coming correction? No. I don’t mean that at all. This has nothing to do with any current views of stocks. I have zero opinion about all that. That’s all irrelevant daily noise generated by the Financial Infotainment Industrial Complex.

Play the odds

My argument in favor of 100% equities rests on one foundation:

Probability theory.

Stocks (I mean diversified, not individual, stocks) go up most of the time, and they go up more than bonds, most of the time. The more time you have to leave your money to grow – such as with retirement money, which is by definition “for the rest of your life” and possibly beyond – the more the laws of probability work in your favor.

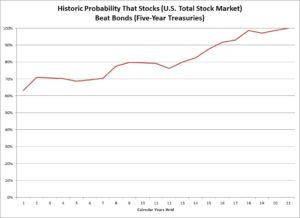

Stocks beat bonds 60 percent of the time in any given year, 70 percent of any 5 years, 90 percent of the time in any 10 years, 95 percent of the time in 15 years, and nearly 100 percent of the time in any 20-year period. And the ‘beating’ is huge.

Retirement money, even for a retired person at aged 65, probably needs to last for 20 more years, so I still think 100 percent stocks are still the best bet, even in retirement.

Not a bond hater

And by the way, I don’t hate bonds.

I’m a former bond guy. I love bonds for what they do decently well, which is to preserve nominal wealth. So, if you already have enough wealth – as I mentioned at the beginning – go ahead and buy those bonds.

Also, to clarify – some bonds are in name only. I used to traffic in emerging market bonds and distressed mortgage bonds. These are “bonds” in name and structure only, but are really like stocks in their risk, volatility, and potential returns. So when I say 99 percent of us can’t afford to own bonds in retirement accounts, I really mean bonds of the plain-vanilla riskless variety. Also, when I say bonds, I really mean to include bond-equivalents, like cash, money markets, CDs and annuities. Ok, that’s all the clarifying I’ll do for now.

Arguments Against Me

Almost all investment advisors disagree with my 100 percent recommendation, and the smart ones have powerful voices on their side.

Hedge fund “quant” Cliff Asness published an influential paper in 1996 in which he argued that a blend of 60 percent stocks and 40 percent bonds (which pretty much all investments advisors endorse) will perform better than a portfolio of 100 percent stocks, because you get more return for every unit of risk in the portfolio. To most efficiently get a return from your units of risk and achieve an even higher return than would be available with 100 percent stocks, Asness further argued, you could theoretically use borrowed money to purchase more stocks – using ‘leverage’ in finance parlance.

Josh Brown, a writer and investment advisor I admire, made the case earlier this year for diversification with bonds, on the strength of the idea that few people can stomach the wild ride of 100 percent stocks.

Josh Brown, a writer and investment advisor I admire, made the case earlier this year for diversification with bonds, on the strength of the idea that few people can stomach the wild ride of 100 percent stocks.

He joked that the only people who should have 100 percent stocks are people “in a coma of indeterminate length,” or people who are “going to be living on a desert island for two decades without access to TVs, radios, the internet or Barron’s.”

Math and Psychology

Combining Asness and Brown’s views, we can see the arguments against 100 percent stocks in retirement are both mathematical and psychological. Mathematically, Asness says, a “units of risk” analysis suggests diversification through bonds to invest at the efficient frontier of risk and return.

To which argument I would reply that non-hedge fund people don’t buy beer in retirement with “units of risk,” but rather with actual money. And your money will grow faster, over twenty years, in 100 percent stocks.

Also, Asness’ recommendation about using leverage (borrowed money) in order to maximize your return as well as to efficiently maximize ‘units of risk’ isn’t so relevant for non hedge-fund investors either, for whom leverage may be either unavailable, or downright dangerous.

Psychologically, Brown argues, hardly anybody can stomach the ups and downs of the inevitable market booms and busts, and our inability to ‘do nothing’ in the face of the roller-coaster will undo our portfolio gains. I agree with Brown that many can’t handle the volatility. I’m unconstrained by that psychological component, however, when giving advice here.

What I mean by that is that I’m not your investment advisor. I don’t worry about losing you as a client, and therefore some of my own income. I can tell you the ‘right thing’ for long-term wealth and not worry about whether we’ll have a difficult fight half-way through our relationship when the crash happens and you want to bail out of stocks, and fire me as your advisor. (FWIW: Don’t bail! Never sell!)

You want to know what I really think about 60/40? My cynical view of the investment advisory business – if you catch me in a grumpy mood – is that the 60/40 split that everyone advocates is about client retention rather than maximizing client wealth.

Since you’re not paying me, ironically enough I’m freed up to say what you should really do. I’ve got nothing at stake if you take my advice or not. If you want the most money in the end, you have to be psychologically steeled for the roller-coaster ride in your investment portfolio. It may feel horrible. But that may be what is required to get wealthy over your lifetime.

A version of this ran in the San Antonio Express News

Please see related posts:

Ask an ex-Banker: Should I also own 100% stocks?

The case for stocks over bonds

A video discussion of this post here:

Post read (594) times.