Without giving it much previous thought, I’ve historically been mildly opposed to the legalization of marijuana. I’m not a user, and on balance I haven’t seen ‘more pot in the world’ as something to advocate for.

Without giving it much previous thought, I’ve historically been mildly opposed to the legalization of marijuana. I’m not a user, and on balance I haven’t seen ‘more pot in the world’ as something to advocate for.

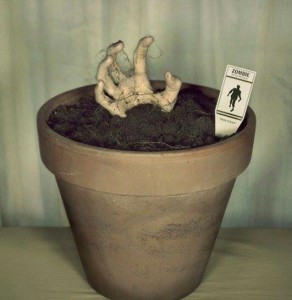

However, I find my views shifting in recent years, and I’m likely falling behind the (high) times. I mean, from what I gather, munchies-seeking zombies are not currently overrunning the states of Colorado and Washington. And if their green light to legalization leads to a slow-rolling legalization in other states, that seems increasingly like an ok application of the Tenth Amendment and our ‘laboratories of democracy’ idea.

In fact, the steady process of legalization has significant momentum throughout the country, not only in states but also in cities. Earlier this month, Washington DC’s city council voted to study expanding the current legal private use of marijuana to ‘pot clubs.’

Oregon and Alaska, with little fanfare, decriminalized recreational use over the past two years.

In a sign of the mainstreaming of the industry, Privateer Holdings – a Seattle-based cannabis branding, production and advocacy group – raised $75 million in private equity last year, setting a high-water mark for financing of the industry.

Follow the money

Since I’m a “follow-the-money” guy when it comes to public policy, I have to hand it to the legalization folks for building up the financial base for their case.

One of the advantages of exploiting the medical-use loophole for marijuana products over the past decade is that – as more legal companies got in the game – a legal business lobby has new resources for the fight. But private-industry lobbying only forms only one pillar of the industry’s financial strength.

The more important pillar is that state tax revenues derived from the business – and dedicated to some public purpose – form a difficult habit for governments to break.

Colorado and Washington

I downloaded and tallied state tax receipts in Colorado. These include a 2.9 percent tax for retail and medical marijuana, 10 percent special retail tax, a 15 percent excise tax, plus licenses and fees.

Summing these up we can see that tax revenues in Colorado from marijuana have grown faster than hothouse hydroponics under continuous ultraviolet rays.

In the last full fiscal year Colorado reported $102 million in total receipts from marijuana-related taxes and fees, with a year-over-year growth rate above 60 percent, suggesting significantly more money to come to the state in future years.

Washington State – with a 30% retail tax on marijuana sales, has had a similar experience. Bloomberg reported that Washington expected $135 million in tax receipts in 2015 at the state, county and local levels, with year-over-year growth above 100%.

I don’t know much, except this: When you have a massive revenue stream like this going into otherwise needy public coffers, there’s no going back.

In previous decades states got addicted to lottery revenues. This past decade has seen the burgeoning of casinos with their hefty state tax revenues. It seems highly likely that marijuana-tax revenue will follow in many more states in the next few years.

Texas – $500 million?

If you compare the populations of Colorado and Washington to Texas you begin to see the tax revenue potential of legalization here.

The per-capita marijuana tax revenue of Colorado, adjusted for Texas’ population, would be $519 million. Now, you might just argue to me that – culturally at least – the Mile-High state isn’t a good comparable for Texas. And I might just argue back to you that everything’s bigger in Texas.

Meanwhile, per-capital tax revenue of Washington State, adjusted for Texas’ population, would be $516 million.

These amounts understate the financial potential since they reflect less than two years’ data, and the numbers keep growing rapidly. I’m confident we’re looking at –conservatively – an estimated $500 million in incremental tax revenue per year for Texas from marijuana taxation.

Back To Reality

I know what you’re thinking – what is this guy smoking? In Texas, we see little evidence of a statewide push for marijuana legalization. In the near future, however, we could imagine a rainbow coalition of Libertarians, Rastafarians, small business owners, and fiscal conservatives each puffing from the same pipe on these issues. I’d say given the rapid spread of legalization to other states and cities, the formation of that coalition in Texas is not a question of if, but when.

My policy advice

My advice to the pro-stoner crowd – who should, by the way, never take political advice from a finance columnist – is to exploit Texas’ financial weakness on the state revenue side. Without a state income tax, important policy initiatives go unfunded all the time, starved for new revenue streams.

Add in one more key constituent group – let’s say the liberal public education crowd – and you’ve got yourself a winning statewide coalition here. Do you think the education-policy folks could find a use for an extra $500 million? As my close personal friend Sarah Palin might say, ‘You Betcha!’

Wait! Hold on. Deep breath. Inhale with me on this vision for a moment. With a tax on marijuana, what educational programs could suddenly happen? Picture the expansion of San Antonio’s well-known “Pre-K for SA” statewide, for example, but now with a dedicated revenue stream.

When you name it “Tokes for Tots,” how could anyone object?

Think of the children!

Ok, obviously I’ve gotten a contact high just thinking about this. Disregard my loopy political advice. But the rest is serious.

Post read (157) times.