I teach an adult course next month about teaching one’s kids about money and finance. I also engage in home-based experiments on my own guinea pigs (err, children) all the time, trying out lessons on stock investing, or compound interest. But most home-schooling requires a textbook (or e-book), so I was pleased to receive a copy of Rob Pivnick’s What All Kids (and Adults) Should Know About Savings and Investing.

Pivnick’s book boasts many virtues, not the least of which is that an adult could read the 38 pages in about an hour. (Kids, maybe two hours). The next virtue of his book – and this is no small thing – is that he covers a comprehensive range, hitting all the major points of savings, budgeting and investing for the long run. A third virtue – he’s right on so many of the important topics where the Financial Infotainment Industrial Complex is wrong, or at best, misleading.

I wrote yesterday that many parents are afraid or unable to start a conversation about money with their children, almost as if its a powerful taboo like sex. For that reason, I’m looking forward to reading Ron Lieber’s The Opposite of Spoiled, for further ideas about how to broach the subject.

But if you were looking for a single, efficient, comprehensive text with which to lay out the right ideas for your kids, you could have confidence in the right messages from Pivnick’s What All Kids Should Know About Saving and Investing. Pivnick and I have total alignment on a bunch of key topics which the Financial Infotainment Industrial Complex fails to make clear.

Pivnick’s right messages include:

- Saving early is hard but makes all the difference

- Compound interest rocks our world

- 401K Plans and IRAs are freaking awesome

- Budgeting can help (sometimes)

- Pay cash, negotiate

- Risky beats Not Risky (in the long run)

- Passive Investing beats Active Investing most of the time

- Low cost investing makes a huge difference

- Simple (probably Indexed) stock investing is appropriate for most people

- And most importantly – Money Is Not Everything

I plan to write my own “Teach Your Kids About Finance” book some day, but Pivnick’s book fills the need quite nicely while you all wait, breathlessly, (I’d say maybe three more years?) for me to finally get my book written and published.

In the meantime, any ideas for my snappy title?

Please see related posts:

Daughter’s First Stock Investment

Looking forward to reading Ron Lieber’s The Opposite of Spoiled

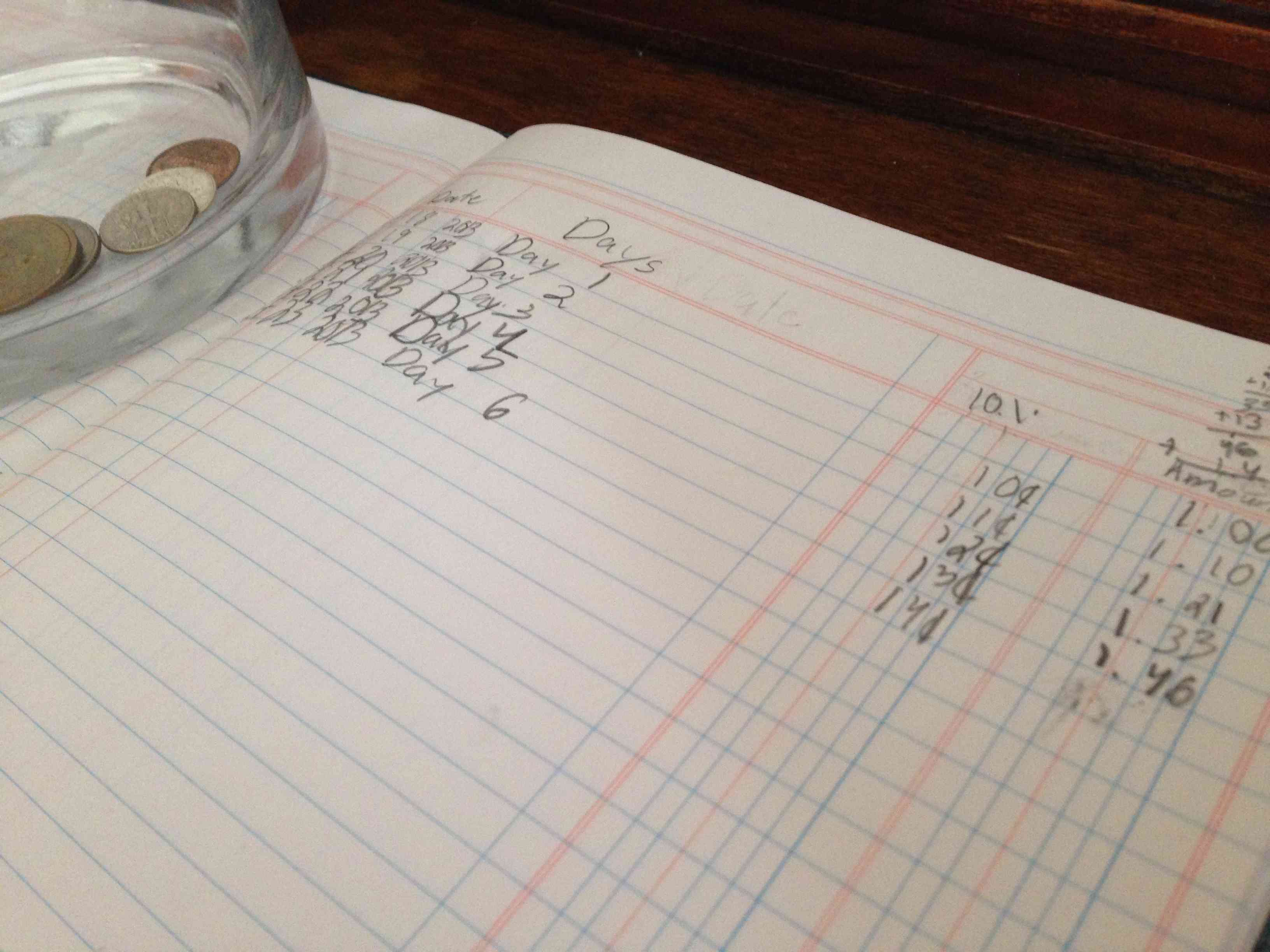

Rapunzel and Compound Interest

Book Review: Make Your Kid A Millionaire by Kevin McKinley

Book Review: The Only Investment Guide You’ll Ever Need by Andrew Tobias

Post read (1900) times.