A significant portion of the Financial Infotainment Industrial Complex dedicates itself to selling you gold, as an investment.

A significant portion of the Financial Infotainment Industrial Complex dedicates itself to selling you gold, as an investment.

Resist.

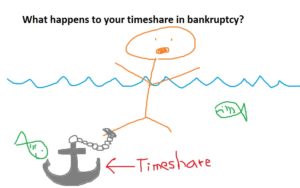

I have already written about the three other horsemen of your personal financial apocalypse: variable annuities, times shares, and bitcoins.

The commonality of these four horseman is that they are sold to credible people as “investments” when they are really the opposite of investments. All four act as a drain on your net worth.

Gold fails the fundamental test of what constitutes an actual investment.

What do I mean by the “fundamental test” of what makes an investment? I mean that unlike true investments, gold produces no cash flow. The birds-and-the-bees of compound interest is like this. Money begets money. True investments make you money because over time they reproduce little baby monies, which over time, reinvested, grow up to be big monies. That’s what positive cash flow means.

The way to value real investments is to measure future positive cash flow.

The way to value real investments is to measure future positive cash flow.

If you don’t want to get more technical than the birds and the bees, skip this next paragraph.

To get a bit technical for a moment, the fundamental value of every investment is the sum of all of its future cash flows, discounted to the present day. This is how to value private businesses, as well as publicly owned stocks, based on future re-invested profits and future dividends. This is how to value bonds, based on future interest and principal payments. We similarly calculate the value of commercial real estate, based on the expectation for future rents.

Gold, by contrast, produces nothing. No cash flow. No baby monies. It just sits there, a non-fecund lump. In fact, gold in physical form – like all other commodities – has negative cash flow, because of storage costs. You should reasonably expect a negative return over time on your long-term gold holdings, all else being equal.

But now you might be thinking that you’ve heard people, or at least seen people on television, talking about making money investing in gold. Gold certainly fluctuates in value, which can create the illusion of an investing opportunity. But it’s a speculator’s illusion, a gambler’s trick. It’s based on expecting other people to become fearful about the state of the world, which for a short time can make the price of gold go up. The little silver ball of a roulette wheel, similarly, consistently lands on either black or red, and you can observe people making  money over a short period of time by correctly guessing the future color.

money over a short period of time by correctly guessing the future color.

The key is not to look at how gold (or stocks, or bonds, or real estate) performed over the last few weeks or last few years. Rather, the key is to look at gold’s long-term results, in order to overcome any distraction we may suffer from short-term fluctuations.

Professor Jeremy Siegel – author of the finance classic Stocks for the Long Run offers the definitive take down of gold as a long-term effective asset class, especially when compared to real investments like stocks or bonds or real estate.

According to Siegel’s time series, one dollar invested in stocks in 1802 would be worth $706,199 by the end of 2012. One dollar in long-term bonds would be worth $282. Meanwhile, one dollar in gold would be worth just $4.50.

But what if you think of gold not so much to grow your money, like an investment, but rather simply to hedge against inflation? That’s also important to consider, for two reasons. First, because Siegel also notes that one dollar hid under a mattress in 1802 would be worth just 5 cents by 2012, its value eroded by inflation. Second, many gold-purchasers view their shiny metal not as a way to earn a positive return, but to guard against inflation.

But again, this lacks the historical view.

To hedge against inflation, you need the value of the thing you’re buying to increase in value at least as much as inflation erodes your money. But if a dollar only buys one twentieth of what it bought 200 years ago, then earning gold’s real return of 4.5 times isn’t enough.

If you really want to keep pace with inflation, buy real estate and stocks. Unlike gold, these actually do increase in value as fast as inflation. A company that sells a successful product can increase prices to keep pace with inflation, and can even earn a profit in the face of inflation. Own the company through its stock, and you too can outpace inflation handily with your investments.

Owning your own house, interestingly, is an effective inflation hedge. The price of homes, in aggregate, generally increases in line with inflation.

Some people buy TIPS – inflation-adjusted bonds from the US Treasury. I wouldn’t, but that’s at least a rational decision, with a positive cash flow, under inflationary conditions.

Some people buy TIPS – inflation-adjusted bonds from the US Treasury. I wouldn’t, but that’s at least a rational decision, with a positive cash flow, under inflationary conditions.

What if you had a $100 million investment portfolio? Should you buy some gold then? Ok, maybe. I don’t endorse it, but sure, you can afford to buy a wide variety of experimental assets without cash flow for diversification – including art – and maybe a diversified basket of commodities. Go ahead and buy collectible beanie babies while you’re at it. You can afford the loss. It won’t do you any good, but who am I to argue? You’re the one with the $100 million.

But what about the fact that during times of extreme financial crisis – like we last experienced in 2008 – gold prices soar. Didn’t gold prove its hedging value then? Yes, I can’t deny that gold prices temporarily responded to financial panic, mostly because other people and institutions buy into the fiction that gold is a “safe haven” appropriate for the financial, or zombie, apocalypse. You had a couple of weeks for feeling smug, but I know you’ve lost money on your gold investment since then. The medium and long-terms prospects for gold are always terrible, because gold is primarily a psychological trick played upon the scared and financially naïve. Don’t participate. Its fundamental value is as fictional as the Walking Dead. Nobody wants your lumps of shiny metal when the undead approach. You would be better off with backup power generators, baseball bats, and canned goods as an investment.

The only apocalypses are the ones happening in your head, and to your net worth.

A version of this post appeared in the San Antonio Express News and Houston Chronicle.

Please see related posts:

Post read (792) times.