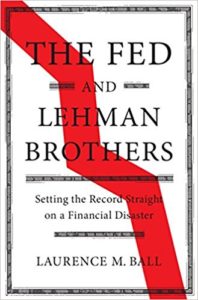

In a new book just out to this month, The Fed And Lehman Brothers, economist Laurence M. Ball re-examines the evidence of the choices facing the managers of the 2008 financial crisis. In particular he looks at a crucial choice – to let the storied Wall Street firm Lehman Brothers fail in bankruptcy rather than offer taxpayer support for a bailout.

His conclusion: the Federal Reserve, US Treasury, and New York Fed made a grave unforced error in allowing Lehman Brothers to declare a messy bankruptcy – still the largest US corporate bankruptcy of all time – in the process adding destructive force to the financial tsunami already enveloping the economy and financial markets in September 2008. And they disingenuously described the reasons for their decision.

The main managers of the 2008 financial crisis, Treasury Secretary Hank Paulson, New York Federal Reserve Bank President Tim Geithner, and Federal Reserve Chairman Ben Bernanke all claimed in official testimony and their subsequent memoirs that Lehman Brothers was “insolvent” at the time of the bankruptcy. One of the conditions of Fed lending is that it cannot lend money to insolvent institutions, or banks with insufficient collateral to pledge for a new loan.

It is undeniable that Lehman faced a liquidity crisis in September 2008 – the inability to pay back everyone it owed money to, if everyone wanted their money back right away. That’s a classic problem facing any bank in which depositors demand immediate return of their deposits. The dispute Ball addresses is whether Lehman had enough assets in the medium-to-long run that would have covered what it owed so that a fresh loan from the Fed could have averted bankruptcy.

In household terms, we can imagine a well-off person with a valuable house and car worth a million dollars, $25,000 cash in the bank, and who owes $750,000 in a combination of a personal loan, mortgage and car loan. If a lender suddenly demands a $100,000 personal loan be paid back immediately, we would say that person has a liquidity problem but is not insolvent. Given enough time, the person could likely solve the problem, through a sale of the car and house. Even easier than a fire sale of the car and house, a fresh loan against the home equity would ease the situation. Bankruptcy is far from inevitable.

In the case of Lehman, Ball argues, the Federal Reserve had created a program earlier in 2008 that could have provided that fresh loan.

Through reviewing pre-bankruptcy financial disclosures, reports of the bankruptcy managers, and independent analyses of firms that considered purchasing Lehman but declined, Ball details the amount of assets Lehman had the week before it declared bankruptcy.

He conservatively estimates the assets available to pledge as collateral for a new loan from the Fed totaled $118 billion. Lehman’s ultimate need for funds, again conservatively estimated, probably reached $84 billion. In that difference, in the amount of available assets above Lehman’s borrowing needs, Ball makes the case that this was a liquidity problem, not an insolvency problem.

He conservatively estimates the assets available to pledge as collateral for a new loan from the Fed totaled $118 billion. Lehman’s ultimate need for funds, again conservatively estimated, probably reached $84 billion. In that difference, in the amount of available assets above Lehman’s borrowing needs, Ball makes the case that this was a liquidity problem, not an insolvency problem.

$84 billion, of course, is quite a bit of money. But considering that the Fed committed $123 billion to AIG and $107 billion to Morgan Stanley that same month, it wasn’t out of the range of what the Fed was otherwise and ultimately willing to commit to dampen the financial tsunami.

The managers of the crisis have claimed, to this day, the opposite. They argue that Lehman was insolvent, and any new loan from the Fed would put taxpayer money at risk of loss.

This may all seem like ancient history, but it’s still relevant today. The Fed raised rates a few weeks ago and plans a few more rate hikes the year, unwinding policies in place since the crisis. Meanwhile, we’re still trying to figure out what the right lessons are from 2008. We still do not have an agreement on the correct solution to Too Big To Fail financial institutions when they get in trouble and face a loss of confidence, essentially a “run on the bank.”

Do we essentially nationalize them, as we did to mortgage giants Fannie Mae and Freddie Mac? Do we take an 80 percent government ownership, then slowly sell the pieces back to the public markets as they recover, as we did with insurance giant AIG? Do we guaranty portions of their bad debt portfolios and force a shotgun marriage among investment banks, as we did when JP Morgan Chase bought Bear Stearns and Bank of America bought Merrill Lynch? Or do we convert them to commercial banks from one day the next, and inject $20 billion of capital to signal public support, as we did with Goldman Sachs and Morgan Stanley?

Do we essentially nationalize them, as we did to mortgage giants Fannie Mae and Freddie Mac? Do we take an 80 percent government ownership, then slowly sell the pieces back to the public markets as they recover, as we did with insurance giant AIG? Do we guaranty portions of their bad debt portfolios and force a shotgun marriage among investment banks, as we did when JP Morgan Chase bought Bear Stearns and Bank of America bought Merrill Lynch? Or do we convert them to commercial banks from one day the next, and inject $20 billion of capital to signal public support, as we did with Goldman Sachs and Morgan Stanley?

The managers of the crisis did all these different things, with wildly differing outcomes for firms, employees, executives, shareholders, bondholders, and taxpayers.

The managers tried everything. The messiest, least controlled, and most destructive was the Lehman bankruptcy. Ball’s big question – did it have to happen? – is a counterfactual exercise that informs future choices. He further concludes, despite all the testimony of the crisis managers, that Treasury Secretary Paulson essentially made the call to let Lehman fail.

Paulson’s concern was to avoid the label “Mr. Bailout” in 2008, so he wanted to signal with the bankruptcy that sometimes firms did fail and that the government wouldn’t always be there. Ironically the bankruptcy was so disruptive that Paulson and the rest had to double-down, triple-down, and then quadruple-down on further bailouts. Clearly they did not anticipate the depth of the mess of Lehman’s bankruptcy filing.

Having said that, it doesn’t mean I think that Paulson, Geithner and Bernanke blew it in the management of the 2008 crisis. My overwhelming thought, ten years later, is how well they responded to unprecedented and unpredictable events. We are incredibly fortunate those particularly competent people held those positions at that particularly crucial time. They made one big mistake with Lehman, and they kind of fudged their reasons for it, but overall managed throughout the fog-of-war of the 2008 crisis admirably.

Having said that, it doesn’t mean I think that Paulson, Geithner and Bernanke blew it in the management of the 2008 crisis. My overwhelming thought, ten years later, is how well they responded to unprecedented and unpredictable events. We are incredibly fortunate those particularly competent people held those positions at that particularly crucial time. They made one big mistake with Lehman, and they kind of fudged their reasons for it, but overall managed throughout the fog-of-war of the 2008 crisis admirably.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

Book Review: Too Big To Fail by Andrew Ross Sorkin

Book Review: Diary Of A Very Bad Year by Anonymous Hedge Fund Manager

Post read (728) times.