NOTE: This one ran in the San Antonio Express News back in May 2021, and its being posted a bit late. 1

San Antonio-based graphic and web designer Ron Garcia works at the intersection of technology and art. On May 8th he and his fellow members of RePublic Arts Collaborative will host a gathering “The Revolution Will Be Digitized,” in a near-downtown studio, featuring physical art as well as digital art at auction in the form of NFTs.

Non-fungible tokens (NFTs), as you may know, are THE art trend of 2021. Collectors can purchase individual copies of digital art, verified and authenticated with their NFT certifying ownership. If the NFT-linked art ever changes hands between collectors, that will be tracked, and artists can collect a commission on the sale.

Warning, a brief word salad ahead:

Garcia’s preparation for the show includes teaching artists how to upload the digital files of their work to the Ethereum blockchain. He also coaches them on how to create a digital wallet, linking their regular bank accounts to Coinbase, which serves as a place to store cryptocurrency. As part of the link of art pieces to an NFT, artists will need to pay the “gas fee” needed to mine a unique Ethereum coin that will serve as the NFT.

Are you with me so far? Not really? I’ll spend the rest of this space unpacking that word salad above.

Blockchain is the term for distributed computer networks that create a permanent database (like a fancy spreadsheet!) that allows anonymous participants to verify storage of data and transactions without any central authority. The point of linking an NFT to digital art is to offer a permanent certificate of authenticity as well as a way of tracking the art’s authorship and the collector’s ownership.

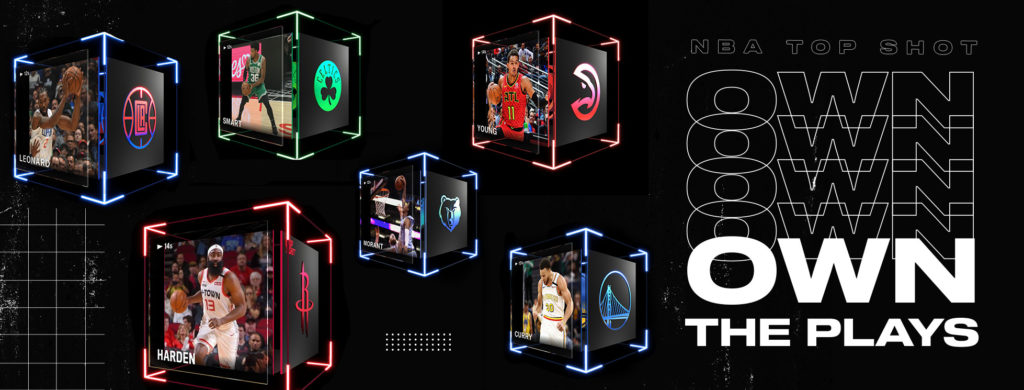

Garcia purchased an early NFT released by the National Basketball Association, which pioneered the issuance of blockchain collectibles with something called NBA Topshots. NBA Topshots are digital video clips with stats – basically like online playing cards – first released in October 2020. Garcia bought one for $14 and later reports flipping it for $1,000. That experience opened his eyes to the possibility of NFTs for artists. Why couldn’t his fellow artists participate in and benefit from this emerging technology?

Garcia – like others attracted to the NFT market – foresee the increasing importance of the Metaverse, a virtual reality that exists either apart from or alongside physical reality. In the Metaverse, humans will need to populate their living areas with video or static digital art. When you observe young humans like my teen and pre-teen constantly interacting with their friends via screens, I think the Metaverse is not far away. It’s actually kind of here already.

“Society is changing to a whole new form,” says Garcia. “All these different things are happening. I saw that NFTs are part of that whole turning. We’re going from the physical space to the virtual space,” he continued.

Digital art NFTs use the blockchain associated with the cryptocurrency Ethereum, making that preferred medium of exchange for art-linked NFTs. The Ethereum blockchain works similarly to, but does not interact directly with, the better-known Bitcoin blockchain.

Coinbase is a company that facilitates blockchain transactions, charging fees for services like offering a digital cryptocurrency “wallet” to individuals. Coinbase Global Inc went public on the NASDAQ stock exchange with a direct listing in mid-April.

With a market capitalization above $60 billion, Coinbase is evidence that some investors believe in the staying power of blockchain transactions, as well as the fees that Coinbase can charge cryptocurrency participants.

Garcia views the fees from Coinbase as high, but hopefully someday soon will come down through competition.

Let’s now review the good, the weird, and the bad of NFTs.

The unquestionably good: Artists who work in digital media – including video and music – have a new tool for creating and selling limited-quantity or individual pieces that collectors can own.

When Napster made music incredibly easy to reproduce and pirate illegally around the year 2000, musicians lost their ability to earn music royalties. Music streaming services have since gone a long way to solving that problem.

NFTs may, analogously, allow artists to earn money through the sale of their work that otherwise might be infinitely reproducible and pirate-able. Earning additional commissions each time a piece of art changes hands has so far been generally impossible with physical art. So NFTs are maybe a helpful leap forward for digital artists.

As a technology, NFTs represent the first blockchain application that I think solves a real problem – specifically, the problem of verification and authentication of art and ongoing payments to artists.

Here are as couple of weird NFT outliers that happened in March 2021, as these things exploded in popularity.

New York Times business columnist Kevin Roose arranged the NFT auction of a digital image of his printed newspaper column about NFTs, which sold for the equivalent of $560,000.

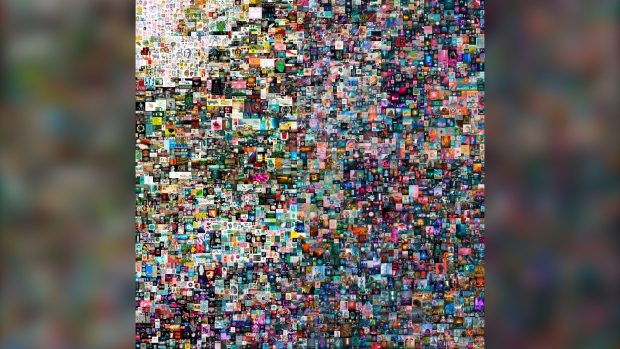

The big weird one, the one that conferred global art legitimacy on NFTs, was from Beeple.

A digital artist named yes, Beeple, sold an NFT via auction house Christy’s a digital montage of his images named “Everydays: The First 5,000 Days,” for $69 million.

As a result of these outliers, and as a responsible finance guy, I feel obligated to attach a warning sticker on this new thing. NFT art is not worse than signed baseballs or rare stamps or first edition books. It’s not even necessarily worse than paying $100 million for a physical Van Gogh or Picasso, if that’s the scale you operate at, financially.

But they are also not suitable as investments.

As art? Sure. As a neat technology? Definitely. As an expression of your values? Very cool, I love it. But only burn money on this that you would otherwise dedicate to collecting for non-financial reasons, please. Please don’t dedicate your money to this in the hopes of a quick flip. Turning $14 into $1000 quickly on an NFT flip, as Garcia did, should not be your financial expectation.

The emergence of NFTs this year exposes the different fundamental worldviews of different types of people. Technologists, of course, will embrace NFTs, for their clever deployment of blockchain to solve a problem. Artists, unquestionably, should welcome the emergence and adoption of NFTs.

“A lot of artists are afraid of technology. It goes against their artistic sentiment somehow,” adds Garcia. “On the local front that’s the biggest contribution I can make.”

Financial types – and I’m mostly in this camp – view NFTs with a combination of awe, worry, and shadenfreud-ish skepticism.

Of course as a business columnist I also cannot help but slow clap, nodding sagely in approval that someone somewhere would spend over $500,000 for a digital copy of a newspaper business column. I am absolutely on board with any reader of this column, for example, looking to create a collector’s item of my own work. Heck – you could even buy this from me at half price. Let’s say $250,000 as a starting amount, just to be fair all around. Hit me up, let’s collaborate.

Post read (196) times.

- Since NFTs could very well disappear forever as a thing in the next month, or they could become the most important invention since sliced bread, I figured I should post it before people entirely forgot how crazy NFTs seemed in the Spring of 2021 ↩