The Houston Chronicle recently started running my stuff, and I’m excited.

In honor of my introduction to Houston, I’d like to offer a personal story about my very first trip to Houston. Best of all, this anecdote has a pithy financial moral at the end.

In Spring 2001 I lived in New York City and sold emerging market bonds for Goldman Sachs. “Emerging markets” means Latin American, Asian, Eastern European, Middle Eastern and African bonds – all very volatile products. It was a super-fun job. I had recently picked up a new client – a couple of clever guys who operated a hedge fund within a successful pipeline company in Houston.

I set up a visit to Houston because, of course, I already knew this company’s reputation. They dominated not only their pipeline business but had financially engineering their way into oil and gas trading, water-rights and paper-trading, and now a sophisticated, relative-value, emerging market bond hedge fund. (If the words “relative-value emerging market bond hedge fund” make perfect sense for you, then congratulations. If they don’t, then this column is for you.) Anyway, Fortune Magazine named them “America’s Most Innovative Company” for six years in a row. These guys were my kind of client.

I set up a visit to Houston because, of course, I already knew this company’s reputation. They dominated not only their pipeline business but had financially engineering their way into oil and gas trading, water-rights and paper-trading, and now a sophisticated, relative-value, emerging market bond hedge fund. (If the words “relative-value emerging market bond hedge fund” make perfect sense for you, then congratulations. If they don’t, then this column is for you.) Anyway, Fortune Magazine named them “America’s Most Innovative Company” for six years in a row. These guys were my kind of client.

First trip to Houston

We drank cocktails together in a fancy Houston bar while I listened to my clients describe the keys to their success.

“We just have the smartest guys in every business we tackle, and we know how to go after a business and make money off it.”

I was so convinced. I’m not kidding.

The smartest guys, with the best ideas, and all this awesome financial engineering? What could possibly go wrong? Personally, I planned to invest in the stock of that pipeline company as soon as I got my next bonus. Which, fortunately for me, was many months away.

For the next few months I spent a fair amount of my free time researching the company on my Bloomberg terminal. The amazing thing about Bloomberg terminals – for those of you who haven’t worked on Wall Street – is that I could find anything and everything about the company I could ever want or need. Historical earnings data and future projections. Analyst reports. News stories. Key executive bios. Charts and graphs and comparisons. I even personally knew key executives there! I loved my clients, and I loved this stock. And I couldn’t wait to get paid, so I could start investing in all those smart guys with all their innovative financial techniques.

One of the most important lessons I learned in my Wall Street years is that it’s far better to be lucky than good. (That’s not the previously-promised pithy moral lesson, but it is true.)

Enron collapsed in the Fall of 2001 – before I got paid my bonus – so I never poured my own money down that rat hole. But boy was I eager to do it – only weeks before they collapsed.

Ever since then, whenever I hear people tell me about an individual stock they have bought, or plan to buy, and their reasons for doing so, I think of my clients at Enron.

What I learned from this Enron experience is that – not unlike Lord Commander Jon Snow – I know NOTHING when it comes to picking a good stock to buy. I thought I had access to EVERYTHING. And yet, I was completely wrong.

What I’d like you to know also – that promised pithy financial moral is right here – is that when it comes to picking individual stocks, you also know nothing.

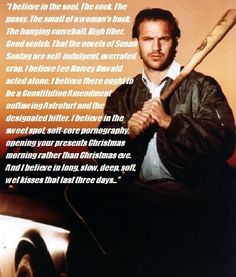

My “I believe” speech, Bull Durham-style

So, I don’t believe in individual stock-picking when it comes to money matters and being smart.

So, I don’t believe in individual stock-picking when it comes to money matters and being smart.

“Well now,” you, as Susan Sarandon’s character Annie Savory in Bull Durham, might ask, “what do you believe in then?”

“I believe in getting wealthy,

Markets, cost discipline, the power of compounding,

Aggressive allocations, never selling, and neighborhood poker (if you like to gamble),

That Jim Cramer’s finance shows are self-indulgent, dangerous, garbage fires.

I believe Lee Harvey Oswald could not have acted alone.

I believe there ought to be a constitutional amendment outlawing variable annuities and the carried interest loophole.

I believe there ought to be a constitutional amendment outlawing variable annuities and the carried interest loophole.

I believe in index funds, entrepreneurship, selling investments only when you have to have the money and never for ‘timing” or ‘tax’ reasons, and long, slow, deep, soft automatic retirement-account dollar-cost averaging that lasts five decades.”

“Good night,” I whisper, as I turn and walk out the door, Crash Davis cool.

Leaving you/Annie/Susan Sarandon character breathless to say anything but:

“Oh my.”

A version of this ran in the Houston Chronicle and the San Antonio Express News.

Post read (107) times.