A version of this post ran in the San Antonio Express News.

I want to be wealthier. I also want to be a good person.

A friend – someone who also wants these two things – recently asked if I could recommend a good, reasonable-cost, ‘socially responsible’ mutual fund.

My answer: Nope. I can’t.

Now, I know this makes me a 42-year old Grumpy Cat of the investment world. Also, while I’m not a fan of socially responsible mutual funds, I respect people who disagree with me on this topic.

Unlike some topics – (Greatest Of All Time status in their respective categories go to Tom Brady, The Wire, and Rihanna, and I will not argue this) – I’m not hopelessly dogmatic about socially responsible investing.

However, I’d like to make the case against socially responsible mutual funds because of:

- Costs

- Endlessly arguable selection criteria

- Lower returns

- There’s a better way to be wealthier and a good person.

I’ll take these one at a time.

Costs

Most socially responsible mutual funds – not all, but most – charge above-average management fees when compared to other actively managed mutual funds. This makes sense partly because of the additional layer of ‘screening’ or selection that a socially responsible manager theoretically does.

This also makes sense because an investor in socially responsible funds has already agreed – silently, implicitly – to the idea that she’ll buy a premium product at higher costs because it suits her values.

My analogy here is to the buyer of an organic or farmer’s market tomato: The buyer agrees to pay $4.50 for a tomato, because those big, red, tasteless $0.75 things are an abomination. In the case of tomatoes, I get it.

In the case of mutual funds – as an ardent index fund believer – it’s really hard for me to endorse 1.25% fees rather than the 0.25% fees of an equity index fund.

Selection Criteria

Fine, call me Grumpy Cat, but I just don’t know how to get precisely the values I want when I buy public company stocks.

Socially responsible filters vary widely by fund, but many apply both an ‘eliminate the negative’ and ‘accentuate the positive’ filter to their stock selection.

Can you avoid the ‘negative’ companies in industries you oppose? Like…

Oil and gas drillers and refiners? (Exxon)

Saturated fat pushers? (McDonalds)

Gun manufacturers? (Smith & Wesson)[1]

High-fructose corn syrup dealers? (Coca Cola)

Tobacco companies? (Philip Morris)

Beer producers? (Anheuser-Busch)

Weapons manufacturers (Lockheed Martin)

Subprime mortgage CDO structurers? (Goldman Sachs)

Casinos? (Las Vegas Sands)

Union-busting retailers (Wal-mart) or offshoring manufacturers (Apple) that don’t care to pay workers a living wage?

Incidentally, those companies above represent some of the most successful stocks of all time.

Those are the easy ones to eliminate, I suppose, but where do I draw the line? Am I ok with plastic bag manufacturers? Styrofoam cup producers? Battery makers? Animal-testing pharmaceutical companies? When I looked at the portfolios of social responsible mutual funds, many of the companies above filled their portfolios. It all depends on what one deems ‘socially responsible,’ which can vary widely from fund to fund, and individual to individual.

If I kept applying filters like this, I’m afraid my universe of acceptable companies shrinks almost to zero.

On the other hand, would it be possible to only invest in ‘positive’ companies?

Companies engaged in sustainable energy manufacturing? Sustainable agriculture? Microcredit lenders?

The list of public companies truly engaged in only, pure, ‘positive’ activity, untainted by greed and potential harm is pretty slim. Unless you are willing to be fooled by green-washing.[2]

Overall, though, what’s my problem? My big problem is that mutual fund investing would be an extremely blunt, imprecise expression of my values. Do I really trust that the mutual fund managers can engage in ‘positive’ investing while eliminating the ‘negative’? According to me?

No, I really don’t.

Of course I could invest in individual companies, but that would violate other investment rules of mine, regarding individual stock picking.

Lower returns

In addition, am I willing to receive a lower return on my money by filtering out all of the companies in certain industries? Especially some of the spectacularly profitable ones listed above?

Implicitly, I think most socially responsible investors would say they are willing to receive a lower return on their money as a result of their selection criteria.

For the most part, I’m unwilling to do that.

Is there a better way?

My own preference is to try to make the most money I can through ordinary – in my case, index – investing. I own none of those companies I named above directly but I’m pretty sure they’re all tucked away in my retirement account through a broad market index I own.

With more money in my account – admittedly made from investments in companies engaged in the broadest range of moral, immoral, and amoral activities – I’ve got more money available for expressing my personal values.

When I give money philanthropically, I much more precisely express my values with a philanthropic contribution. I’m not willing to give up money – through fees and underperformance – that would leave me with less to contribute philanthropically.

At least, that’s what I tell myself, when I want to be both wealthier and feel like a good person.

Starbucks, you are a greenwashing drug dealer. (And I love you!)

[1] I recommend this New York Times’ article on socially responsible investing, highlighting the profitability of gun-manufacturing stock Smith & Wesson and the ‘greed v. values’ dilemma this creates for people opposed to investing in gun makers.

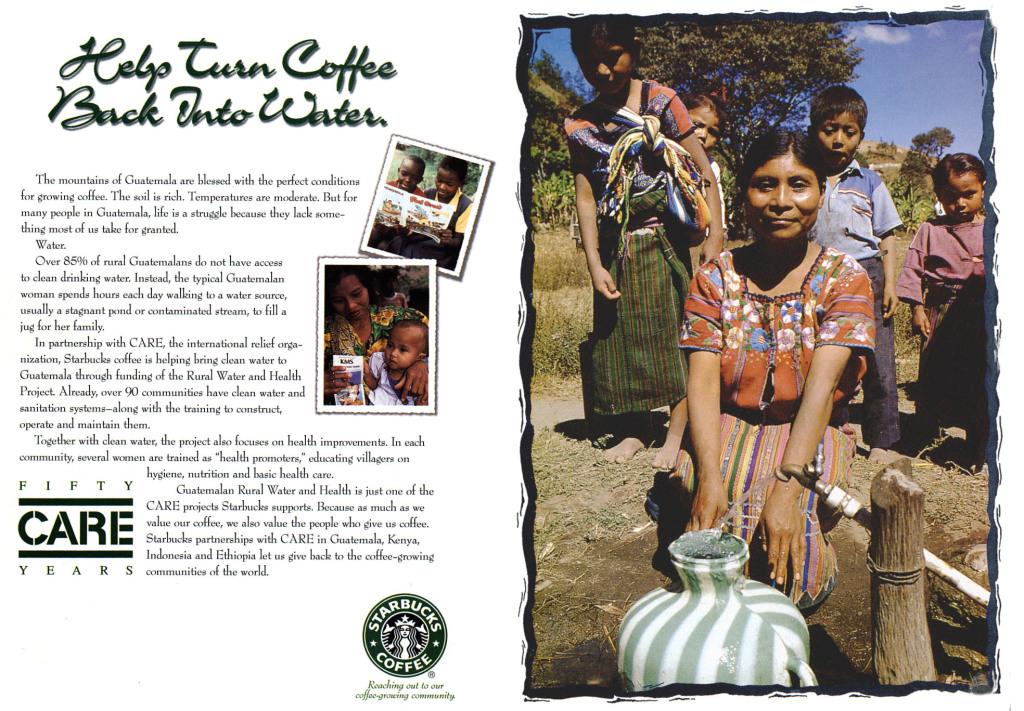

[2] Oh, what’s green-washing? When a rapacious capitalistic conglomerate posts pictures of happy Guatemalan coffee pickers smiling in their huipiles, so that I go ahead and buy their product every morning at the drive-through partly because I’m a hopeless addict and partly because I’m mistakenly comforted in the belief that I’m buying a “fair-trade” product safely on the side of the angels – that’s me being green-washed. And also, hopelessly addicted. Damn you Starbucks! But I digress.

Please see related posts:

Book Review of A Random Walk Down Wall Street by Burton Malkiel

The Simplest Way to Invest by Lars Kroijer

More on Actively managed vs Index funds

Post read (4890) times.

4 Replies to “Not A Fan Of Socially Responsible Funds”

This is a fascinating and thorny topic and I enjoyed your piece though I agreed with some but not all of it.

Firstly I think there is an argument that people should consider whether Passive Investing feels morally right i.e. are they happy with investing in:

a) companies they might disagree with e.g. tobacco / weapons

b) companies that are inefficient, pay their directors too much for running the company down, their employees too little, and ignoring the rights of their shareholders.

Obviously it is harder if you are a firm Efficient Market proponent, but you could say that Active Investing is a moral duty as people should invest in ‘good’ companies, i.e. ones where sustainable (i.e. long-term profits) are pursued. I would say that these are generally the type of ‘quality’ Phil Fisher companies that Buffett likes.

The tobacco etc issue is a separate, more personal thing.

Have a read of this report which puts it better than I can:

http://www.firststateinvestments.com/uk/intermediary/Funds/First_State_Stewart_Sustainability/

As far as I’m concerned, First State are an outstanding model for investing in Emerging Mkts (though the Worldwide Sustainability fund is also interesting).

I totally agree with you that traditional ‘ethical’ funds don’t have the performance to merit investing amongst the other problems you mention, but I think that the First State ‘Sustainable’ model has a lot more legs (although they have found it a difficult label to market).

Apologies if you have no interest in Active Investing!

Tom, thanks for reading and writing in. I don’t do active stock selection myself excepts in rare cases, but I know many people do, and many enjoy it. Thanks for pointing out First State, I was not previously aware of them.

If someone was dedicated and determined to engage in social investing, I’d probably recommend individual stock selection rather than fund selection because its likely to more closely reflect one’s values. But, pluses and minuses to everything…

I had a look inside my green funds and i was surprised to see the greek branch of coca cola in them(because they plant trees) Nike (being nicer to their employees and recycled cardboard) and an iT consultancy firm i used to work for (10000 guys in brand new lease cars selling ms office and drinking their coffee from disposable plastic cups). Still those are the only funds i own at the moment.