Hey, how is the cryptocurrency market doing?

Early June brought us some news. Three big pieces of news in fact.

First, the US Securities and Exchange (SEC) sued US-based cryptocurrency exchange and public company Coinbase for violating securities law by operating an illegal securities exchange.

Second, the SEC sued Binance, the largest cryptocurrency exchange platform globally, for violating securities law by operating an illegal securities exchange and also for misusing customer funds. The iconoclastic multi billionaire founder of Binance, Changpeng (CZ) Zhao, was also personally charged for securities violations.

Third, the SEC declared 10 additional cryptocurrencies as securities, a designation that makes trading in them in the United States subject to SEC regulation. Interestingly, the two cryptocurrencies in widest usage – Bitcoin and Ether – were not declared securities.

Look, I don’t want to gravedance on the crypto market but –

Ok, fine, I do want to gravedance a little bit.

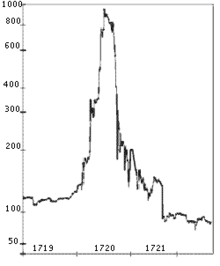

During the hype times of crypto – especially the 2019-2022 years – I tried my best to never mention crypto because media coverage of crypto was itself a big part of the hype problem. Now, as crypto fades from view, I mostly still don’t want to talk about it, but I feel like there’s some value in a post-bubble post-mortem. If we can understand the phases of bubbles, maybe we can avoid their destructive power in the future? So in that spirit I want to offer some further context on the June 2023 news, what it means, and why I think this is worth understanding.

Let’s talk about Coinbase first. The company has long represented the most mainstream access point to cryptocurrency for US-based people and institutions. It trades on the US stock exchange, does 80 percent of its business in the US, and continues to have a roughly $13 billion valuation, albeit down from a peak around $100 billion two years ago.

Although many in the crypto world have been passing in order through the five stages of grief over the past year – Denial, Anger, Bargaining, Depression, Acceptance – I would say Coinbase CEO Brian Armstrong is still in the bargaining phase, based on his comments.

“The whole point of this case from our point of view is to go get regulatory clarity,” Armstrong told CNN in early June, after the SEC sued his company. “Regardless of the outcome of the case, it’s a step towards clarity.” I find his optimism refreshing. Refreshing, and utterly unrealistic. Coinbase makes money charging huge fees to US crypto investors, and that business has to halt now. Best of luck, Coinbase. Best of luck, Armstrong.

Binance and CZ are in a slightly different place as a result of the SEC action. They have operated less directly in the US markets, which in theory leaves them less exposed to the US’ SEC regulation. “We are operating as a fking unlicensed securities exchange in the USA bro” is something Binance’s chief compliance officer once wrote in an email, so they were long aware of the business risks operating here, and didn’t put as many eggs in this basket. With the SEC moving to freeze their US assets and the claim that they misused customers funds, however, Binance’s reputation will be put at risk.

Reputational risk, you may recall, is what destroyed one of the previously largest cryptocurrency exchanges named FTX, run by wunderkind and one-time billionaire Sam Bankman-Fried, last November. Interestingly, it was a tweet from Binance’s CZ regarding the risks at FTX that started a weeklong long chain of events that culminated in FTX’s bankruptcy.

One thing that’s clear is that few people in the crypto enthusiast world actually trusted Binance CEO CZ. Rather, they seem to think he is just clever and roguish enough to remain beyond the heavy hand of US government regulation. Time will tell whether he is, and what that will mean for his company.

The theoretically great thing about cryptocurrency was that you didn’t have to trust anyone. It was just code. Immutable, mathematical, scientific, apolitical, and non-geographic. Outside of any particular regulatory regime. No trust in a government regime or finance companies required.

What crypto enthusiasts hate about the SEC action is that it brings the heavy hand of US government regulation down on the free-wheeling markets of this promising area of financial technology. What non-crypto enthusiasts hate is people pumping up fake securities to investors and stealing money, which happens an awful lot in the free-wheeling markets of this promising area of financial technology.

Crypto Winter

In the light of June 2023 developments, I checked in on my favorite source of community cryptocurrency news – the social media site Reddit, where the last year is described as crypto winter.

A few patterns of reactions seem noteworthy.

Reaction 1 on the Reddit news threads is that this June 2023 SEC action is proof that the US is becoming authoritarian, because authoritarian regimes generally tried to shut down crypto in earlier years. Okay.

Reaction 2 on the Reddit news threads is lots of anger at the SEC for either:

1. Being too late

2. Being too early

3. Specifically targeting the little guy

4. Specifically targeting the whales, but leaving the little guy exposed.

What there is less of is introspection into the fact that the absence of regulation of financial assets – the thing crypto enthusiasts seem to want – historically correlates to a very high level of fraud.

On the Reddit threads, many claim to be still accumulating their magic beans.

By the way, the best description of crypto is “magic beans.” If you know nothing else about crypto, remember this: These are invented magic beans that true believers think other people will someday value highly for “reasons.”

Common reaction 3 is the idea that crypto enthusiasts should protect themselves by moving their magic beans off of centralized exchanges such as Coinbase, Binance, or the now-defunct FTX. Keeping your currency in what they call “cold storage” is the proposed plan, removing them from circulation. This is roughly analogous to storing your data on a non-internet connected hard drive. Or like stuffing your cash in a mattress, or your gold in a lockbox, buried in your backyard. I mean, sure. But, like, hard drive cold storage, mattresses, and backyard boxes are great for preppers, but really not great for spending. Currency loses its central function when it is totally removed from circulation.

On the Reddit threads, in June 2023 they are not at the depression phase yet. Mostly they have moved past denial, but are still in the anger and bargaining phase. I would judge they are not yet at the acceptance phase of grief.

Obviously, I still don’t get it.

A version of this also ran in the San Antonio Express News and the Houston Chronicle

You may also be interested in these related articles:

A fall update on billionaire philosopher kings — and some have fallen

Sam Bankman-Fried — billionaire philosopher at cutting edge of cryptocurrency, philanthropy

Post read (91) times.