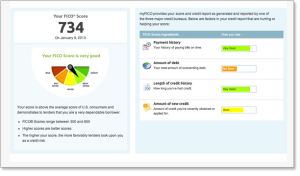

I recently advocated buying one’s FICO score for about $20, but warned that the process of buying only that one thing – and not getting semi-swindled into some expensive monthly credit-monitoring program – is actually much harder than one should expect.

I recently advocated buying one’s FICO score for about $20, but warned that the process of buying only that one thing – and not getting semi-swindled into some expensive monthly credit-monitoring program – is actually much harder than one should expect.

You start out trying to buy that one thing…but the websites of the credit bureaus Experian, Equifax, and TransUnion plus MyFico.com are all designed to get you to buy a much more expensive recurring-cost thing (that you don’t really need). Or they offer it ‘free’ for the first 30 days, but you end up paying for years after that, for the originally free 30-day thing.

Anyway, this kind of consumer marketing strategy goes on pretty often 1

What goes on less often is the catching of the company in the act of being really skeevy with these practices.

Also, there’s aggressive marketing practices, and then there’s outright misrepresentation. Citibank agreed this week to refund $700 million to customers for doing exactly what I was describing about the Fico scoring/credit bureau companies.

Citibank charged $14.95/month to some customers for ‘credit-monitoring’ services that it wasn’t actually performing. In other cases they offered a ‘free trial’ for a month on identity fraud protection, but charged customers right away, skipping the free part they had promised.

Citibank charged $14.95/month to some customers for ‘credit-monitoring’ services that it wasn’t actually performing. In other cases they offered a ‘free trial’ for a month on identity fraud protection, but charged customers right away, skipping the free part they had promised.

I’m sure there’s a lesson or two there somewhere. Something about seemingly free things that actually cost a ton of money over time.

See related posts:

But don’t buy too much FICO – Part II

Post read (846) times.

- If you squint your eyes a little bit you could argue that in some ways this is the basis for much of both retail banking and investment advisory. Like, here’s some ‘free’ portfolio construction advice that you don’t pay upfront for, and now I will charge you pretty hefty fees on a quarterly basis for doing very little follow-up work, over the next 30 years. I’m being a little unfair to investment advisors, but there’s a kernel of truth there. ↩