Far be it for me to stand in the way of progress, but did a little part of you die when you read this morning that Fair Isaac Corp will slightly alter its FICO score formula to make it easier for people to get loans?

Far be it for me to stand in the way of progress, but did a little part of you die when you read this morning that Fair Isaac Corp will slightly alter its FICO score formula to make it easier for people to get loans?

Is nothing sacred?

Decline of Western Civilization?

My immediate thought was that deflated feeling I got when I heard, in 1995, that the College Board would recenter the SAT to 500, because average scores kept dropping. Ugh. How would I know whether my SAT scores are higher than my kids’ scores? We can’t even compare now.

How will kids develop a competitive drive if they don’t know how their old man did on the SAT?

I remember when not every kid would get a shiny ribbons for “participation.” Instead, we would only get the giant trophy if you WON, and pummeled your youthful opponent into abject submission.

I mean, I remember when I used to walk all the way to school, uphill both ways, in a driving blizzard. And back for lunch.

And we loved it.

FICO scores

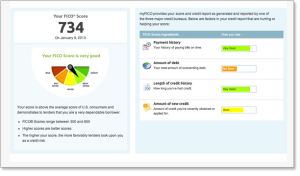

Anyway…back to FICO. According to the WSJ this morning, the makers of FICO will drop ‘settled’ delinquent accounts from their formula for calculating their key number used by practically every US lender in consumer credit decision-making. The result is that for people who had made late payments or let debts go to collections – but later paid or settled the accounts – the negative mark on their credit will drop off quickly.

The second change in the FICO formula is to de-emphasize the negative effect of delinquent medical bills.

Since FICO scores have traditionally been quite sensitive to a history of delinquent payments, the result is that millions of people could see their scores rise as a result of the formula change. Higher scores theoretically means that more people will have access to credit.

The point of the FICO score – for lenders – is to offer a snapshot of the probability of future consumer loan defaults. Fair Isaac says they studied whether the history of delinquent – but paid – accounts mattered to calculating these probabilities. Following the study, they said they could reliably drop the paid collection accounts, as well as lower the impact of medical delinquency and still maintain the same predicative power in the score.

A caveat

Although this change made the front page of the WSJ this morning, the real impact could be completely unrealized. Deep in the article Fair Isaac Corp says they will implement this more forgiving FICO formula via a new score called “FICO 9,” which makes it sound like this is just a supplemental score that banks could decide to pay attention to, or not.

Lenders make their own decision about what FICO score to buy, and they may not choose to shift from traditional FICO to FICO 9.

Like a college deciding to review the ACT rather than the SAT. So we’ll have to see whether banks adopt the new score or just ignore it.

Post read (4483) times.

5 Replies to “FICO Scores Change – Is Nothing Sacred?”

Questions and thoughts: What would be gained by the FICO shareholders? FICO scoring is a product. Why would its makers unexpectedly water-down that product, give it a new name, and then peddle it along side of the flag-ship product, telling the customers that they can see both and pick the one that seems more conducive to their lending standards? This seems a little fishy to me.

As I reviewed this further, I think FICO probably isn’t changing their flagship product, but rather innovating on the margin in the hopes that banks will adopt this for specific purposes. I also think there’s extraordinary inertia when it comes to bank lending and underwriting practices, so it would take a lot for them to adopt this new version if the flagship FICO stays the same. I can’t tell for sure from the news whether this alters their flagship product or just the new “FICO 9.” Admittedly I’m just kind of guessing as an outsider though.

I work for a medium sized company. We sell a service. If we were going to alter our bread-and-butter deliverable, I can assure you that we’d have all kinds of focus groups, research companies, meetings, charts, SWOT discussions, cost-benefit research, and it would all be part of a strategy that was based on verified market conditions and predictions. Entry-barriers are lowered for deliberate reasons. I just can’t exactly figure the reasons for this one.

Back in the late 1970s, when I was a new Commerical bank loan officer, I noticed many of our long time customers had these types of “charge offs” on their records and indicated they did not know what the charge was for and had never received a bill.

We advised them contact the medical off, pay the bill if it was valid and take a supplied form to the local credit bureau and come back to us for a reconsideration. If they did,

We did not consider this a loan denial.

One customer related the bill was from a veterinarian their son had taken an injured pet to for care.

In speaking to the other loan officers at the bank, their experience with medical bills was those offices sent out three bills and then charged it of as an unpaid debt without any notice. Rarely did these types of businesses turn things over for collection, but just sent the information to the local credit bureau as a bad debit (O-9).

I know fair credit reporting laws may have changed things over the past 40 years, but in later careers in fesral civil service with a USAF hospital, I founds rally with medical peofessionals that they felt most military regulations did not apply to them and were have great difficulty in accepting their culpability under HIPPA.

This may be a correction of an abuse of the credit system by the medical field long over due. Of, they could be the first have felt they are not accountable, as you indicated is not a rampant problem in our society starting with the me generation of the 1960s and 1980s.

As for me, we determined years ago that we were self-insured, only needed one credit card, in addition to out bank account debit card, paid off our home early and sometimes pay cash for our cars, unless there is a discount for taking out a 90 day loan.

Only time will tell!

I wish that “anonymous” hacks the FICO system and destroyes it..

It is a bias system to its core… The algorythm is not complete,and make life harder for those whom are poor to get back on their feet. It doesnt take into account somany things, and it protects those Corporation that know how to abuse their clients and how to force you to pay no matter their worng doings. None of that is taken into account. The small guy has no chance to build a life with the limitations set by this fascist approach to money and dept.