Last week I wrote about the sharp rise in super-manager pay throughout the 1990s, and specifically a funny (to me) quirk of stock option awards and bad math by corporate boards. The good news is I have a bunch more thoughts on the rise of super-manager pay and – but wait – Wait — WAIT! Listen. You Guys! Before you turn the page. This is important.

Last week I wrote about the sharp rise in super-manager pay throughout the 1990s, and specifically a funny (to me) quirk of stock option awards and bad math by corporate boards. The good news is I have a bunch more thoughts on the rise of super-manager pay and – but wait – Wait — WAIT! Listen. You Guys! Before you turn the page. This is important.

The rise of CEO pay is part of a larger topic.

You might have read last week’s post and thought, on the one hand, who cares what top executives get paid, that’s their business. And, on the other hand, it doesn’t apply to you.

I somewhat agree. I wish the rise of CEO pay applied to you and me, obviously, but jealousy can only get us so far.

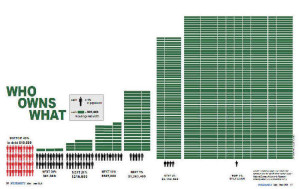

Wealth Inequality

We – I don’t mean you as readers of a blog and me – but rather we as a society, need to have a serious discussion about “wealth inequality.”

I know I can’t make you think it’s important. Personally, I see rising wealth inequality as one of the top three most important political, moral, and economic issues of our time.

Believe me, I understand, even putting those two words – wealth inequality – together feels political. It feels ‘socialist.’ Also, it bears repeating that I consider myself a pretty hard-core capitalist. But I feel like – just as democracy depends on outspoken critics to make it stronger – capitalism too needs its critics in order to make it stronger.

Wealth inequality in this country seems like such a taboo topic – somewhere on the scale between sex and the surprising likeability of songs by the band Nickelback – that I feel the need to make the case for even talking about it.

So I say the sharp rise in CEO pay matters, specifically, right now, because wealth inequality matters.

Political insurgencies

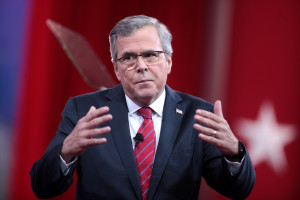

Do you know what these bizarrely contentious Presidential elections of 2016 are actually about? I think I do. It’s about anger from people who resent the concentration of wealth and power in the hands of elites.

The surprising insurgency successes of the Presidential campaigns of Bernie Sanders, Ted Cruz, and Donald Trump each in their own way are “anti-Establishment.” A year ago, few would have given any of those three a serious shot at making it so far into primary season.

All three – Cruz, Trump and Sanders – tap into anger at how elites (regardless of whether you label them “Washington Insiders” as Cruz does or “Wall Street Fat Cats” as Sanders does, or “Sad-Pathetic-Loser-Fraud-Establishment” as I imagine Trump might) seem to have benefitted disproportionally at the expense of ‘regular people’ over the last thirty years.

What the anti-establishment insurgencies indicate to me is that old labels of “Left” and “Right” matter less right now than whether you identify as an “Insider” or an “Outsider,” or simply part of the “Powerful” or the “Vulnerable.” We know many people in the New Hampshire primary were torn between voting for Trump or Sanders.

The collective id senses some unfair proportion of wealth and power has concentrated at the top, at the expense of the bottom.

Meanwhile, folks at the top are surprised at this resentment. Folks at the top have embraced a narrative of meritocratic success. “We earned it. We worked hard. These rewards came to us through highly moral means, such as education, savings, delayed gratification, professional advancement, and investment. What are these Cruz/Sanders/Trump supporters even complaining about?”

In that context of inequality and resentment, properly explaining executive compensation matters tremendously. Depending on your explanation, you would favor a whole series of different political choices.

Back to CEO pay

So that’s why explaining the rise of super managers in my lifetime matters, at least to me. (Also, why the heck am I not a super manager?)

The market

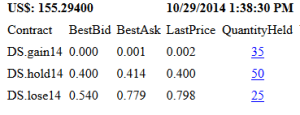

One logical thing to say is that in a market system, supply and demand sets compensation to the “correct” market level. Executives get paid so much because their skills are in high demand and top managerial talent is in short supply, hence the ‘price’ of executive talent rises to a market-clearing level. If that happens to be over $10 million dollars per year, so be it, that’s just the labor market for top executives.

This tautology – the market pays $10 million because that’s where supply meets demand and where the market clears – has some elegance.

And if that’s the explanation, and you don’t like inequality, then you might see ‘the market’ as something worth fighting, as I think Sanders and his supporters tend to do.

Increased corporate scale

The global scale at which corporations now operate creates tremendous efficiencies. Our organizations are profitable through combining technology with the cheapest global talent, both in the country (via immigrants) and out of the country (via offshoring). But if you believe CEOs are paid the big bucks on the backs of cheap labor, and domestic workers feel their wages undercut, then Trump’s plan to build a wall against that cheap labor starts to sound less insane than it really is, right?

Interlocking board members

Anybody who watches public companies knows that while corporate boards theoretically represent shareholders, in practice they represent the insider interests of corporate management and themselves. Board members – themselves often highly paid executives typically invited to join the board by the CEO – would not be so gauche as to limit top executive pay. It’s like a private club, and when you’re on the inside, you get paid quite well.

I see this “club” explanation as the sort of “us vs. them” mentality which seems to fuel Cruz’ fire. The guy never gets invited to the club, like, ever. As his Senate colleague Lindsey Graham noted, “If you killed Ted Cruz on the floor of the Senate, and the trial was in the Senate, nobody would convict you.”

Lower taxes

Personally I think taxes explain everything in life. So, outside of the math errors of corporate compensation committee boards I described earlier, I believe the drop in marginal income tax rates leads directly to wealth inequality.

And I request of our leaders: please don’t raise taxes until after I’ve gotten paid for a few years like a super manager.

Please see related posts:

CEO Pay and the Options Math Error

Inequality in America – Video and Graphic

Inequality in America – The WSJ Video

Inequality in America – The Interactive Map

Yahoo Executive Compensation – It’s all about the stock awards

Executive Pay with Equity Awards – It takes a Buffett to push this agenda

Post read (1265) times.