With Congress and the White House unified under the same party, radical corporate tax reform is coming our way very soon. Although some reform is welcome, this is a column about the part of the reform that worries me the most, known by the non-mellifluous label “Destination-Based Cash Flow Tax With Border Adjustment.”

With Congress and the White House unified under the same party, radical corporate tax reform is coming our way very soon. Although some reform is welcome, this is a column about the part of the reform that worries me the most, known by the non-mellifluous label “Destination-Based Cash Flow Tax With Border Adjustment.”

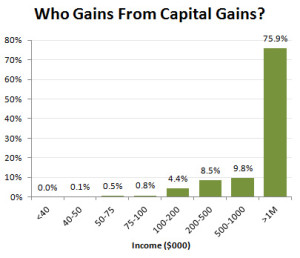

Let’s say you are a tax-policy maker in Washington and you wanted to address two problems at the same time with US businesses that make money overseas. The first problem might be that US multinationals leave a big pile – an estimated $2 trillion – of profits overseas, which they do in order to avoid having to pay our relatively high 35 percent corporate tax rate. The second problem might be that you want to create more jobs here by encouraging an “America First” approach to global trade. You would do that by giving US corporations tools to export more stuff, and maybe import less stuff, to encourage businesses to expand in the US, create jobs, and help our trade balance.

DBCFT

The solution among tax nerds is this so-called “destination-based cash flow tax with border adjustment.” It’s a mouthful, I know. The Twitterati have shortened it to #DBCFT for the newspaper readers who want to follow along this debate, in real-time.

But DBCFT is NOT just for tax nerds, it’s the core of House Speaker Paul Ryan’s “A Better Way,” the proposal that sets the blueprint for the major tax reform that’s likely to pass with Donald Trump in the White House.

DBCFT says that US companies would not get taxed on sales revenue generated outside of the country, only revenue made on sales inside of the country. It also says that US companies would pay taxes on the full value of all their imports into the US, rather than deducting import costs like other ordinary business costs.

This reform would take care of the accumulated $2 trillion pile of cash, since US multinationals would not pay US taxes on revenues generated overseas. They could onshore future profits with no consequences. Presumably some tax amnesty plan would bring in the existing pile, and there would be no incentive to create a new pile offshore.

This reform would take care of the accumulated $2 trillion pile of cash, since US multinationals would not pay US taxes on revenues generated overseas. They could onshore future profits with no consequences. Presumably some tax amnesty plan would bring in the existing pile, and there would be no incentive to create a new pile offshore.

DBCFT also appears to offer a massive subsidy to exporters through tax breaks. Like, if Apple earns $1000 in profit (to use numbers absurdly small and simple) from sales in Europe, it would owe Uncle Sam nothing, rather than the current up-to-35 percent rate, or $350. Without that tax burden, big exporters like Apple can turn around and sell stuff even more cheaply than foreign competitors.

Mission accomplished, right? On-shored profits and strengthened export businesses! Everything’s good?

Actually, we don’t know for sure.

A tax plan like this has never been implemented.

We have some economic theory about why everything will be fine – which I’ll explain in a moment – but it’s also fair to say that a massive shift like this could have unpredictable consequences. DBCFT is untested in reality, and like a lot of what’s happening in other policy areas, things could get weird.

Former Treasury Secretary and economist Larry Summers argues that DBFCT could have at least two big troubling consequences.

The first worry is that big exporting companies might generate negative tax bills in perpetuity – meaning a big tax refund every year – which seems super odd, and maybe something the US government wouldn’t really allow.

The second troubling consequence is that companies that import a lot of stuff which they then sell inside the US might have tax bills that are equal to – or bigger than – their entire amount of profits – also a weird result. It wouldn’t feel good – or be financially sustainable – to pay more in taxes than you even earned as a business.

This is scary, and potentially highly disruptive for a company that depends on imports to produce its product.

Think of the kittens?!?

Maybe a small business example can help illustrate this problem for importing companies that sell only in the United States. I have a buddy in San Antonio whose online business delivers disposable cat litter boxes to households, based on an online monthly subscription plan. GoGoGato imports Chinese-manufactured litter boxes from Canada, and then ships them to anywhere in the United States. So, he has significant import costs, and purely domestic sales.

Let’s say each imported litter box cost him $5, which he retails for $25 each, and manages to eke out a $1 profit (remember, he has shipping, marketing, packaging, and storage costs) on every box shipped.

Let’s say each imported litter box cost him $5, which he retails for $25 each, and manages to eke out a $1 profit (remember, he has shipping, marketing, packaging, and storage costs) on every box shipped.

At a 20 percent corporate tax rate (the new Paul Ryan-proposed rate) on his $1 in profit, he’d owe $0.20 in taxes on every box he sold. But under DBCFT, the $5 cost of each box imported from Canada would not be tax deductible. Instead, suddenly GoGoGato would owe taxes on $6 – That’s the $5 import cost, plus his previous $1 profit. Instead of owing $0.20 in taxes per box, he’d owe $1.20 in taxes per box, more than his entire profit per box. That’d be a business killer for GoGoGato. Litter-ally.[1]

UC Berkeley economist Alan Auerbach, an advocate for DBCFT, argues that the fears are overblown. The economist’s view is that the tax change would cause an immediate upward move in the value of the US dollar compared to other currencies, which would leave importers and exporters equally well-off from before the change.

How does that work? A strengthened US dollar – the economic theory goes – boosts imports and suppresses exports, in roughly equal proportions to the tax benefits and costs caused by DBCFT. That’s the theory anyway, which Auerbach and other tax policy experts like Kyle Pomerleau at the Tax Foundation say make fears about DBCFT overblown.

The fact that economists say “Don’t Worry!” isn’t stopping retailers, however, from heavily lobbying against the tax proposal.

With the example of even a small business like GoGoGato, it should not be surprising that big-importing retailers like Wal-Mart are gearing up to fight DBCFT.

America First?

Ready for one more potential problem with DBCFT? Summers further argues that if the US dollar appreciates by 20 percent versus other currencies as a result of DBCFT, it might cause disruptive effects on world markets. Heavily-indebted emerging market countries, for example, could find their dollar debts 20 percent more expensive to pay. Financial chaos could ensue.

In an “America First!” world we might not care about the potential devastation our tax policies cause. I would argue, however, that we brush off the risks of untested tax changes at our own great peril.

[1] I apologize.

Please see related posts:

Corporate Tax Reform is Coming

How to Evade Taxes Offshore – Wyly style

Post read (170) times.