I’ve written before about carried interest taxes, estate taxes, and real estate tax policy using the contrasting lens of what is ‘fair to me,’ (typically, If I don’t have to pay it, it’s fair to me) versus what is ‘fair to society,’ (My attempt to take the broad view, even if it hurts me personally.)

I’ve written before about carried interest taxes, estate taxes, and real estate tax policy using the contrasting lens of what is ‘fair to me,’ (typically, If I don’t have to pay it, it’s fair to me) versus what is ‘fair to society,’ (My attempt to take the broad view, even if it hurts me personally.)

Another common way of thinking about tax policy – today’s way – would be to think specifically about what behaviors the policy would encourage and discourage.

Now, I understand you may resent the idea that Big Brother imposes its will on you via tax policy. I don’t have a big problem with it myself. The way I figure it, behavior-modification is one of the main things that determine good or bad tax policy.

My state and local governments already discourage me from using tobacco and gasoline through targeted sales taxes on those products. The federal government discourages me from working for a living through income tax policy. In addition, the federal government encourages me to be born into a wealthy family via the $5.43 million estate tax exemption.[1] All of these behavior modifications are just part and parcel of tax policy, forming part of what we use to think about what makes for a good or bad tax.

Democratic Party candidate Hillary Clinton recently proposed behavior modification through changes in the capital gains tax.

I expect I’ll have plenty of critical things to say in the future about Clinton as she moves from candidate to President, but I actually dig this proposal.

Before getting into her tax proposal, however, I’m troubled by the insufficiency of the title I just used, “Democratic-Party candidate.” Because she is far, far more important than that title implies.

Can we instead go with something like “Hillary Stormborn, First Lady of the House of Clinton, Democratic Senator from New York, Secretary of State, Encourager of Benghazi Jihadists, Webmaster of Clinton.com, Queen from Across the Narrow Sea, First of the Andals, and Unburnt Mother of Dragons?”

I think that about covers all of her past experiences accurately, no?

Anyway, back to tax policy.

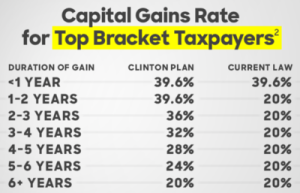

Clinton’s campaign proposes capital gains tax changes for the highest income tax bracket that would step down each year that an investor holds securities.

Currently, taxpayers in the highest tax bracket pay 39.6% in taxes on gains for securities held less than a year, and 20% for holdings held longer than that. Taxpayers in lower tax brackets currently pay their regular income tax rate for holding securities less than a year, then 15% for anything held longer than one year.

Clinton’s proposals would incrementally lower the capital gains tax rate on the highest taxpayers, for each year that those investors hold securities. The tax rate on capital gains would drop to 36% by year 2, then step down to 32%, 28%, 24%, and finally to 20% by year 6.

Have I lost you yet? I’m not trying to. Here’s the deal. If you make a lot of money each year, the Clinton proposal would encourage you, via tax incentives, to hold on to securities for a long time horizon, of at least six years or more.

Have I lost you yet? I’m not trying to. Here’s the deal. If you make a lot of money each year, the Clinton proposal would encourage you, via tax incentives, to hold on to securities for a long time horizon, of at least six years or more.

This behavior modification tax has two explicit targets. The first target is investors, who would be rewarded for holding stocks for six years or more. If investors find they can lower their taxes by holding stocks for a longer amount of time, they likely will approach stock ownership with a greater emphasis on long-term wealth creation.

The second target is public-company managers.

“It’s time to start measuring value in terms of years – or the next decade – not just next quarter,” she announced in her speech proposing these changes, according to the Wall Street Journal.

Longer-term investors, the idea seems to be, will encourage longer-term thinking among the management of public companies. Without the pressure to perform on a quarterly basis, maybe, public companies will avoid short-termism in their decision-making.

By the Clinton campaign’s own telling, the capital gains tax modification would not raise much additional federal revenue.

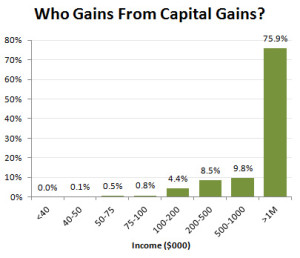

One reason is that her proposal only affects investors already in the highest tax bracket, earning above $464,850 for married couples, or $411,500 for singles, or somewhat fewer than 1% of all income earners in the United States.

The second reason this would raise limited revenue is that many investors hold a majority of their investments in tax-protected accounts such as IRA and 401Ks, Investors do not need to pay taxes on capital gains on securities held within these accounts.

So again, the entire point of this is behavior modification, not revenue generation. If you already hate behavior modification via tax policy, you’re not going to like this idea as much as I do.

Since I feel so strongly that the correct time horizon for equity investments falls somewhere in the range between five years and forever, I think Clinton’s on to something good here in encouraging a six-year minimum holding period for securities, via tax policy.

One criticism I have of the proposal is that it doesn’t apply to the bottom 99% of earners. Since the point here is behavior modification of both investors and public company managers, I don’t see why the rules wouldn’t equally attempt to modify their behavior as well.

Everybody should have a six-year-or-greater time horizon with their investments, so everybody should be subject to the rule.

Please see related posts on taxes:

Can we have an adult conversation about income tax policy?

Real estate tax – Agriculture exemption rant

[1] Think about it: Heavy taxes on income if you work to earn it, but a tax free $5.43 million if it comes from Daddy!

Post read (738) times.