Mortgage banks will quote you a mortgage interest rate, with the option to pay more money upfront, in the form of ‘points,’ for a lower interest rate over the life of the loan.

Mortgage banks will quote you a mortgage interest rate, with the option to pay more money upfront, in the form of ‘points,’ for a lower interest rate over the life of the loan.

The quick answer to “good, bad or indifferent?“

Mostly bad, for most people.

It’s possibly good or indifferent under very specific scenarios.

One ‘point’ on a mortgage means precisely 1% of the loan principal amount. If you plan to take out a $200,000 mortgage, for example, and you pay 1 point upfront, you will pay exactly $2,000 additional at the mortgage closing, ie the time you take out the loan.

The effect on your interest rate of paying 1 point varies, but might be in the order of 1/4 of 1%.[1] At today’s rates, you might lower your 15 year mortgage interest rate from 3.75% down to 3.5%, which could lower your monthly payment on a $200,000 15 year loan by about $25.

Let’s do 30-year mortgages now.[2]

The effect of paying 1 point on a 30-year mortgage, or $2,000, could also be in the order of 1/4 of 1%, and you could lower your 30-year mortgage interest rate from 4.75% to 4.5%, providing approximately $25 in monthly savings. This is similar to the effect of points on a 15 year, except that a 30-year mortgage provides more time for monthly savings through the lowered interest rate.

The effect of paying 3 points on a 30-year mortgage, or $6,000, could be in the order of 5/8 of 1%, lowering your interest rate from 4.75% to 4.125%, providing approximately $75 in savings per month.

Does it make sense to pay points?

Not for most people.

The important thing to note, if you want to understand ‘points’ is that the monthly savings by paying points is a fraction of the upfront cost.

In the quotes above, after paying 1 point on a 15-year or 30-year mortgage, or 3 points on the 30-year mortgage, it will take 80 months to ‘break even.’ That’s $2000 upfront, divided by $25/month savings, or $6000 divided by $75/month savings.

Nearly 7 years to ‘break even’ on the optional points seeks like a long time to me. I don’t think of myself as particularly prone to refinancing or moving, but as I review my own 15 year history of real estate home ownership & mortgages, I realize I’ve taken out 5 different mortgages. No mortgage has lasted more than 4 years. Granted, this is during a period of falling interest rates[3] and I’m young enough to have moved a few times in that period, but still, I think most people can’t know for sure that they’ll be in the same place, in the same mortgage, for the life of a mortgage.

Points make even less sense on a 15-year mortgage than they do for a 30-year, since there’s less opportunity to ride out the life of loan, past the 7.7 year break-even point.

Receiving, rather than paying, points

My mortgage lender[4] also offers the option to receive points, essentially payment toward closing costs, in exchange for a higher mortgage interest rate. This process works the same way, except that you get $2,000 applied to lower your upfront costs but might agree for example to pay an additional 1/4 of 1%, raising the rate from 4.5% to 4.75%.

The breakeven calculation for ‘receiving points’ now would work the other way, in that you’re worse off the longer you stay in the same mortgage. In the specific situation that you knew you only wanted to stay in a house for 3 years, it might make sense to lower your closing costs through receiving points.

The larger issue, however, is that if you knew you would stay in a house for only 3 years you probably should think twice about buying, since home ownership is risky and you could end up losing money in the short run.

In sum, on mortgage points: Don’t do it. That’s all.

Tax deductibility of mortgage points

Ok, not quite all. One additional factor about paying mortgage points is that they are tax deductible in the year you signed the loan. Mortgage points are considered ‘pre-paid interest,’ which allows you to itemize them on your income taxes, just like other mortgage interest. Now, that is all.

Please see related Mortgage posts:

Part I – I refinanced my mortgage and today I’m a Golden God

Part II – Should I pay my mortgage early?

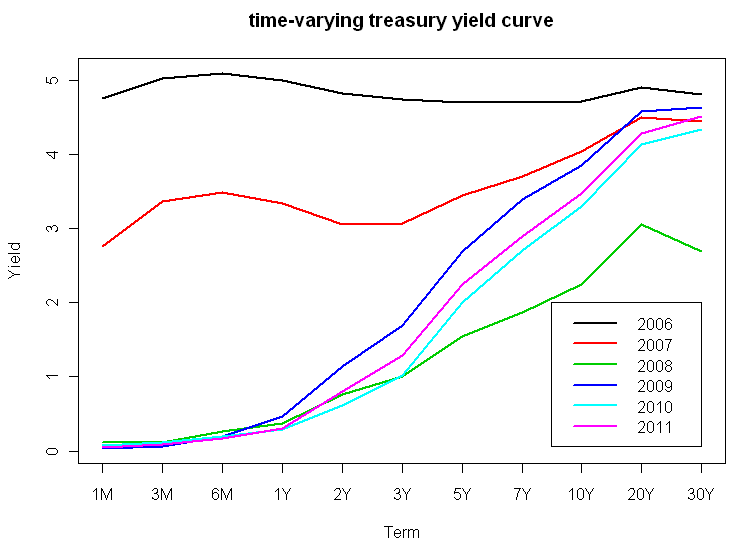

Part III – Why are 15-year mortgages cheaper than 30-year mortgages?

Part V – Is mortgage debt ‘good debt’ A dangerous drug? Or Both?

Part VI – What happens at the Wall Street level to my mortgage?

[1] There is not a precise formula for knowing in advance what effect paying points will have on the mortgage interest rate you’re quoted by a bank. These examples are real, taken from mortgage quotes I’ve asked for at today’s rates, but you can expect they’ll vary somewhat within a range. My goal here is to give a sense for likely ranges.

[2] I started with 15-year mortgage rates because, did I mention I refinanced into a 15-year mortgage?

[3] And that trend might have permanently reversed itself last month!

Post read (13410) times.