Why are 15 year mortgages cheaper than 30 year mortgages?

The answer has to do with the interest-rate curve. Contrary to what some may believe, the economy does not have one interest rate, but rather an infinite number of market-based rates, and dozens of important benchmark rates that determine the cost of money to different groups of borrowers.

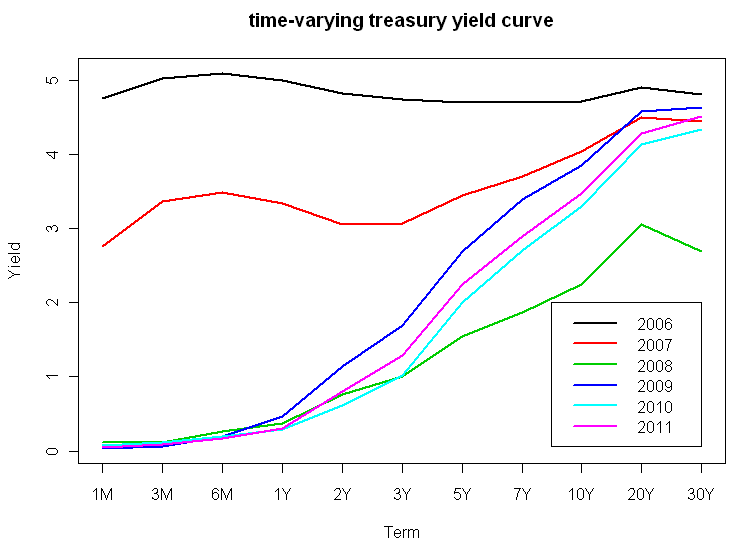

Mortgage interest rates respond to market-based interest rates, which may be seen as an upward-sloping curve on a graph, showing a Y-axis of % interest rates and an X-axis of different loan “terms” that represent the cost of money for time periods from 1 day, to 3 months to 30 years.

Generally, 15-year mortgage interest rates trade somewhat below 30-year rates, as lenders charge less to lend money for 15 years than 30 years.

For that matter, generally 3, 5, and 7 year mortgage rates are lower than 15-year or 30-year rates, which is where the ‘teaser’ rates for adjustable-rate mortgages (ARMs) come from, before those interest rates float upwards at the end of a their 3, 5, and 7-year fixed period.

Mortgage borrowers historically refinanced after the fixed period, making it statistically reasonable – in pre-2008 crisis times – to charge lower rates for 3, 5, and 7-year interest rates. The fact that ARMs got combined in a toxic manner with sub-prime lending temporarily gave ARMs a bad name, although I think they’re great products, and I got a 5-year ARM in 2001 and a later a 3-year ARM in 2006.

Please see related Mortgage posts:

Part I – I refinanced my mortgage and today I’m a Golden God

Part II – Should I pay my mortgage early?

Part IV – What are Mortgage Points? Are they good, bad or indifferent?

Part V – Is mortgage debt ‘good debt’ A dangerous drug? Or Both?

Part VI – What happens at the Wall Street level to my mortgage?

Part VII – Introduction to Mortgage Derivatives

Part VIII – The Cause of the 2008 Crisis

Post read (11951) times.

4 Replies to “Mortgages Part III – 15-year vs. 30-year Mortgages”

A little off topic, but the graph reminded me of something: yield curves compress before recessions.

Try plotting the 10-yr Treasury rate minus the 3-month T-bill rate on FRED using the weekly data. The spread hits zero 1-2 years before a recession and hits about 3-4% when the economy exits recession. The pattern seems to work for the entire data series.

Hi,

Please take my sincere apology for disturbing you…

I am Diana, I would like to take the opportunity to be a part of your bankers-anonymous.com/blog as a guest writer & want to contribute an article there. I have more than 5 year’s of experience in finance content writing.

So, it is my humble request to you that kindly give me one chance to prove myself, I can assure you that you will find my writing worthy to be published in your website.

If you consider to review my work, I will be happy to send you my latest published contents.

Waiting for your reply

Diana Perkins

Hi Diana,

I’ve typically only had friends or relatives provide a ‘guest blog’ piece. But, you’re welcome to contact me by email. info@bankers-anonymous.com

John Moel here.

I’m recently building my own website so have been looking at other similar sites for inspiration and found yours.

I own my own small new brokerage firm and am licensed in Indiana and Kentucky and am amazed at how tough it’s gotten for us small guys lately. Hence building a site and getting online.

Anyway I wanted to say hello and that I loved the podcast on your about us page. People really should be educated a bit better about the world of finance. That they’re not makes my job a little tougher.

Maybe some basic courses in our K-12 system?