I’ve recently written about the Millennial trend known as FIRE (Financial Independence, Retire Early), in which people in their 20s and 30s strategize and save and aspire to be able to retire from work very early in their life. While complex planning is interesting one thread links the people I know who successfully retired early: They are super frugal.

Elizabeth

My friend Elizabeth Morse lives in rural New Mexico. Now 48, she retired at age 42. She had previously earned close to $40,000 per year through work, mostly at a private school. Her income spiked to approximately $80,000 for just four years prior to retirement when she worked in the development office of her school. She was pleasantly surprised to be earning that much in those years, but soon realized – by around age 38 – that she could retire very early. She didn’t do any fancy math or tax-savings tricks to plan her FIRE.

Instead, she realized she and her husband Alan could live on around $42,000 per year. Between his pension and their joint savings, they have that covered.

I asked Elizabth about her keys to retiring early.

Elizabeth and her husband, a retired math teacher, previously lived in the faculty housing of their private school, taking financial advantage of that, plus free cafeteria food. Living that way, they saved 25% of their pay every year.

“If I’d had kids or divorced, I wouldn’t be able to do it,” she acknowledged.

Her hobbies come straight out of the 19th Century. They frequently walk in the national forest land that abuts their property. She reads constantly. She knits constantly. She makes her own yarn for knitting, with a spinner. In fact I learned from Elizabeth the origin of the word “spinster.” (Look it up!) As she says, “If your hobbies are free, the money just accumulates.”

They are too far a drive from the nearest town to buy coffee from somewhere else, or to go out to eat much. She bakes her own bread and almost always cooks at home. She recently bought a half-cow and a whole lamb from a nearby ranch, from which they’ll derive 2 years’ worth of meat. By her estimation they will pay $1.12 per pound of grass-fed meat for that privilege. She adds that this quickly justifies the cost of their chest freezer.

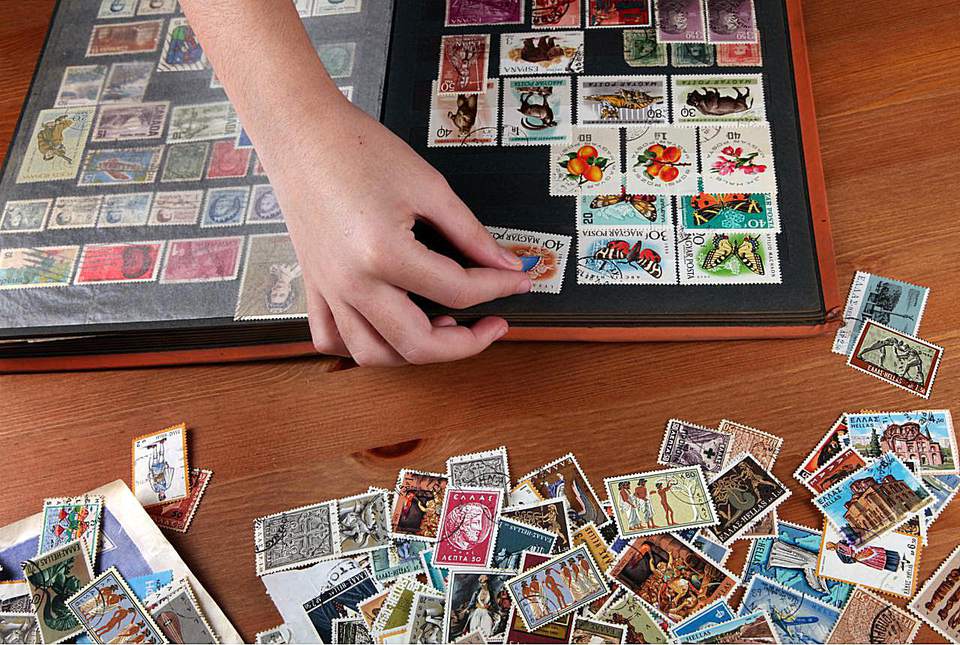

Her husband’s tastes and hobbies are similarly modest. Although he loves stamp collecting, he recently scratched that itch by organizing and disposing of someone else’s extensive stamp collection. Which, as Elizabeth explained, provided all of the fun with none of the expense! Philately, I gather, may be pursued either expensively or frugally.

Elizabeth wasn’t always this way. “I grew up as an American in the 1980s, where going to the mall and shopping is recreation.” But as her twenties became her thirties and forties, she figured out what she really liked doing with her time. Which turned out to be shockingly free or frugal. And although she jokes that her non-participation in consumerism is ‘counter-cultural,’ she also sees it as a key to her early retirement.

“Everybody who wants financial independence has to be somewhat counter-cultural. We live in a culture that pushes instant gratification.”

As old-school as this life seems, they aren’t shut off from the world. She’s on Facebook. She and her husband listen to radio and podcasts. Their internet plan at home doesn’t have enough bandwidth to stream video, so they still do the old-school Netflix CDs through the mail. (I thought Netflix CDs through the mail ended in in the 1950s, but that just shows what I know.)

Gerald

Gerald Van Den Dries, now 59 and living near Lake Medina, Texas, retired at age 53 from teaching at public school.

In his highest earning years as a teacher he made less than $55,000 per year. He lives partly from his Texas teachers retirement pension, partly from investments, and partly from part-time work that he and his wife still do – work they do more for stimulation than for the money. Gerald emphasized to me, however, that he and his wife never let their part-time work get in the way of their extensive travel schedule.

Gerald and his family were featured in a newspaper article in 2005 about how frugal they are. This isn’t his first frugality rodeo.

Now in retirement, it’s not that Gerald avoids spending money on meals out, or on travel. On the contrary, he provided to me extensive details of his planning a 66-day trip to Asia. He says he and his wife travel so much they are running out of places to go on vacation. They’ll go out to a steak dinner, if he can get a 30% discount. But if there’s no discount, there’s no eating out.

Just as exciting as the trips and the steak, it seems, are the cheap deals he gets.

They travel off season, picking up flights, hotel, and cruise-ship rides at crazy-bargains. A big part of the joy of travel for Gerald is in the steal he gets by using websites like groupon.com for travel, golfnow.com for recreation, and mindmyhouse.com to save on hotels.

Frugality, for Gerald, is not a cold, joyless existence. It’s a game that he relishes and maximizes. Some people write symphonies. Gerald is the Mozart of saving his money.

Elizabeth’s expressed her counter-cultural philosophy as the commonest of common sense: “The important thing for me is framing my world so that my wants and my needs are not that far apart”

Speaking to Elizabeth and Gerald. the FIRE thing seems to work for a lot longer and a lot more consistently if frugality is not a struggle, but rather an expression of who you are in the world.

As I write this, I see from Facebook that Elizabeth and her husband are in Paris, on a houseboat on the Seine River. Gerald and his wife’s trip to Asia will happen in February.

Their day-to-day frugality and early retirement has led to some pretty big perks.

A version of this post ran in the San Antonio Express-News and Houston Chronicle.

Please see related posts

FIRE Part II – Doing it The Complex Way

Post read (426) times.