When comparing the economic health of cities, I’m interested in credit scoring becoming a more mainstream tool for measurement of financial health. A recent WalletHub study, which I’ll describe below, kicks off a comparison between Texas cities. Beyond intramural municipal competition, however, it seems regular measurement of the accessibility of credit should stand alongside other measures such as household income and wealth, for policymakers and others.

WalletHub recently posted the average credit scores among 2572 cities in the United States. You probably want to know where your city ranks, at least among Texas cities, right? FICO scores range from 300 to 850.

Austin – that eager-beaver city full of high achievers – ranks highest among Texas cities and the 62nd percentile nationwide, with an average credit score of 712. That tells me that the average person in Austin can get a prime mortgage and car loan, enjoying the lowest rates of interest.

El Paso and San Antonio cluster down at the 20th percentile (not so good!) with median credit scores of 662 and 661 respectively. The cities of Houston and Dallas are further down the list, at the 18th and 16th percentile nationally, and with median scores of 659 and 658 respectively. In each of these four cities, the average person is not qualifying for low-interest home and low-interest auto loans.

Among large cities in Texas, Corpus Christi trailed all others, with a 12th percentile ranking nationally and a median score of 652.

Meanwhile, Corpus Christi people are like, “hey, at least we’ll always have Atlantic City, in the 2nd percentile, with a median score of 614!” (Now listen, everyone, comparisons are odious. Every city is special in its own way. Also, Atlantic City is not in Texas, bless their hearts.)

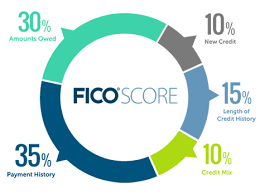

Unlike normal people, I actually really like the score put out by FICO, the firm formerly known as Fair Isaac Company. I like it partly because it’s a score that uses 100% objective historic data.

Specifically – how well have you paid your debts in the past? How much credit are you using today? What indications do we have about your intent to borrow in the future? And that’s it.

Interestingly, FICO does not take into account wealth, income, job status, home ownership status, geography, or marital status, even though we can easily see how all of these factors could make a big difference in whether you’re a safe bet to lend money to.

Also, FICO does not track race, religion, political beliefs or any other modern identity we can come up with. To FICO, we’re all just faceless data streams. That’s a good thing.

While in general we would expect a poorer city to correlate with lower credit scores, it doesn’t have to be that way. We could imagine a concentration of high average credit access even within a lower-income region, due to cultural aversion to debt, or the cultivation of careful use of credit.

And interestingly, high debt balances actually correlate with high incomes. So poor access to credit is a characteristic of poor cities, but maybe ironically high debt usage correlates with richer cities.

From a public policy standpoint, the relative FICO scores of a community matter. If I’m the mayor of Austin versus the mayor of Corpus Christi, I would take this WalletHub data seriously. A whole different set of policy tools might matter to one city versus another.

A low citywide average credit score means huge numbers of the population are locked out of the affordable mortgage market, which implies the affordable housing market as well. A low citywide average credit score would also make a much higher portion of the population susceptible to high-interest loans and predatory lenders. You can’t stop the credit card companies from signing up customers online and via mail, but policy makers have at times taken steps to limit payday lenders within cities.

Credit access is not yet a typical measure of financial health for city policy makers, although academics and economists are increasingly studying it and using it. Income and wealth differences between cities and within cities are one measure of financial health, while access to credit is another significant measurement which can tell a distinct but complementary story. A 2018 study by the Federal Reserve Bank in Boston contains a few interesting comparisons between cities in Massachusetts.

To give just one example, while we often think of debt as dangerous, in fact higher amounts of debt correlate with much higher-income cities and neighborhoods. In 22 large cities in Massachusetts, the households in the wealthiest city in the study carried the largest average balances of household mortgage debt, as well as credit card debt, and even student loan debt. Lower income and lower wealth cities, by contrast, report much smaller average debt balances. This holds true in comparisons between neighborhoods of Boston as well, with stark differences between rich and poor.

Because access to credit leads to access to home ownership and higher education, access to credit as measured by credit score is a not just a result of income and wealth, but is in fact a predictor of future income and wealth.

One of the ongoing debates in economics is the best way to measure financial health in a local economy. Obviously no one measurement or number tells a complete picture today or the full story of financial or economic progress over time. Access to credit seems to me a major measurement to always include in assessing the financial health of cities.

A version of this post ran in the San Antonio Express News and Houston Chronicle earlier this year.

Please see related posts:

Post read (345) times.