The Texas State Securities Board notched a victory for the good guys this spring, and there was a April 30 deadline to file a claim if you’d been a customer of Metals.com.

I sincerely hope you were not a customer of that company – which also went by the names Barrick Capital, Tower Equity, and Chase Metals – and which since I last wrote about them has had a terrible, no good, very bad, year.

Texas began to blow the whistle on them in May 2019. Since then, 29 other state regulators and the federal commodities regulator filed an administrative action, causing Dallas federal court to shut them down last September. The court appointed Dallas-based receiver Kelly Crawford to liquidate assets to attempt to recover something for victims. Crawford has set the April 30th deadline.

According to the administrative action, the scheme involved at least 1,600 victims and $185 million, of which 1,300 were elderly and $140 million was from their retirement accounts.

Customers of Metals.com and related companies believed they were safeguarding their retirement by purchasing precious metals as investments. Representatives of the companies specifically tapped into fears among elderly retirees of imminent losses – due to government conspiracies, devalued currencies, and seized retirement accounts.

According to court filings, the companies sold precious metals at 100 to 200 percent markups, ensuring investors a huge loss upfront.

Regulators allege that when challenged on the value of their portfolios by clients, company representatives either lied about the precious metals’ resale value or claimed the difference in prices reflected some unusual scarcity of the particular metals in question. Unfortunately, investors had locked in losses from the very beginning.

Regulators allege, and previous investigations show, that the company chose their victims carefully.

An online advertising pitch from the companies claimed “liberals are seeking to siphon money from successful Americans,” and misleadingly represented the companies’ affiliations with Fox News and the Republican Party. Phone pitches followed the collection of online leads.

Salespeople for the company, according to an earlier investigation by Quartz.com, would claim “I don’t know what your religious beliefs are, but I’m Christian. Did you know there are 700 references to gold and silver in the Bible?” According to an Alabama State Securities Commission filing, one investor found the Metals.com website through a website claiming that Fox television host Sean Hannity believed the stock market would decline. According to the Quartz investigation, a former salesperson for the company was told “if someone says they’re liberal or they don’t like Hannity, you just hang up.”

In this manner they carefully selected their victims, who became predisposed – via identity-affiliation – to believe in the precious-metals-as-investments pitch.

Travis J. Iles, Securities Commissioner for the TX State Securities Board, says Texas brought the first administrative action against the companies, in May 2019. “We really were the bellwether in identifying this issue and bringing it to the attention of other state and federal regulators.” From there, the Commodity Futures Trading Commission, the federal regulator for metals trading, coordinated with state regulators to track and prosecute the companies nationwide.

Iles is proud of Texas’ leadership in the matter, but he also emphasized that enforcement was a team sport involving the feds and 29 other states. Says Iles, “I’ve been doing this type of enforcement work for 20 years, and I can’t remember a more collaborative effort in an enforcement action. Texas is very proud to have had the opportunity to have raised the alert and to assist our teammates in this regulatory area.”

Although enforcement against the two individuals previously running the companies is not resolved yet, Iles noted that “the matter is ongoing as it relates to the individuals.”

“The receiver reports liquidating high-end automobiles, office equipment and recovering bank funds late last year from the primary owners of Metals.com. The receiver warns that customers will unlikely recover their full investment. Unofficially, they may only receive pennies on the dollar.

This may all sound like a boring and cruel scam. And it is. But if you’d like to liven up the narrative, you can see what one of the two named leaders of the Metals.com companies has been up to lately. Look up #LucasAsher on Instagram, and his postings under the further hashtag #OmertaComplexFamily. There you will see hints of where the money might have gone, although I’m admittedly speculating there. Maybe he has plenty of money from other sources, and isn’t spending any Metals.com money on the skydiving, Porsches, helicopter rides and the James Bond-lifestyle that he Instagrams about. 1

https://www.instagram.com/p/CDemPUFgkUF/?utm_source=ig_web_copy_link

What’s interesting to me about the Metals.com story is how closely it resembles non-criminal methods for selling the same products to similar audiences. The normal markups may “only” be 5 or 20 percent on precious metals, but the fear-mongering is similar. The way to sell these bad products is to tap into irrational fears, appeal to conspiracies, and lie about intentions. The idea that precious metals are an appropriate investment for individuals’ retirement accounts – or any investment account at all – is itself, essentially, a fraud.

The conspiracy theories and polarized identity-appeals are necessary because it is certainly not possible to pitch gold and silver on the merits of their long-term returns. Which are terrible.

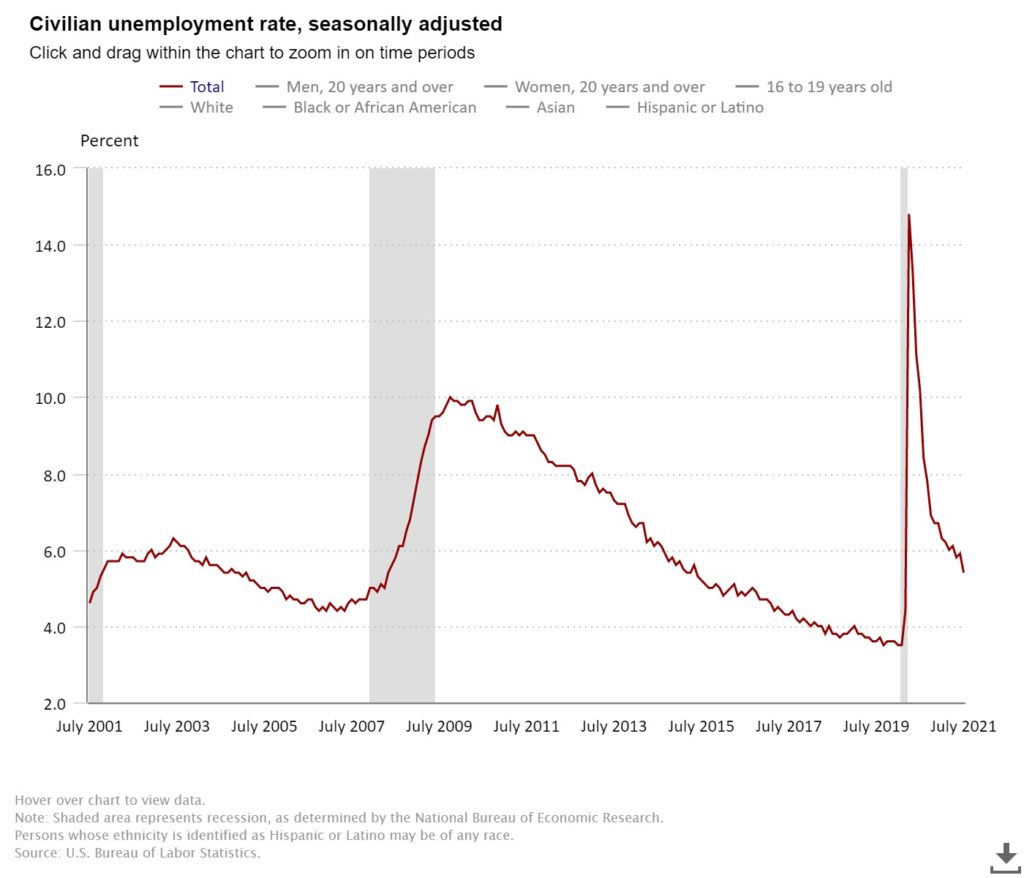

To keep it simple, let’s look at annual returns of the most commonly cited precious metal, gold, versus a basket of stocks, the S&P500, and adjust for consumer price inflation in both cases. This allows for comparing “real” returns on investment.

Using these terms, the 10 year returns on gold and stocks are 15 percent and 257 percent respectively, from March 2011 to March 2021. That’s obviously terrible for gold. It gets worse.

The 30 year returns on gold and stocks are 174 percent and 1773 percent respectively.

The 50 year returns on gold and stocks are 654 percent and 15737 percent respectively. Essentially, in a little longer than my lifetime, you could have either turned your $1 into $6.54 or into $157.37. You choose! This does not take into account storage costs for gold, which would further erode its usefulness as an investment asset.

It is always possible with any volatile asset like precious metals to find temporary time periods of outperformance. The longest time frame is always best for evaluating an asset. The longest run return on gold is pathetic. Other precious metals will be similar, again allowing for short-term fluctuations.

In the Metals.com case they are alleged to have stolen the money upfront through massive markups in price. In the rest of the precious metals sales industry for gold and silver, they are siphoning your money over longer periods of time, as precious metals produce no wealth. Meanwhile you give up the opportunity to have invested in something real, that would grow your wealth over time.

When you buy precious metals from legal “legitimate” sellers there’s no receivership at the end that can partially reimburse you for your losses. There’s no civil enforcement action. You have only yourself to blame.

I realize I will convince precisely zero of you gold bugs of this view, but the long-run returns on precious metals are so obviously bad that the whole enterprise can only have been built on cynical salesmanship, conspiracy theories, and crackpottery.

A version of this post ran in March 2021 in the San Antonio Express News.

Please see related posts:

On Metals.com, the short con and the long con

Coins fine for collecting, terrible for investing

Texas builds it own Fort Knox to store gold because…Texas

Post read (256) times.

- You should seriously click on the instagram link and spend some time on this fraudster’s supposed lifestyle. ↩