President Joe Biden pitched a pair of new federal spending and taxation bills on a scale rarely seen, intended to have transformative effects on the economy and the role of government in the economy.

The $2 trillion American Jobs Plan infrastructure spending plan includes rebuilding physical infrastructure such as roads and bridges along with federal boosts to workforce development, in-home care, and domestic manufacturing.

The $1.8 trillion American Families Plan includes targeted tax credits and education spending to benefit middle and lower earners as well as a plan to raise revenue through higher corporate taxes and taxes on higher earners and holders of wealth.

If the twin proposals pass with narrow Democratic majorities in the House and Senate, it will herald changes of a piece and on a scale with Lyndon Johnson’s Great Society.

I’m asking myself three questions about these plans. I figure I’m unlikely to sway your fixed opinions either way, but here goes. My three questions are:

Is massive federal government stimulus spending on infrastructure a good idea right now?

Are higher taxes on corporations and wealthy households, combined with targeted tax breaks on lower earners a good idea right now?

Is increasing the federal debt by an additional $4 trillion a good idea right now?

Each of these three questions can be further considered on economic terms, political terms, and moral terms. As a citizen, I’m interested in all of these questions, on all of these terms.

Let’s start with the plan for massive infrastructure spending at this moment in the economic cycle. It’s surprising.

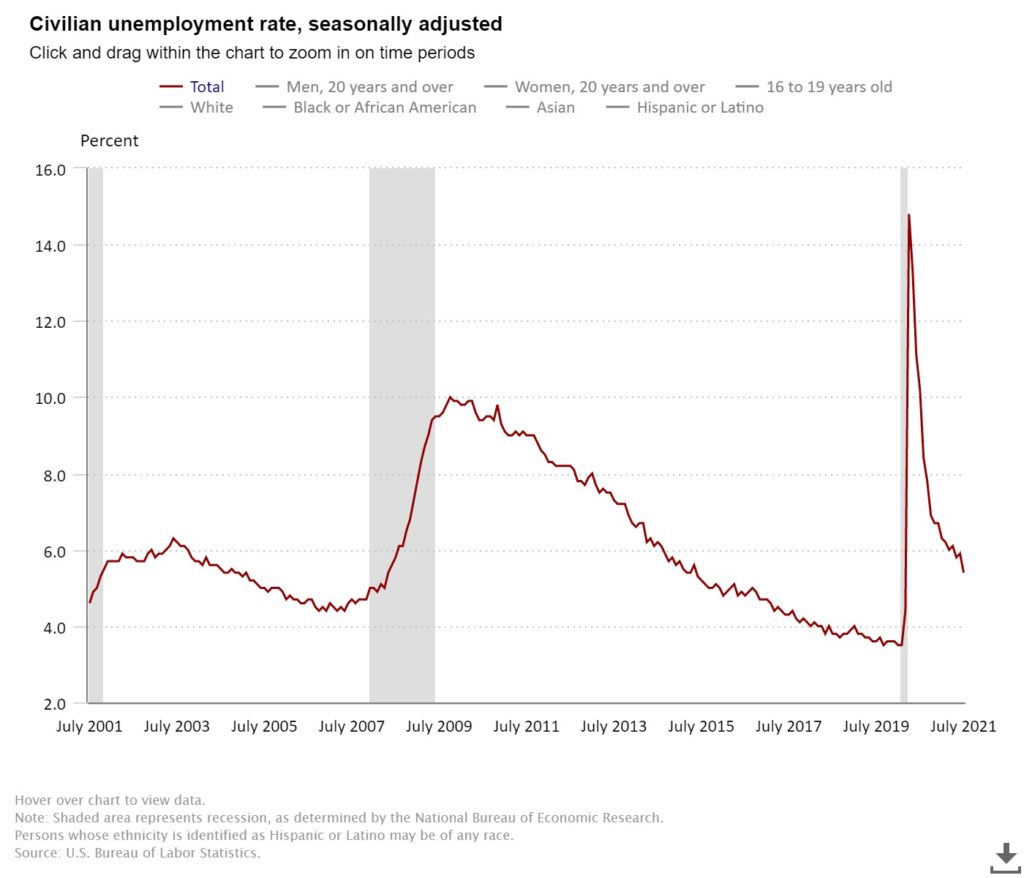

What I mean is that in a sluggish, ailing economy – with let’s say above 10 percent unemployment like the Great Depression or even the Great Recession following 2008 – a massive government stimulus push makes tremendous sense. That’s basic Keynesian economics.

We’re not in that zone right now. The July 2021 unemployment rate was 5.4 percent. Yes, that unemployment rate is still worse than pre-COVID levels (3.5 percent unemployment in February 2020) but we also haven’t even fully re-opened the economy yet.

Vaccinations, herd immunity, and the resumption of economic normalcy may naturally get us back to the relatively roaring economy of pre-COVID February 2020, without any further federal stimulus. The stock market is hitting new highs every week. (Yes, I know the stock market is not the economy, but it is a highly visible leading indicator, which is why we refer to it). Real estate prices are, in general, on fire. (Yes, housing is also not the economy, but it is an important and visible subsector of it.) And the latest GDP number was 6.4 annual growth, higher than normal trend. A massive stimulus bill right now feels, at the very least, unprecedented. I harbor strong doubts about the size and the timing of this one.

What about the American Family Plan for higher taxes on corporations, higher earners, and capital gains taxes? I am here for it. I mean this more as a moral statement than an economic statement, since inequality is a leading problem of our time. But I also think it’s ok economically. First, because we need the additional revenue. Second, because the tax changes merely roll us back to times when the economy also grew strongly under higher corporate and upper income rates. Third, because tax rates and tax policy should alleviate, not exacerbate, inequality.

And the child and family support measures? I believe in expanded pre-K and community college access both morally and as an economic measure. I think poverty alleviation similarly has both moral and economic benefits, and we need to do more of those as well. We’ll be both a richer society and a better society for it.

Finally, what about expanding federal debt by $4 trillion more right now? Phew. This is the craziest part of the conversation. A conversation that we’re kind of not even having. Republicans blew their authority and credibility on the issue of fiscal responsibility long ago.

If Biden gets this passed, it will mark a wholly different direction than the Clinton and Obama presidencies. Despite what critics said at the time and after, the Clinton administration prided itself on shrinking government. They actually balanced the federal budget and set a course for retiring federal debt. That seems forever ago but it was merely the year 2000. In that same spirit, Obama politically hamstrung his signature health care legislation by requiring that it pay for itself and not increase the federal deficit. In hindsight, this lack of generosity probably doomed it in the eyes of the many who needed it most.

After a career in Congress built on being a deficit hawk, Paul Ryan shepherded a unified Republican Congress and Executive Branch to pass a $1.5 trillion tax cut in 2017, a tax cut that overwhelmingly favored upper earners and corporations. This is the opposite move than a real deficit hawk would make, but Ryan just YOLOd his own reputation for those sweet tax cuts.

When the W. Bush and Trump administrations massively increased federal debt despite the Republican party’s claim to favor fiscal responsibility and limited government, Democrats seemed to have internalized a whole different approach to government debt. Democrats are no longer willing to self-limit as they did in the past. At this point they are daring the cowards and hypocrites in the Republican party to stop them.

I honestly don’t know what to think about $4 trillion in additional deficit spending. We’re in total YOLO territory. It feels like the Washington DC version of lots of things I don’t understand about money in 2021, like GameStop, Bitcoin, SPACs, and NFTs. The assumptions we long held about fundamentals and financial gravity don’t seem to hold anymore.

“It’s different this time” are frequently called the four most dangerous words in finance. It’s been different for a while when it comes to deficit spending, as the laws of financial physics are seemingly suspended. I don’t get it. I continue to worry about gravity.

A version of this post ran in May 2021 in the San Antonio Express News.

Please see related posts

Paul Ryan wrecks his reputation on the way out the door

Post read (148) times.