We seem to have lost the thread about businesses and political speech. Something has changed recently. Governments seem more willing these days to punish companies for political opinions which clash with current leaders’ politics. It’s a bad trend. It’s very likely anti-constitutional.

Based on laws passed in the 2021 legislative session in Texas, any company entering a state contract worth $100,000 or more must certify certain “politically correct in Texas” stances. First, the company must pledge that it does not boycott fossil fuels. Second, that it does not boycott firearms. Third, that it does not boycott Israel. If you attempt any of these political things, apparently, your business is not welcome in Texas, by statute. The attorney general’s office and the comptroller’s office have issued letters to companies seeking certification statements from businesses to pledge allegiance to this political stance.

According to a report by National Public Radio, the actual implementation of these “politically correct” requirements in Texas is messy. Plenty of loopholes exist. It’s not working.

Nevertheless, the intent is to bully companies into agreeing to the politics of a particular place and particular party leadership in power now. Contrary to Texas lawmakers’ intent, this version of business political correctness should not make conservatives happy. This should make them very, very worried, from a constitutional standpoint.

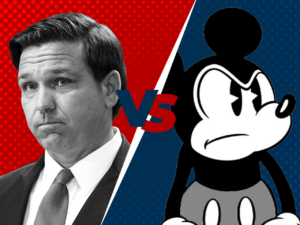

This feels of a piece with Florida Governor Ron DeSantis’ moves in the past month to punish Disney for its supposed pro-LGBTQ messages.

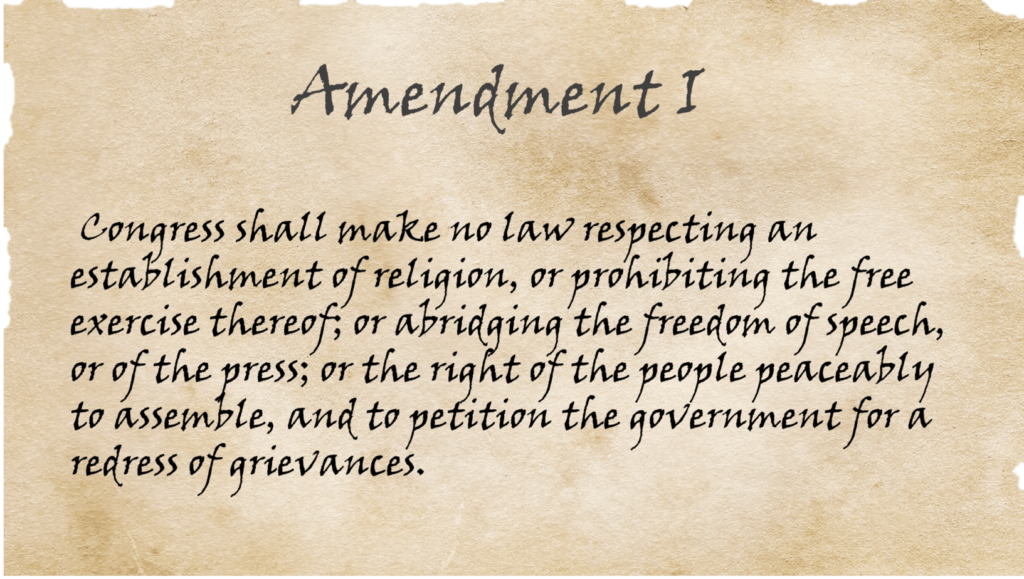

I’m no First Amendment scholar, but here’s how I understand things. We start with the idea that there’s a big difference between whether you are a private citizen, a business, or the government.

As a quick reminder, private citizens get to say almost anything they like. They can’t incite violence or do the equivalent of yelling “Fire!” in a crowded theater for safety reasons, but most everything else – including quite offensive things – is fair game.

Private corporations and their owners and executives also get wide latitude to express political opinions, usually lImited by civil protections like employment law. Private businesses run the risk of a loss of business for unpopular opinions and politics, but generally they can say or express nearly anything as well.

Public officials and government entities, however, do not and should not have the ability to impose their own political views on individuals or companies. That’s the direction of autocrats, both of the left and the right. In our pro-market, anti-autocratic system, it’s been an important tradition that political leaders do not pressure companies to conform with their politics.

In this context, the San Antonip City Council vote a few years back crossed the line in explicitly deciding against letting Chick-fil-A open a restaurant in the municipal airport because of the fast food chain owners’ perceived hostility to gay marriage. If individual consumers want to shun chicken to punish Chick-fil-A for its politics, that’s their right. But when a city government imposes a political litmus test like this on a private company, it oversteps. The left-leaning city council rightfully reaped the whirlwind for its choice. This isn’t the right way for governments to treat private companies.

Meanwhile, Florida Governor Ron DeSantis has joined the trend set by the Texas legislature of punishing corporations for their left-leaning politics. He urged the Florida legislature to strip Disney of its special tax status, when Disney joined a letter condemning proposed legislation in Florida. DeSantis made clear this was personal, and his action retaliatory, saying “Disney thought they ruled Florida. They even tried to attack me to advance their woke agenda.”

Official government retaliation for protected speech is a violation of the First Amendment. I guess it goes to the courts next but this is really important: Our system depends on DeSantis getting slapped down for this attempt to retaliate for political speech.

Here’s how it should go. Disney gets to express any type of speech or political stance it wants. Within the bounds of employment law, of course. Private consumers for their part get to decide whether to buy more, the same, or fewer of Disney’s products as a result of Disney’s expressions. Disney is free to be as woke or as reactionary in their public utterances as they please, and then they can suffer the consequences. Cancel, or embrace, or just appreciate princess movies for what they are – it should be all the same under the law.

In a non left-right culture-war context, this may be easier to understand. If I run an ice house – serving beer and spirits – and I flip the bird to the mayor of my city or the county judge or the governor, that’s my absolute right. I’m an American, damnit! If the next week I get a visit from the Texas alcoholic beverage commission and learn my license to serve has been revoked for no other reason than I was being rude to the powers that be, that’s retaliatory and a violation of my rights. Governments and government officials are not allowed to act like precious snowflakes. Private citizens and businesses are protected in a way that governments are not.

Public officials and governments need to be circumscribed in their statements and actions. They don’t get to do and say what they want. That’s the whole point of the constitution. To protect us from the government. It is not ok for a public official to opine and then try to shape the politics of a private company. It is worse still to bring the power of the regulatory state to bear on a private company, as long as the company is acting within current law. To do what DeSantis has done in Florida is to make an important move toward an autocratic state. This should be equally clear to conservatives and progressives alike.

Forcing corporate allegiance to current office holders’ political stance is both anti-market and pro-autocrat. Punishing companies for their political stances is anti-American. It’s the stuff of Putin’s Russia.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related post:

The anti-constitutional attempt to regulate speech in TX on social media platforms.

Post read (99) times.