The US Financial Infotainment Industrial Complex needs to tell us bad, shocking, surprising, and emotionally arousing news. It is less good at pointing out the opposite. Like good news. Or, “things were less interesting or less frightening than we expected.” That stuff tends to get ignored in the media.

As financial news consumers we need a good dashboard for tracking the main indicators of economic health. Meanwhile, instead, financial media acts like a series of blinding strobe lights, flashing shocking inflation numbers or surprise jobless claims numbers, what stock dropped or jumped 25 percent this week, or which maniac billionaire tweeted an irrelevant weed joke yesterday.

The Financial Infotainment Industrial Complex does not want to discuss the boring things, or the good things. But I do, damnit.

“Give me the boring, Taylor, and give it to me straight!” is how I imagine you exhort me when you open up your weekend paper, as we sit down together at The Club. (I like to pretend I’m a 19th Century English gentleman, so “The Club” is my preferred way to exchange boring financial news with friends.)

So, friends, let’s talk about inflation and employment in April 2021. And then a brief nod at the end toward taxes, assets, government debt, and economic growth.

Inflation

Data released on April 12 for the widely followed Consumer Price Index showed 8.5 percent inflation over the past year. The highest in 40 years.

This seems perverse to say, but I’m glad to see this inflation. Relieved. This feels to me…normal. Reassuring.

Why? Because during COVID the Federal Reserve explosively grew its balance sheet to $9 trillion. That was a jump up from $4 trillion for the extraordinary quantitative easing (QE2) period during the 2014 to 2020 era, which itself was a doubling from the $2 trillion post-Great Recession expanded balance sheet in 2009. And we have had a 20-year run of historically-low interest rates. I was sick of predicting inflation for 20 years in a row and being wrong every time. The absence of traditional consumer price inflation was weird.

If inflation hadn’t taken off in 2021, all economic laws of money supply theory would be out the window. Fortunately, the appearance of regular consumer inflation means that the fringe economic ideas of Modern Monetary Theory can be relegated to the footnotes of history.

Before 2022, we only saw inflation in indirect forms.

The cryptocurrency and NFT weirdness in 2021 was inflation. The positive S&P500 returns of 29, 16, and 27 percent in 2019, 2020 and 2021 respectively was inflation. Rapid home price appreciation over the last 3 years was inflation. We just didn’t see it so obviously in consumable goods. And now we do. Order is restored to the universe.

Also, the Federal Reserve will hike interest rates approximately 6 more times this year and will shrink the balance sheet. Inflation will revert to normal levels with normal policies. This is boring, and good.

Employment

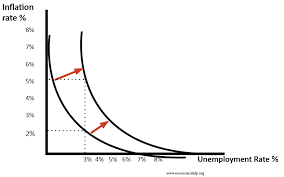

Classic economic theory links employment and inflation, in something called the Phillips Curve. The Phillips Curve is a picture of the following words: When unemployment goes down, prices go up. When unemployment goes up, prices go down. (or more accurately, prices go up more slowly).

The Phillips Curve is a bit dated, and debate continues about causality, magnitude of effects, secondary confounding factors, shape of the curve, etc, but the basic relationship between employment and inflation is considered real. Federal Reserve economists explicitly adopt this linkage, and try for a happy Goldilocks medium of moderate inflation (around 2 percent) and strong employment, understanding that helping one side may unintentionally hurt the other.

All of this is prelude to look at our dashboard metrics and to point out the following: You guys, employment has never been better than it is right now. The unemployment rate announced April 1st is 3.6 percent. Except for a few briefs months right before COVID hit, we’ve never measured unemployment this low. This is amazing, unabashedly, good news.

Complaints in financial media from the business community about the difficulty of hiring workers is a very negative spin on a very positive situation. Working people have pricing power. They can get jobs, and then they can negotiate to get a better job, because unemployment is so low. Unemployment at 3.6 percent is considered way better than standard models of the US economy would predict, because we’ve simply never had it this good.

Good news like this doesn’t make for exciting headlines but it doesn’t make it any less true. And also traditional models would suggest that when employment is this good, we should expect higher than normal inflation.

It doesn’t feel like it, you may not believe it, financial media won’t admit it, but: These are the good times.

Time for a lightning roundup on stocks, housing, tax collection, and economic growth to complete the dashboard review.

Stock Market and Housing

Big upward moves in stocks and home values between 2019 and 2021 were a form of inflation. But also, a form of wealth. The US stock market is about 8 percent off its all-time highs, but by any reasonable and historic metric has performed like an absolute racehorse in recent years. From a dashboard perspective, these asset markets are still booming. That’s usually considered good.

Taxes

Federal tax collection hit a record high last year. This is good news. You might think that’s bad news (because you don’t like taxes) but it is also good news because (hopefully) you also don’t like government debt. We have lots of debt, so it is good that we collect lots of taxes in order to stay current on the debt.

We collected a lot of taxes last year in part because over 96 percent of people who want a job have one, and also because an elevated stock market generates a tremendous amount of capital gains taxes.

Economic Growth

The US economy grew 5.7 percent in 2021, well above trend, nicely undoing the steep COVID recession of 2020 that shrunk the economy by 3.4 percent.

Financial media doesn’t want to admit it, but these are the good times, right now.

A version of this post ran in the San Antonio Express News and Houston Chronicle

Please see related post:

Economic Theories – Hayek, Keynes, MMT

Post read (82) times.