Q: We moved away from San Antonio last summer. Our prior APR, with 11 years left on our mortgage, was 3.25 percent. The interest rate for our new house was 5.25 percent. We took out a 30-year loan with plans to refinance it into a 15-year when interest rates go down. Now I’m not sure when they will ever go down. Or, when they start to go down, how long do we wait? Our old 3.25 percent seems like a dream now. If it gets to 4 should we jump on that? Will it get to 4 in the next year?

-Jeff J, Nashville, TN

A:

You have many high-salience mortgage questions in a very short note! I’ll address each one.

One of my rules is to not forecast markets. Neither stock markets nor interest rates markets. Partly that’s because I will always be wrong and I don’t like being wrong. Partly it’s because it really bothers me when finance media people pretend they can predict the future. In reality, that specific habit of forecasting by otherwise supposedly serious finance media people should earn them a fortune-teller’s cap (with all the stars and lightning bolts) to signal their likely accuracy.

Having said all that, I still have some guideposts for you to watch for the future.

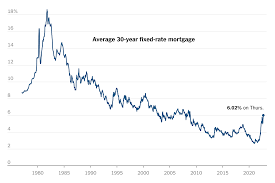

The Federal Reserve last raised the benchmark fed funds interest rate on July 26, completing its eleventh hike after more than a year of very aggressive interest rate rises. National mortgage rates changed a lot in the last 16 months as a result. While the Fed does not directly control mortgage rates, the benchmark fed funds rate plays an important anchoring role in setting 15-year and 30-year mortgage rates. All that means is that while future interest rate predictions are impossible to make, the first thing that would have to happen for mortgage rates to come down dramatically is the Federal Reserve signaling they are done raising rates. They have not yet signaled that. So you have a ways to wait still for the first guidepost.

The next guidepost would be that the Fed intends to actually lower rates. Usually that happens because a recession has begun or some other shock to the system forces the Fed to lower rates. That hasn’t happened yet either. Once the Fed signals an intention to lower rates – or actually starts to do it – then you can sharpen your pencil to pick a target for refinancing your mortgage.

Mortgage rates as of this writing (with “no points”) are above 6 percent for 15 years and above 7 percent for 30 years, making your current 5.25 percent 30 year mortgage comparatively attractive right now. You are very much not incentivized to refinance at current rates.

“How much would interest rates have to drop to make it worthwhile to refinance?” is the logical and popular follow-up question. Mortgage lenders, because they earn fees every time you refinance, would have you refinance with a 1 percent improvement in your interest rate. To answer one of your questions directly, I probably wouldn’t bother refinancing into a 4 percent mortgage rate. Reasonable people can differ on this but for myself, I probably wouldn’t do it until I could drop my interest rate by 2 percent points from my current mortgage. There are just too many fees, “points,” and closing costs to make it financially worthwhile to refinance for a minor improvement in rates.

If you have the extra monthly cash flow required, and you prefer to be in a 15-year mortgage, I’d still look for a 2 percent interest rate improvement over your existing 30-year mortgage to make that change. In your case therefore I’d personally wait until the 15-year mortgage rate hit 3.25 to do it. That’s pretty far away from here and it seems unlikely – barring an emergency crisis or recession – that interest rates will get that low next year.

One other semi-tangential thought for you to watch over the next few years, while waiting for lower interest rates.

In the olden days of the late ‘90s and early 2000s, mortgage rates were roughly around current levels and many people found it advantageous to use floating rate mortgages – known as Adjustable Rate Mortgages (ARMs).

ARMs got a bad name following the 2008 mortgage crisis, mostly because sub-prime ARMs were a particularly painful product that caused a lot of misery. ARMs would start out for 3 years or 5 years at an affordable fixed rate – 4 or 5 or 6 percent for example – but then adjust upward at the end up the time period into a much higher floating rate with 25 or 27 years remaining on the mortgage. For sub-prime borrowers, the rates adjusted upwards into usurious rates like 12 to 14 percent at the end of the fixed rate period. People lost their homes as a result.

But for prime borrowers, ARMs were not inherently terrible, just somewhat risky. I purchased homes with an ARM (twice!) without doing myself harm. I mention this not because you should necessarily refinance into an ARM, but rather to just remind you that these products exist, they are not inherently evil, and there could come a time when it would make sense to consider refinancing into an ARM.

But not yet. Not to get too technical on the shape of the interest rate curve, but ARMs are generally attractive when short-term interest rates are much lower than medium to long-term interest rates. As of this writing, short-term interest rates in the US are remarkably and unusually flat-to-inverted, meaning short term interest rates are actually higher than long term rates. This makes ARMs particularly unattractive right now. So they are definitely not a solution to your problem today.

It’s not impossible, however, that ARMs rates could become attractive before traditional 15 or 30 year mortgages do. Just something to watch out for in the next few years while you hope for improved rates for refinancing your mortgage.

A version of this ran in the San Antonio Express News and Houston Chronicle.

Post read (71) times.