A version of this post ran earlier in the San Antonio Express News

I recently received in the mail retirement plan documents for a local employer’s 403B plan.

I’m going to spend the first part of this column complaining about this 403B plan provider. Later, I am going to offer a better, simpler, version of the plan. And that better, simpler, version of the plan will make 99.5% of all investment advisors throw up in their mouth. But they are wrong and I am right.

But before I complain

Let me start with an important public service announcement first:

403B plans and 401K plans – employee-sponsored, tax-advantaged retirement accounts for non-profit and for-profit employers respectively – are Totally. Freaking. Awesome.

If you have access to one of these through your job, and you are not taking full advantage of these accounts, then drop your newspaper or iPad right now – seriously, right now – and call your HR department and sign up for automatic payroll-deduction investing.

Do it. I’ll still be here when you get back.

What are you waiting for? I said I’ll be right here.

Go!

Ok. Are we good?

Now then, my complaining

I received in the mail this packet entitled “important information about your retirement plan,” consisting of 42 pages, printed on double-sided paper and in small letters. You might be able to guess where this is going.

The problem

I’m bothered not by any deficiencies in the plan, but rather, the opposite. The document provides a gold-plated menu of options.

The problem is that anybody except a sophisticated financial professional would find the choices totally overwhelming.

I did some simple addition and this is what I found:

141 mutual funds of 100% stocks;

38 mutual funds of 100% bonds;

41 mutual funds with a blend of stocks and bonds, in varying proportions;

6 money market mutual funds; (By the way, this is perhaps the most ridiculous part of the whole list. A money market fund is a money market fund is a money market fund. You don’t need 6 to choose from.)

6 fixed return investments;

1 lifetime annuity investment;

And a partridge in a pear tree.

Hello? Is anybody there? This makes me so mad.

Paradox of Choice

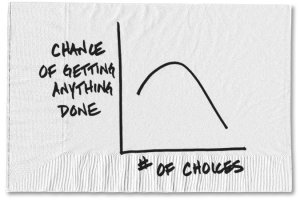

These choices make no sense. You would think the designers of this 403B plan had never heard of the behavioral finance theory known as the ‘paradox of choice’ idea in retirement planning.

Behavioral economists have shown that the more mutual funds you offer, the less likely people are to actually invest in anything. We tend to choose instead to delay decision-making to some later date. And that delay, in the case retirement planning, is a horrible outcome.

An economist’s study using data from fund company Vanguard showed that for every additional 10 mutual funds offered in a retirement plan, the rate of employee participation in the 401K and 403B programs declined 2%.

If you offer 50 additional funds for example, we would expect 10% fewer employees on average to participate in their retirement account.

The decision – due to confusion – to defer contributing to some far-off future date may cost you millions of dollars in your retirement. I’m sure the friendly folks in charge of designing this 403B plan felt good about offering so many choices because, hey, more choices are better, right?

Unfortunately, not when it comes to encouraging people to invest in their retirement accounts.

My solution, as DRAGO

Sometime in 2035, when I am elevated by President Miley Cyrus to the post of Dictator of Retirement Account Great Options (You can just call me DRAGO, for short) there will be two – and only two! – funds to choose from.

In this way I will maximize your participation.

Risky and Not Risky

I will call these two funds Not Risky, and Risky.

Not Risky will never lose you money. Not Risky will provide you between 0 and 2% positive annual returns year in and year out. It will also never make you any money on your money, especially after taxes and inflation.

If you have 10 years or more until your retirement (a key ‘if!’) Not Risky is totally forbidden for your retirement account.

Risky, by contrast, is quite volatile. You can lose as much as 30% of your investment in one year. You can also gain as much as 30% in one year. Viewed over long periods of time, Risky has returned about 9% per year in the last century. Risky is also the only way to actually grow long-term wealth with your retirement account.

In the future with Risky, you should reasonably expect no more than 6% annual returns, over the long run, with tremendous volatility in the short and medium run.

But after taxes and inflation, Risky offers you a far better return on your money than Not Risky, many, many times over.

Finally, as your DRAGO, if you have more than 10 years to go until your retirement account (a key ‘if!’), I will force you to only have Risky in your portfolio.

Retirement money for most of us, remember, is long-term money. For most workers in their 20s, 30s, 40s, and 50s, retirement is more than 10 years away.

Only if you plan to retire within the next ten years (a key ‘if!’), will DRAGO allow you to invest in a blend of Risky and Not Risky.

In this way, I will maximize your wealth in retirement.

You can thank your DRAGO, as well as President Cyrus, for this important service and improvement in your quality of life in your retirement years.

please read related posts:

Stocks v Bonds, the Probabilistic Answer

Book Review of Simple Wealth, Inevitable Wealth by Nick Murray

Post read (2258) times.