The Center for American Progress (CAP) recently published a summary description of their proposals for addressing tax and spending policy, in the light of the ‘Fiscal Cliff,’ Simpson-Bowles, and the ongoing flustercluck of fiscal policy negotiations going on before January 1, 2013.

The Center for American Progress (CAP) recently published a summary description of their proposals for addressing tax and spending policy, in the light of the ‘Fiscal Cliff,’ Simpson-Bowles, and the ongoing flustercluck of fiscal policy negotiations going on before January 1, 2013.

Their summary report is as good as anything I’ve seen yet in terms of both credibility and reasonableness for addressing tax policy and fiscal deficits.

Who is the Center for American Progress? The CAP represents the Clinton Wing of fiscal policy, with such getting-the-band-back-together Clinton Administration veterans as Bob Rubin, Larry Summers, Roger Altman, William Daley, John Podesta, and Leslie Samuels. Before you roll your eyes at those same-old left-of-center Democrats, consider the facts:

- This team produced fiscal surpluses at the end of the Clinton Administration[1]

- This team cut Welfare

- This team is EXTREMELY Wall Street friendly

And, so, now that I’ve established why both the Left and the Right will hate whatever these guys propose, my reply to the haters is that they have fiscal and financial credibility in a way nobody from the Bush era can claim, and they are far from being European Socialists when it comes to policy.

Some specific things I like about the CAP proposals:

- They eliminate the ‘Carried Interest’ loophole, which I wrote about here.

- They tax dividends like ordinary income – as they were taxed for 90 years before 1993[2]

- They raise long-term capital gains taxes from 15% to 28% – as they were taxed after the Reagan tax reform of 1986[3]

- They limit the kind of tax breaks which disproportionately favor high earners, such as mortgage interest tax deductions[4]

- They simplify and reduce the need for itemization of one’s personal tax returns

- They eliminate the Alternative Minimum Tax, aka the Tax Accountants and Preparers Full Employment Act[5]

Here’s the most compelling statement from the summary report:

[T]he real-world experience of raising taxes on those with higher incomes in the 1990s and cutting them in the 2000s strongly supports the view that higher taxes for those at the top – in the range seen in the United State in recent decades – don’t depress growth, and lower taxes don’t spur it. In 1993 when President Bill Clinton raised taxes on the top income earners, his opponents argued loudly that such tax hikes would mean economic decline, with some even promising lower tax revenues as a result. Needless to say, they were proven wrong in spectacular fashion with the longest period of economic growth in US history, increased business investment, 23 million jobs added, and, of course, budget surpluses. Eight years later, President Bush promised that his tax cuts would spark an economic boom. That boom never materialized, but renewed large deficits did. In addition to the clear historical record, study after study has found no relationship between deficit-financed tax cuts and economic growth.

On the other hand, here’s some things I don’t like or don’t understand well enough from the CAP proposals on spending to find credible:

- They rely on a series of health care delivery reforms for fiscal savings. I’ve heard that one before. I’m calling BS on that one.

- They rely on lowering drug costs and Medicare payments for savings. I’ve heard that one before too. If it was easy they’d have done it by now.

- They propose $100 Billion in savings from nondiscretionary programs. “Non-discretionary” to me implies that somebody is going to squeal very loudly when you try to save $100 Billion on their particular non-discretionary item. I’m seeing a political hot mess.

- They propose $300 Billion in new “job creation” spending by the Federal Government. Hey guys? Now you’re just opening yourselves up to being accused of typical lefty Democratic thinking. Just stop it.

In sum, I like the tax side of this CAP Report, and either can’t agree or remain skeptical of the spending side of the CAP Report. But hey it’s a start.

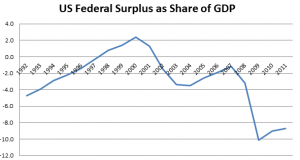

[1] Which is a reminder of the enraging fact that only 12 years ago the big problem was figuring out what to do with the expected fiscal surpluses we’d have by 2012.

[2] And the world didn’t end

[3] And again, the world didn’t end

[4] A helpful reminder of why this is, from their report: A high earner who pays $10K in mortgage interest could potentially deduct $3,500, while a low earner who pays $10K in mortgage interest could potentially deduct only $1,500. They both paid $10K in mortgage interest over the year, but the higher earner gets a much better deal on the deduction

[5] In other words, eliminating the AMT could greatly increase the # of folks who could file their own taxes. Which seems like a good idea to me.

Post read (4889) times.

4 Replies to “A Tax Proposal Worth Considering”

Can you expand more in the interest deduction from the point of a person owning single family homes for rental income? Wall Street friendly? This is the same crew that gave us the repeal of Glass Steagall right? There is a little bad in the best of us and a little good in the worst of us indeed. As always, thanks for your insights.

I definitely can’t give tax advice, so that’s the first caveat.

However, my main thought is that if you own SFRs for rental income, then you’re running a business for which ANY expense, not just mortgage interest, can offset any revenue, before you pay taxes.

So…If you have $10K in monthly revenue from rental properties, and you end up paying, say, $7K in mortgage interest expense, then the entire interest expense nets out with your income. For tax purposes you only need to worry about the difference, in other words the $3K, in remaining income.

Mortgage interest expense for a business is thus very different than the dedicated mortgage interest tax deduction that individuals or households get in the tax code.

Does that answer your question?

Yes sir. Thanks for your clarification.

This is a bit of a tangent but I think it’s important to address comments like: “This is the same crew that gave us the repeal of Glass Steagall right?”

Not really. This is equivalent to saying that Clinton was responsible for the repeal for Glass-Steagall which is something we often hear. These guys were not the architects of Gramm-Leach-Bliley (responsible for the repeal of Glass-Steagall). They get blamed for the wrong reasons.

Of course, we could have an entirely different conversation about value of GLB.