What’s the best age to start a successful company? What is the average age of the founders of the most successful startup companies?

What’s the best age to start a successful company? What is the average age of the founders of the most successful startup companies?

Most important of all, is it too late for me – at the ripe old age of 46 – to become a billionaire, founding the next SnapChat?

A new research paper co-authored by researchers from MIT, Northwestern University, and the US Census Bureau shows the surprising relationship between business startup success and the age of the founders.

We have an image from popular media that startup success is a young person’s game. Venture capital investors appear to target young founders, seeing in them the greatest chance for originality and high-energy. We celebrate the youth of the founders of Facebook and Google. In an earlier era, the founders of Microsoft and Dell all hit the big time before age 30.

In measuring the average age of successful entrepreneurs, and the average age of the founders of highly successful companies, the researchers used interesting data sets. They accessed and built databases from the Census Bureau showing the growth of all non-farm businesses with at least one employee, blended with IRS data showing the K-1 forms for pass-through businesses like S-corporations, and partnerships.

Unlike other studies which typically pick a group of successful businesses and look for patterns, these researchers studied the entire universe of startups in the United States over time in order to describe the most accurate correlations with success.

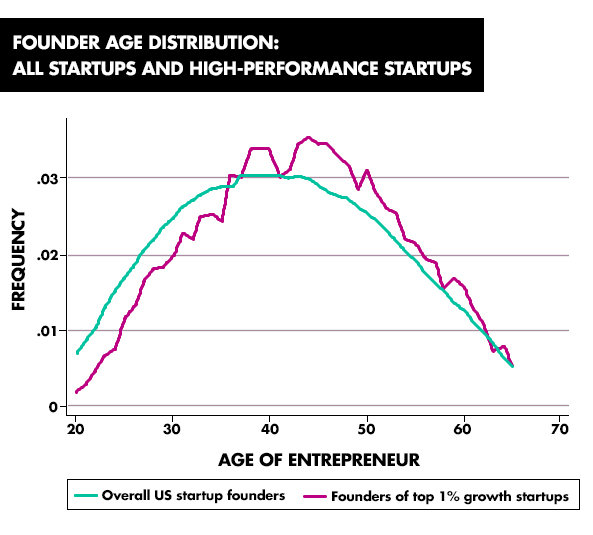

It turns out that when you can track all startups in the US over time, surprising patterns around age emerge.

The researchers first discovered the average age of startup founders, which is a surprisingly non-youthful 41.9 years old.

In journalistic presentations of successful entrepreneurs, especially tech entrepreneurs, the authors note a strong impression of youth. Lists of “Top Entrepreneurs” or “Entrepreneurs to Watch” skew toward people in their twenties or early thirties. That just isn’t the reality of who founds companies in this country.

The researchers then calculated the age of extreme success in startups. This is important because while most startups do not lead to extraordinary greatness, a small number of highly successful companies produce outsized results. Maybe runaway success require a youthful disregard for precedent or a willingness to blow up the traditional way of doing things?

To found the disruptive mega-successes like Facebook, Google, Microsoft, and Dell – do you have to be young?

Their study zeroed-in on unusually “high-growth” companies, the type of company that creates an extraordinarily big economic impact. They calculated the average age of the founder of the top 0.1 percent of startups in terms of employment growth – in other words the best successes compared to 999 of its startup peers. Before I give the answer, want to guess the average age of founder for these companies?

The answer is 45.

In other words, the age of the founders of the very top startups, the one-a-thousand runaway successes, skewed even older and grayer than typical founders.

Beyond that average age for top performers, the researchers found that the probability of entrepreneurial success in general increased steadily with age.

50-something founders were almost twice as likely to succeed at the highest level than 30-something founders. Not only that, but business founders in their 20s were the least likely to succeed. All of this flies in the face of the popular image we get from financial media of Silicon Valley prodigies disrupting everything around them before they’ve been kicked off their parents’ health care plan.

Once we know that decidedly middle-aged founders do better, the logical explanation for this isn’t hard to guess. Youth may boast high energy and a disruptive disregard for the status quo, but age and experience bring even more important advantages to bear. The three most important of these appear to be deep experience in a particular industry, access to financial resources, and harder-to-measure factors like managerial experience and social capital.

If you were an investor looking to back a company in the hopes of outsized success, should you pick youth or age? The data shows you should give your money to the team with the grey hair.

And if you’re an entrepreneur trying to figure out if your best days are behind you, this research suggests the opposite. Your probability of success increases with age.

So, if you’re 45 or older, what are you waiting for?

A logical follow-up thought from this study is whether investors in startups are making an error. Do they back the kids, overlook the olds, and is that losing them money?

One of the authors of the paper, Ben Jones at Northwestern University, described to me two further anecdotal thoughts on that issue, when I talked to him about his paper.

First, young founders often seem to believe that their youth is an advantage, despite the data to the contrary. They self-perceive as “the next Mark Zuckerberg.” For better or worse, they have absorbed the media narrative around young disrupters, especially in technology.

Second, while venture capital investors back firms with founders younger than average, they tend to get thoughtful about their own biases.

Maybe they back younger founders because investors can cut a better deal for themselves? Or maybe investors are swayed by that same media narrative, despite the evidence collected by Jones and his co-authors? There’s potentially a lot of money at stake in the answer to these questions.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

Getting Started – Advice from Hugh Laurie

Entrepreneurship And Backpacking in Mexico

Post read (189) times.