We here at Bankers Anonymous love ex-bankers[1] so it makes sense to throw our two cents in to the discussion on the departure of Bob Diamond from the head of Barclays PLC this week.

We here at Bankers Anonymous love ex-bankers[1] so it makes sense to throw our two cents in to the discussion on the departure of Bob Diamond from the head of Barclays PLC this week.

Journalists love to attach the word “scandal” to his departure, and indeed Barclays got hit last week by a combined $453 million fine from US & UK authorities for LIBOR rigging. At the risk of alienating both my financial and non-financial readers, LIBOR rigging deserves some explanation, which I will do in the next post. But first, Bob Diamond actually deserves an honorary slow clap as he exits the building.

A few points in his favor:

Diamond spends this week being grilled by members of the UK parliament, in a mock trial similar to our own Congress’ recent treatment of Jamie Dimon, except with more paddle than flatter.[2] The parallels to Jamie Dimon include both of their relative successes as risk managers and opportunists throughout the 2008 debacle. [3] In fact, Diamond should be remembered as one of the few prudent banking heads of the 2008 Credit Crunch. To paraphrase Kipling’s If Poem, Diamond kept his head when all the other banking heads were losing theirs in the Fall of 2008. He managed to acquire Lehman’s North American business for $1.75 Billion, which given Lehman’s control of $639 Billion in assets, meant Diamond’s Barclays bought one of the most valuable banking assets in the world, essentially for free. Not a bad trick.

Second, Diamond gets grilled this week by UK parliamentarians and regulators extra hard for the sin of being a US citizen.[4] Barclays’ relative success through the crisis, and its grafting of the Lehman franchise to an old-line UK banking franchise has made him in the UK a convenient short-hand for criticizing perceived American cultural traits and their inappropriateness in the UK financial context.[5] Just as there’s an underlying anti-Semitism to some of the populist element hatred for Goldman Sachs,[6] there’s an underlying anti-Americanism to the piling on of Diamond’s leadership at Barclays.

Third, to extend both the Jamie Dimon and Goldman comparisons, the shadenfreude at Diamond’s fall represents the kind of ‘blame the winner’ mentality which muddles the narrative on the Credit Crunch. Dimon’s JP Morgan, Blankfein’s Goldman, and Diamond’s Barclays are virtually the only success stories of major bank heads navigating the Credit Crunch. Barclays did not need, nor did it receive, a bailout from the UK government, or the US government. This is incredible, and you can’t say that about any other of the other major world banks in 2008.

Yes, it’s true that all major financial institutions benefitted from the explicit and implicit guarantees and bailouts handed out willy-nilly during the height of the crisis. But Barclays did better than anyone. Anyone! And yes, you can’t say that Diamond deserves all the credit for this prudent risk management. But we should acknowledge the relatively outstanding performance if we want to go beyond the simple narrative of “Bankers = Bad.“

Political leaders enjoy giving current bankers the woodshed treatment because it’s more riveting than chastising unemployed super-wealthy, golden parachuted ex-CEOs. But seriously, what about the ones who actually screwed up their banks and still got paid? They’re the ones more deserving of public shaming.[7]

Speaking of getting paid for terrible performance, another point in Diamond’s favor is the fact that he and two deputies had already agreed to forgo their bonuses in 2012 as the LIBOR scandal hit the news, a symbolic gesture which has rarely been matched by other banking heads in the US. I’m confident Diamond will not suffer overly much from this loss of income, but I admire the voluntary approach and wish more executives would take a similar approach when their firms suffer losses or scandals.

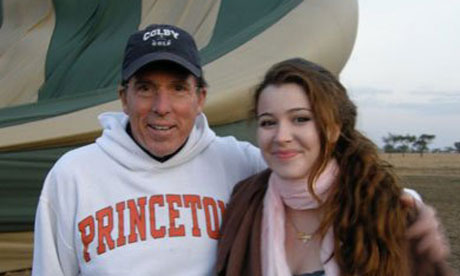

Finally, let’s a raise a toast to Bob Diamond’s newly famous daughter Nell, pictured with her dad at the top of this post, as a result of her politically incorrect tweets, and retweeting other people’s attacks on her dad, on her twitter feed. She was mentioned in this book (page 363) when she was a sophomore at Princeton, urging her dad to try to purchase Lehman Brothers out of bankruptcy. She graduated from Princeton in 2011, which is as good an excuse as I can come up with for linking to this awesome must-see video by a recently graduated Princeton woman.

[1] Bob, hit me up with a DM, let’s do a podcast…

[2] That “more paddle than flatter” phrase makes more sense if you read the previous Dimon post, which you should do right now.

[3]Also, even their names are pronounced similarly! What’s up with that?

[4] Which, just after July 4th makes me need to watch this video: America! F Yeah!

[5] The British are more subtle than us Yanks. An MP named Teresa Pearce tweeted her views of his American-ness in the following way: “Really annoying that Mr Diamond is using our first names. so rude.” Way to stick it to the Colonies, Teresa!

[6] I mean in particular the famous Matt Taibbi description of Goldman Sachs as the “great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.” It’s hard to escape the suspicion that the blood sucking image taps into an underlying mistrust of Jews.

[7] I named all these in an earlier post, but they deserve all the rotten tomatoes we can muster: Ken Lewis at Bank of America, Sandy Weill and Vikram Pandit at Citigroup, Stanley O’Neal at Merrill Lynch, Franklin Raines at Fannie Mae, Joe Cassano at AIG, and Angelo Mozilo at Countrywide

Post read (3063) times.

2 Replies to “Diamond Out. AKA Blaming the Wrong Guy Again”

Totally agree with you. However, as we all know, Mr Diamond was far too visible to be spared. When you get so much controversy regarding your bonuses, mainstreet wants to see you fall, and whatever you do you have no room for even the smallest mistake, which you obviously can’t avoid for ever even if the mistake was not of your fault. It was therefore impossible for Mr Diamond to survive the storm.

I agree, Main Street enjoys seeing someone like Diamond fall as a result of bonus resentment. I do wonder whether Main Street in the UK is more attuned to the bonus issue than Main Street in the US. In the US is it because, as Steinbeck said, “the poor see themselves not as an exploited proletariat but as temporarily embarrassed millionaires?”