One of The Donald’s great strengths is that he latches onto a partial truth – or an unspoken but widely held belief – and then expands upon it for his own purposes. Obviously this can veer into disgusting territory, when it comes to expressing sexually insecure men’s feelings about women, or insecure workers’ feelings about economic threats from China or Mexico. As Matt Taibbi eloquently expressed, he effectively uses this same talent of partial truth-telling to bash government and media elites who do, in fact, disdain, misunderstand, or ignore ‘regular Americans.’ Trump scores these points against Establishment elites because really, we sense some truth in what he says, that others before him won’t say.

One of The Donald’s great strengths is that he latches onto a partial truth – or an unspoken but widely held belief – and then expands upon it for his own purposes. Obviously this can veer into disgusting territory, when it comes to expressing sexually insecure men’s feelings about women, or insecure workers’ feelings about economic threats from China or Mexico. As Matt Taibbi eloquently expressed, he effectively uses this same talent of partial truth-telling to bash government and media elites who do, in fact, disdain, misunderstand, or ignore ‘regular Americans.’ Trump scores these points against Establishment elites because really, we sense some truth in what he says, that others before him won’t say.

Earlier in the week Trump stepped in a pile of it when he expressed truths about US sovereign debt which political leaders cannot openly discuss. Unconstrained by good taste, judicious character, or political consistency – he can pop off in any direction, occasionally hitting on an important point that more people should understand. The Donald said:

“I’ve borrowed knowing that you can pay back with discounts. I’d borrow [as President, on behalf of the US] knowing that if the economy crashed, you could made a deal.”

This is so crazy that he said it – as a person running for President – that you kind of have to laugh at his gall. On the other hand, he’s right. This is what happens when countries borrow too much. And also, we don’t really know – or have any kind of open discussion in this country – about what constitutes too much national borrowing.

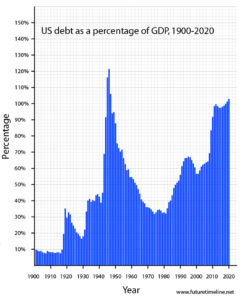

When I worked as an emerging market bond salesman in the late 1990s – slinging bonds from places like Pakistan, Ukraine, Ecuador, Argentina, Russia, and Ivory Coast – we used to put out economic research for our clients that pointed out that a 70% Debt/GDP ratio marked a kind of scary ‘Do Not Cross’ line. If the total amount of sovereign debt exceeded 70% of the economic output of country, you might have to start worrying about whether that country could reliably pay back its bonds. Once you hit 100% Debt/GDP, history seemed to show, emerging market countries would enter a red-zone of risky sovereign renegotiation, or possible default. Their cost of new borrowing would rise, which in turn would hurt their ability to service their existing debt. At between 70% and 100% Debt/GDP, countries could get into a vicious death-spiral of borrowing, ending in sovereign debt restructuring.

At that time, Japan alone among rich countries represented a weird exception to that guideline, with seemingly ‘safe’ bonds offered at very low interest, while maintaining a Debt/GDP ratio of around 100%. Post 9/11, the US and Europe embarked on a new low-interest era, and developed countries seemed to be able to borrow a greater amount than ever before, without adverse consequences. Debt was cheap, borrowing levels rose, and many more countries – developed, and emerging – breached ‘the red zone.’

Present-day debt levels

These days, the US (seemingly comfortably) shoulders a 100+% Debt/GDP ratio, while Japan’s ratio has climbed to 180%. Are either of these ratios too high?

By way of comparison, Greece – which effectively restructured its debt with the rest of Europe in recent years – only had a 150% Debt/GDP ratio. The US now enjoys a previously unthinkable Debt/GDP ratio, seemingly without consequences. I point out these ratios to say that it’s also not impossible that the US would have to renegotiate its debts at some point. Which is why, crazy as Trump is, he’s sort of inadvertently pointed out an important thing.

Don’t get me wrong. In no way do I ‘predict’ a US sovereign debt crisis is imminent.1 Permabears and goldbugs like Peter Schiff like to talk about a coming US debt crisis like it’s a guaranteed future – like it’s a rational reason to:

1. Start buying gold and

2. Buy empty farmland and build bomb shelters.

It’s not. Shortly after the 2008 Crisis in particular, commentators tried to argue that increasing our national debt at our post-Crisis rate would lead to financial Armaggedon. It didn’t.

I just think that – without any current limits on US sovereign borrowing, we might have the impression that we could borrow indefinitely.

Trump’s comments recently made explicit the problem of excessive borrowing that other countries have dealt with on a semi-regular basis. Greece, Pakistan, Ukraine, Ecuador, Argentina, Russia, and Ivory Coast – to name a few – have faced the problem of excessive debt in the past two decades and done exactly what Trump talked about. You sit down with your creditors and have a difficult, adult conversation. We “US exceptionalists” think this is ‘unthinkable’ but really it shouldn’t be. It happens and has happened on a regular basis with many countries. Plenty of unpleasant but semi-banal developments (war, recession, political instability, a Kanye/Miley Cyrus Democratic Party platform in 2024) could put the US’ ability borrow and pay its debts at risk.

Currency control

One of the great advantages Japan and the US hold over Greece (and the rest of the Eurozone) and many emerging market countries is that we control our own currency. Here again, The Donald is our resident genius, in explaining why this is such an advantage:

“First of all, you never have to default, because you print the money. I hate to tell you, okay, so there’s never a default.”

Again, this is totally irresponsible of him to say this out loud as a person running for President, but he’s technically correct and therefore to be credited with bringing complicated unspoken semi-truths to the surface. Dollar-denominated debt becomes only half as expensive in real terms, if you just double the amount of available money, or experience a quick bout of 100% inflation.

There are some nuances here that would make that harder than it sounds coming from Trump’s mouth. Like, you don’t get to trick your lenders more than once this way, because they (the lenders) quickly raise future interest rates to adjust to inflation.2 Also, significant sovereign debt obligations like Social Security, Medicare, federal pensions, and TIPS (an inflation-linked type of bond) adjust payments upward with inflation. But like I said, I admire Trump for bringing up an important unstated half-truth about currencies and sovereign debt.

The US also enjoys another huge advantage relating to its currency – the fact that everybody in the world still wants dollars as a preferred method of trade, and store of value.

The ‘Reserve Currency’ Advantage

In addition to our ability to inflate away too much debt, we enjoy the advantage of a special ‘reserve-currency’ status in the world which acts as an amazing kind of subsidy for our profligacy.

What do I mean by that? I mean something kind of like that joke about the two hunters and the hungry bear. We don’t have to run a great economy or run a great political system, we just have to run our operation better than all the other choices.3 So if you can create (at least the illusion of) the Rule of Law (China and Russia can’t), Growth (Europe and Japan can’t), and Political Predictability (Africa and Latin America can’t) at a Big Scale (Canada, Switzerland, New Zealand can’t) then you get to be the country that controllers of massive amounts of capital want to be invested in.

We attract excess Chinese, Saudi, Singaporean and Norwegian money into our bonds because where’s else can they park huge amounts of wealth? We may have deep structural problems, but so does everywhere else, to an even greater extent. From a sovereign debt perspective, we can outrun the bear better than the others. At least for now.

That’s the part, unfortunately, with which The Donald is not actually helping, though.

Some Ways In Which The Donald Isn’t So Genius

He’s perfectly correct in saying that if the US got in trouble with too much borrowing, we could sit down and renegotiate our obligations. Lots of countries have done this. He’s also perfectly correct that our control over our own currency allows us to ‘inflate away’ the problem, to some extent. What he’s absolutely putting at risk, however, is our special ability to ‘outrun the bear’ in the form of maintaining (at least the illusion of) the Rule of Law, Growth, and Political Predictability.

The following policies will not help our reserve currency status, which is really the key to the US’ sovereign borrowing advantage:

- Building giant walls along our border

- Threatening to default on our bonds

- Threatening to massively devalue our currency

- Forbidding entrance to and/or deporting people based on their religion

- Threatening aggressive trade wars with major bond funders, like China

- Promising to rewrite libel laws in order to quell journalistic enemies

- Encouraging violence against political enemies during public rallies

Now, of course, The Donald will probably say he’s just kidding about all these things. He’s really a more serious person than that, you know he went to a really good school, and he’s really smart and handsome. Lots of women, and even the hispanics, you know, they like him. Maybe bond investors don’t take his little jokes and threats that seriously. Fine, maybe he’s just kidding about all that stuff.

But in my experience, the people who control real capital – the few thousands of wealth managers and bond traders on this planet who ultimately decide whether to continue to roll over the US debt every month – until now rolling it over like clockwork at attractive, low interest rates – in my experience they don’t fuck around.

And by “not fucking around,” I mean they really don’t appreciate heavily-indebted countries, led by hucksters, pushing trade wars and closed borders. They can choose whether – or not – to invest in bonds of countries led by an unserious racist xenophobe who jokingly threatens debt restructuring and inflation. Believe me, they don’t appreciate the joke.

I like our reserve currency advantage. We’ve built a good track record over time of responsibly handling our massive national debts. We’ve been a good bet, and just as importantly perceived to be a good bet up until now, for paying everyone back.

There’s quite a bit at stake here.

Post read (952) times.

- predictions like this are always made by cranks and people with things to sell you ↩

- As our poet-President W. Bush once mumbled “Fool me once, shame on…shame on…You…fool me, can’t get fooled again.” ↩

- At the risk of over-explaining the joke/analogy: We just have to outrun the other hunter. ↩

One Reply to “Donald Trump – Sovereign Debt Genius”

Reading this blog entry is like reading Stephen King novel: great, great, great, so entertained, now I’m terrified.