A friend of mine who bought Facebook shares in the IPO complained last week about its miserable performance post-pricing, and I began to get flashbacks to my time on Goldman’s bond sales desk on new issuance days. I wanted to tell my friend our old bond sales new issuance motto,[1] But, to spare his feelings, I kept my cynical tongue firmly in check.

A friend of mine who bought Facebook shares in the IPO complained last week about its miserable performance post-pricing, and I began to get flashbacks to my time on Goldman’s bond sales desk on new issuance days. I wanted to tell my friend our old bond sales new issuance motto,[1] But, to spare his feelings, I kept my cynical tongue firmly in check.

A not-uncommon new issuance timeline went like this:

10:00 AM: Goldman’s bond syndicate desk would issue hotly oversubscribed bonds to our institutional clients, who would yell at us for not giving them more securities at issuance.

10:01 AM: Sample Dialogue

Favorite Institutional Client: “I’m a *&^% BIG SWINGING [client], and you gave me this *&^#$% allocation? You guys suck!”

Me: “Um, ok.”

Favorite Institutional Client: “Seriously, you @#$%-Heads, lose my number!”

Me: “Would you like to sell them back to us?”

Favorite Institutional Client: “No way, I’m buying more on the open.”

10:05 AM: Quite frequently, the flippers who obtained hotly oversubscribed bonds sold immediately[2] after issuance, driving the price down.

10:20 AM: The same institutional clients who didn’t get enough bonds would then yell at us for selling them such a terrible piece of shit in the first place and why didn’t we support (i.e. commit Goldman’s capital to prop up) the newly issued bonds in the aftermarket?

In the face of such mental artillery fire, we built blast-resistant concrete bunkers around our consciences.

The senior bond salesman would turn to the junior salesman having pangs about his clients losses.

“You know,” he’d say, “Today the issuer made money, and Goldman made money, and clients lost money.”

…beat…

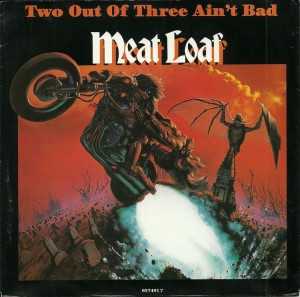

“But hey! Two out of three ain’t bad!”

That always made us smile.

Look, I’m not saying my friend deserved to lose money for participating in a hot IPO. I’m also not saying, as some have, that the issuing bank’s only duty is to pump the new issue price to its maximum saleable level, investors be damned.

In fact, issuing banks know they have both an implied ethical duty to their purchasing investors, as well as long-term financial incentives, to issue new securities at a compromise level that satisfies the issuer’s need for capital yet allows long-term investors to also earn a return on their capital. As is quite nicely articulated here.

But, let’s just say that in the heat of battle and the excitement of a new issue, ethics and long-term interests occasionally take a back seat. To say the least.

To my friends who lost money in the Facebook IPO, Meatloaf said it best:

Your banker wants you, and he needs you, but there ain’t no way he’s ever gonna love you. But don’t be sad, because two out of three ain’t bad.

Post read (6190) times.

2 Replies to “Facebook IPO Bust? Not To Your Banker!”

another awesome, insider article. you are very good at this and should send to CNBC, Bloomberg, huffington, etc.