If you’d like to understand financial instruments used on Wall Street better, but you need a sports or entertainment hook as a spoonful of sugar to make the medicine go down, I recommend this article by Katie Baker on Grantland about the proposed Arian Foster “IPO” deal.

If you’d like to understand financial instruments used on Wall Street better, but you need a sports or entertainment hook as a spoonful of sugar to make the medicine go down, I recommend this article by Katie Baker on Grantland about the proposed Arian Foster “IPO” deal.

[Katie Baker – who I do not know personally – is a hero to me, as she quit her analyst job at Goldman, Sachs a few years ago to become a sports writer (on the hockey beat) for the Bill Simmons/ESPN-sponsored online startup Grantland. The site combines Simmons’ patented sports-plus-hollywood formula with other great writers such as Chuck Closterman, Charles Prince, and Malcolm Gladwell. Grantland makes traditional newspaper sports sections groan-worthy yawn-fests by comparison.]

The Houston Texans’ Pro-Bowl running back Foster announced that a company named Fantex seeks to raise $10 million for him this year, in exchange for a 20% cut of his future football earnings. The “IPO” seems to offer investors a chance to move their fandom relationship with individual players beyond fantasy football, and into an actual investment in the long-term financial success of those individual players. The “IPO” offers the kind of risk profile – as well as upside – of investing in a startup company.

In the article and accompanying sidebar Baker explains some of the myriad details of this new opportunity (e.g. it’s targeted to unsophisticated investors, it’s an entrepreneurial idea that Fantex hopes to reproduce with other athletes, Foster recently tweaked his hamstring, Foster’s future earnings from his children’s book are not included!).

She also makes clear this Foster IPO has plenty of risks, but that it does resemble an innovative risky investment in the upside potential of a star athlete.

Interestingly, to me, the Fantex offering relies on the new “Jumpstart Our Business Startups (JOBS Act),” meant to lower barriers to unsophisticated (less wealthy) investors to participate in risky start-up financing. Passed by Congress in early 2013, as of October 2013 the SEC still is in the process of clarifying provisions of the bill.

What we know so far about the JOBS Act, however, is the following:

1. Smaller companies can limit their obligations to report financial and other information to the SEC.

2. Investors with a net worth far below $1 million (the traditional threshold for sophisticated investors) can buy risky IPOs.

3. Speculative investors such as hedge funds can now advertise their funds.

4. Smaller companies can skip provisions of the Sarbanes-Oxley accounting rules introduced after the Enron debacle.

On the one hand democratizing investment participation allows non-sophisticated folks an equal chance to get-rich-quick by participating in risky investment schemes. In addition, I’m all in favor of entrepreneurs accessing capital more cheaply and with fewer barriers.

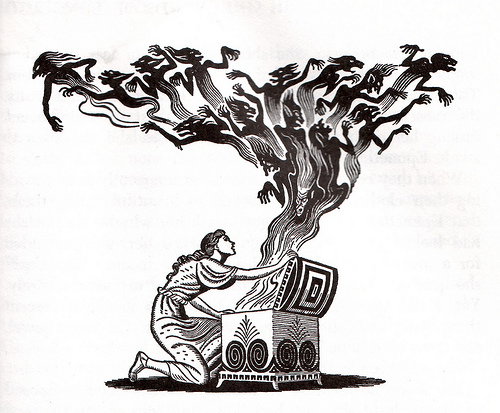

On the other hand, I probably don’t need to spell out the obvious opportunities for fraud, trickery, moronic investing choices, and inappropriate speculation all opened up by the JOBS Act.

All in all, we’ve reintroduced more Wild West into the system. The Arian Foster represents the highest profile example of this new Wild West. This will be interesting to watch.

Historical celebrity-backed investments

Baker goes back in time to explain the most famous example of combining a celebrity entertainers future earning with Wall Street magic – The famous David Bowie bonds. Bowie needed money for his divorce as well as separation with his manager, but did not want to sell outright the rights to his song. Instead, a financier created bonds backed by the future royalties from Bowie’s existing hits.

As an investment, Bowie bonds represented a safe, limited-downside opportunity from a well-defined revenue stream. An insurance company – a typically risk-averse investor – bought all $55 million Bowie Bonds in the late 1990s. Following payment of the bonds, Bowie retained future royalties and any excess beyond what the bonds required. Presumably he still owns those songs, while Prudential got paid a modest return on its bond investment.

The Foster deal, by contrast, only works as an extremely risky start-up type investment. We really don’t know what kind of future earnings Foster will have. Fantex retains discretion to make payments, or to convert Arian Foster stock into general stock in Fantex. Foster ‘stock’ will trade on a Fantex exchange, with Fantex earning 1% per transaction. Practically anything can happen to a football player’s earning potential, many of them bad.

I’m sure there has to be some situation in which investors make money, but I’m equally sure Fantex depends on the ‘fantasy-football’ fun aspect of this to attract investors, rather than the correct pricing of investment risk.

“You own Tom Brady in your fantasy team? Bro, that’s nothing! I own a piece of Arian Foster’s future earnings, Bro! I’m CRUSHING IT Bro!”

That kind of thing.

Concluding thoughts

If Fantex finds enthusiastic investors, Foster gets upfront money, and fans have a good time with the opportunity to gamble with real dollars and at least some probability of upside. All this sounds cool to me.

To be clear, as an investment I find this an absurd idea, and even the ambiguous morality of it also deserves attention.

I appreciate, however, the opportunity to talk about securitization – of David Bowie royalties or any other cashflow – in reasonably complex yet digestible ways.

Most importantly, I’m interested to see how the JOBS Act turns out.

Unleashing capitalist potential – Pandora’s Box!

Post read (8115) times.

2 Replies to “If You’d Like To Understand Financial Instruments But Need A Sports Hook”

The JOBS Act definitely cuts both ways. The risks are obvious but hey, there are already lots of people on Lending Club.

In my own situation I am an investor in a startup that piggy-backs on an already-established (15 years) product. We wanted to build a new manufacturing facility dedicated to this new product. We have had a difficult time finding financing because venture capitalists demand a lot for their money. If we were just a couple of guys with a drawing and some circuits on a bread board I’d understand but this is an established concept with customers already lined up.

We have opted to re-scale our business to use the existing facility instead of building out a new one for the new product. However, we plan on trying to use this new venue to raise the capital for the new facility.