UK economist Anthony Atkinson published a book “Inequality: What Can Be Done?” in May of this year in which he proposes radical solutions to the most pressing financial problem of our time.

I thought I’d heard all the important arguments on the topic, and then this economist comes along with a totally bonkers idea that will never work.

“Hahaha, that Atkinson, what a goofy dreamer” I said to myself.

And then, over the next few days, I kept thinking about one of his totally bonkers ideas. It gnawed at me. And I realized that – practical and political objections be damned! – that is a pretty awesome idea.

That’s the way I feel about Atkinson’s ‘Universal Inheritance,’ which goes something like this.

Every eighteen year-old, upon gaining the right to vote, automatically receives an ‘inheritance’ from the federal government of some amount of money. Atkinson proposes a universal inheritance in the UK of 5,000 pounds, or about US$8,100 per kid.

Now, as a father I’ll be the first one to say, instinctually, kids shouldn’t inherit money. I mean, their brains have under-developed frontal lobes! They’re undeserving and can’t handle that kind of responsibility.

Also, as an American deeply immersed in the dominant financial paradigm that ‘Money for Nothing’ works as a Dire Straights anthem but not as social policy, my first grumbly thought about this idea was ‘those kids will probably just squander their $8,100!’

I can already picture the insidious marketing campaigns launched by Las Vegas casinos as soon my legislation for ‘universal inheritance’ for 18 year-olds passes Congress.

Because of curmudgeonly American fathers like me and similarly grumpy readers like you, clearly Atkinson’s universal inheritance has ZERO chance of happening anytime soon in the United States. Yet I’m intrigued by the thought experiment so let me tell you why I see this as an interesting, possibly awesome, idea.

And by the way, for those of you reading this, who picture a Red Socialist hammer and sickle above my head, I really don’t see this in bleeding-heart liberal terms. I see it as an affordable solution to a failure of the free market, the under-development of talent in an economy.

For the poor but ambitious, could a universal inheritance be the key to continuing their education?

For a huge number of 18 year-olds today, a lack of capital will prevent their enrollment in the next educational program beyond high school, whether that’s an apprenticeship/internship at a business, an associate’s degree, a state college, or an elite four-year private university.

Yes, scholarships exist in limited form to help some of those kids, and yes, some of the ambitious poor will manage to bootstrap their way to educational success. But even those lucky few will find financial roadblocks that scholarships don’t cover, like SAT prep courses, application fees, book fees, and transportation costs.

Clearly, with the cost of higher education these days, a $8,100 inheritance doesn’t get you very far along in a multi-year degree program. But it might be enough to make a start possible.

Why do I like the idea of a ‘universal inheritance’ rather than just further federal subsidies for student loans? I think because the universal inheritance is more flexible – it allows for more solutions than simply more ‘higher education.’

In my optimistic imagination the starter funds of a universal inheritance prevent the national tragedy of young people stuck in an economically-inefficient rut.

For a cohort of eighteen year-olds, a lack of capital may prevent their move from one employment backwater (a small town, a one-company suburb, a dying inner-city) to a more vibrant economy, in need of young workers.

In Queens, New York last month the young woman helping us at the car rental counter mentioned that “If I could just get $5,000 together somehow, someway, I could finally pursue my dream of moving down to Florida and becoming a designer. But until then, I’m stuck here.”

The way she described it, her $5,000 dream in life seemed like it might be years away. I’m picturing this universal inheritance as a one-time opportunity, if used wisely, to fulfill a dream otherwise impossible for children who come from poorer households.

I obviously don’t know what household situation the counter worker at Budget Rental comes from. I do know $5,000 doesn’t hold back other children, who drew a luckier lottery ticket by virtue of their birth family, from pursuing their life’s dream.

For the poor and entrepreneurially ambitious, could a universal inheritance be the key to starting a business?

The bus or the airplane ticket out of town. The first few months’ rent away from home. The new clothes for work, or for a job interview. The tools of a trade. The instruction manuals or training software and laptop. The initial inventory for a sales project. Partial tuition to a computer coding school.

With approximately 4.3 million 17 year-olds in the US, the annual cost of the universal inheritance program could be around 35 billion.

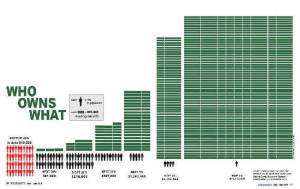

Clearly, the universal inheritance would make little difference to 18 year-olds from the top 10 percent of households, who control over 70 percent of the nation’s wealth, and even less difference to the top 1 percent of households who control close to 35 percent of the nation’s wealth. For them, this universal inheritance is just a lovely perk, a nice trip to Europe or an extra cushion for college expenses.

The bottom fifty percent of US households, by contrast, control 1% of the total wealth in the United States.

What that means, in practical terms, is that half of all teenagers become adults with no capital from their families at all to assist their next move in life, whether it’s work or further education.

In my optimistic imagination this one-time infusion of capital for everyone could create some opportunities.

See upcoming post:

The only feasible way ‘Universal Inheritance’ happens

See related posts on inequality

Washington Post interactive map showing inequality

Post read (791) times.

4 Replies to “Kooky and Good Idea To Address Inequality”

This universal inheritance idea has at least three problems that prevent it from solving the inequality problem. One, as you mentioned, is that it is given to young people. Young people from poor backgrounds are unlikely to know how to spend money wisely as they have few examples of wise money use to draw upon. Therefore, as you point out, most young people will spend the money on bling, or a car, etc. A slightly better idea would be a “one-time” inheritance that could be taken at any point in a person’s life when they could really benefit from it. (Still not a good idea as it might be used to pay rent, etc.)

Another problem is that when people get money to use for, say, college, demand for college goes up, and then prices go up. It’s a similar argument to raising the minimum wage. It helps for awhile, but soon prices rise and we’re right back where we started from.

A third reason this won’t end inequality is that the “abled” kids, the smart ones, are the ones who, in that dream of yours, would benefit. The less-abled kids, the less intelligent, will not know how to use the money wisely, and will squander it, gaining little, and end up with little. And still be disadvantaged shortly thereafter. This idea would help a small percentage of the kids, those “smart” enough to use it wisely, but leave the rest just as disadvantaged as before.

If you really want to end inequality, go to straight, sustainable distribution of resources.

To clarify my argument a little, much of the reason for inequality in the first place is due to competition; all other things being equal, the smart will end up with more than the less intelligent. So, yes, giving some money to kids will help some smart poor kids do better against some dumb rich kids, but it does little for the less intelligent poor kids.

In fact, a system based on competition (i.e. capitalism) will always lead to inequality. And let’s face it, there are some people who are never going to be able to compete (and win the competition).

So much better to have a society based on cooperation where _everyone_ can win.

Michael,

Thanks for your comment. Like you, I have reservations about the idea, even though I’m intrigued. Also, this is far from ‘solving the inequality’ problem, and more like an intriguing experiment that could have economic and social benefits that outweigh the societal cost.

On your first objection – I’d push back on your assumption that that poor kids are more likely to squander because they have few examples of wise money management. I’ve seen plenty of examples in my life of middle class and rich kids also squandering opportunities. Foolishness isn’t exclusive to the poor. And kids are generally irresponsible no matter what class they come from, that’s a given!

On your second objection – I agree that prices rise with extra demand, but I doubt the scale of this proposal ($8,100 per 18 year old), as well as the fact that it doesn’t have to be spent on college education but instead could be used for travel, or debt repayment, or starting a business, would lead immediately to price raises. It might raise prices, but I bet it wouldn’t be so large an effect as say, subsidized federal loans or just low interest-rates, for that matter. But, you raise a valid concern.

On the third objection – possibly you’re right, inequality is inevitable, and there’s no point trying to even up opportunities a bit more, at least at the outset of one’s working life. I take a more optimistic view: Given better opportunities, many of the disadvantaged 50% of this country (remember, they have, on average, zero net worth, by virtue not of their own efforts and talent, but rather, that of their parents) would rise to the occasion and succeed wildly. Or at least succeed mildly, and succeed better than their parents.

In any case, thank you for your comments and for engaging in the thought experiment.

Thanks, Banker, for replying. I look forward to reading more of your posts.