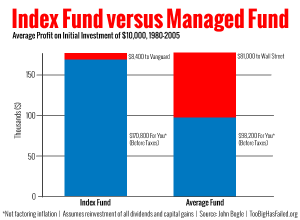

Lately I’ve taken to saying boldly and loudly to anyone who asks my opinion (and some who don’t!) that every academic study ever done on actively managed (high cost) mutual funds vs. passively managed index (low cost) mutual funds shows that, in aggregate, the actively managed funds under-perform the passively managed funds by approximately the difference in fees charged by actively managed funds.

That’s the central and ongoing conclusion of not just the first edition of Burton Malkiel’s A Random Walk Down Wall Street, but every updated edition since the book first appeared in 1973. Although Malkiel’s view has won the academic battle, still the combined marketing heft of the actively managed mutual fund industry has not yet conceded the war.

Investment strategist and and nationally syndicated columnist Scott Burns of Asset Builder – points out in this post yet another important article debunking the usefulness of actively managed mutual funds, when compared to their admittedly doughty but nevertheless more profitable younger siblings, index mutual funds.

If you’re curious to dip your toe into these ideas, I recommend starting with Scott Burns’ post, then move on to the article itself.

Please see related posts:

Book Review of A Random Walk Down Wall Street, by Burton Malkiel

Book Review of Investing Demystified by Lars Kroijer

Post read (2402) times.