Our hosts drilled a total of 239 wells in South Texas, which at $7 million per drilled well would indicate a $1.7 Billion investment in drilling wells alone by this one company. They also report a $440 million investment in a fracking team, plus major investments in building collection points for their product and pipelines to move it. Given that they are only the 12th biggest independent operator in the area, it’s easy to see how companies have invested over $100 Billion the Eagle Ford shale play alone.

Our hosts drilled a total of 239 wells in South Texas, which at $7 million per drilled well would indicate a $1.7 Billion investment in drilling wells alone by this one company. They also report a $440 million investment in a fracking team, plus major investments in building collection points for their product and pipelines to move it. Given that they are only the 12th biggest independent operator in the area, it’s easy to see how companies have invested over $100 Billion the Eagle Ford shale play alone.

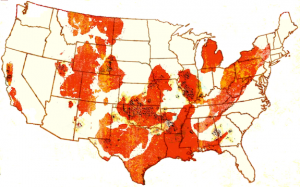

Nationwide, industry author Daniel Yergin reports an estimated 1.7 million jobs will be created in the natural gas revolution, with an estimated additional $62 billion in Federal and State taxes collected in 2012 as a result of this activity.

The New York Times reports that the largest 50 oil and gas companies spent $126 Billion per year in the United States, over the last six years, in new oil and gas drilling and land acquisition.

For my friends who look in dismay at the drilling industry and fracking in particular I’m compelled to point out that this kind of money doesn’t scare easily. The anti-fracking folks are working hard to find evidence of environmental and health damage as a result of the fracking revolution, and will no doubt do their darndest to keep the pressure on, but they have a tough fight on their hands with this kind of major capital.

A Silver Lining on this Massive Scale, Maybe

There is one silver lining, however, to this kind of massive, money-intensive operation. From a safety and environmental perspective, paradoxically, huge scale could be seen as good news. Big, corporate, capital intensive businesses are all about reducing risks, which will make them extremely sensitive to environmental liabilities and public relations liabilities, in a way that wildcatters simply won’t be. That’s the theory at least.

Of course, our host company gives the State Rep and me the pitch on how safe fracking really is, and the safety mechanisms involved to prevent ground-water contamination.

The gist of his presentation, since you’re curious, is that a series of concrete tubes in overlapping layers prevents fracking fluids, and the eventually extracted hydrocarbons, from leaking into our groundwater. We hope.

See also Part I – Mad Max Bizarro World

Part II – Big, Corporate, Well Capitalized

Part III – The Drilling and Fracking Scene

Part V – The Labor Market in the Eagle Ford

Post read (2397) times.

One Reply to “Natural Gas Revolution Part IV – How Big Is This?”

Hi Banker. New reader. Great site.

I have to wonder about the costs of adding things to support the industry going smoothly-things that humans need. Roads, buildings, water delivery, electrical grid expansion, homes, cell towers, etc.

Not everyone is willing to sleep 3 or 4 to a trailer in a chilly parking lot. So…stuff needs to be developed-rather expanded. Water has to be pumped in,waste has to be treated and disposed of. More police and other safety forces will be need and eventually be hired and paper-pushers will be needed.

I am sure many private landowners and local governments are rolling about in the trough full o’ cash but…if fracking moves beyond a quickie drill on each site to an installments that are sucking out the gas perpetually, then supporting industries have to come into play, in order to make the humans happy to work with the machines.

Not unless fracking is just a gold-rush of sorts, leaving rotted camping tents and dusty ghost towns in the wake.

I am very pleased to see work with decent wages being paid ,as well as for an energy source to be utilized that benefits the consumer. However, as we all know , everything has a cost. Have you read about any plans that the municipalities have concocted to help with development and sustaining past the rush?? Are they creating bonds or something? After all , these are small towns and rural areas that are seeing an influx of people.

(The imbalance of males to females will lessen eventually, esp if the amount of money the guys are making keeps getting published.)

All I have read about are fortunate landowners going on luxury trips and city coffers following with revenues. Not unless Lucky the Leprechaun from Lucky Charms cereal is going to appear with a cauldron of gold (like he does at the Fed, Treasury and ECB), this might be a sticky situation.

Look at how the suburbs and core cities are trying to maintain the same services with less revenue.

(BTW, I like happy chickens and buy them as often as I can, in reference to your last post in the series. I pay dearly for the cheerful foods on my plate. )

Thanks.