A key reason why I started a discussion of public pension funds in Texas by saying “Don’t Panic” is because 88% of Texans covered by a public pension plan are participants in one of just four plans, and the good news is that none of these four are in distress. Right now.

A key reason why I started a discussion of public pension funds in Texas by saying “Don’t Panic” is because 88% of Texans covered by a public pension plan are participants in one of just four plans, and the good news is that none of these four are in distress. Right now.

The largest four pension plans – Teachers Retirement and Employee Retirement System (TRS), Employees Retirement System of Texas (ERS), Texas County and District Retirement System (TCDRS) and Texas Municipal Retirement System (TMRS) – cover over 2 million Texans. So no distress means you can stay calm.

On the other hand, if you had a worrying kind of paranoid view of public pensions – like I kind of do – you would notice that size should inversely correlate with complacency. The bigger they come, the harder they fall, as Jimmy Cliff and others point out.

The problem of size

If the Teachers’ pension system goes poorly – or any of these four go poorly – we can’t rely solely on my three rules of thumb to alert us.

We need an additional layer of scrutiny because the absolute scale of the problem is what we should worry about. The bailout for miscalculating on this scale might swamp the state budget.

This is what people in California worried about in the aftermath of the Great Recession in 2010, or what people in Illinois this year worry about. Namely, might the entire state of Illinois have to seek bankruptcy (or its legal equivalent) as a result of unfunded pensions?

Review of the Big Four

Four state pension plans dominate the Texas public pension scene, with over 2 million Texans participating.

Of these, the Teachers’ Retirement System (TRS) is the big gorilla, about six times as big as the next biggest pension system, with about 1.5 million members and over 150 billion in assets, as of its 2015 report.

Of these, the Teachers’ Retirement System (TRS) is the big gorilla, about six times as big as the next biggest pension system, with about 1.5 million members and over 150 billion in assets, as of its 2015 report.

The funded ratio of the TRS – the ratio between estimated assets and estimated liabilities, stands at 80.2 percent – or just at the point where reasonable observers feel comfortable most of the time. Remember, 100 percent means fully funded, but many funds do just fine running in perpetuity in the 80 to 90 percent region.

Meanwhile, the time to amortization – the estimated number of years it will take to fully fund teachers’ pensions – stands at 33 years, which is a bit on the high side. The Pension Review Board would prefer 15 to 20 years, but according to the state legislature, 40 years is the panic point, statutorialy speaking.

Finally, TRS estimates investment returns of 8% going forward, which seems too high to me, roughly in the top quartile of estimates. It’s not totally out of line with other pensions nationally, but it’s not a conservative estimate either.

One of the next biggest, the Employees Retirement System of Texas (ERS) resembles TRS in the sense of a 76.3 percent funded ratio, as well as a 33-year amortization, or time to pay down its unfunded liabilities. Back in 2014, the ERS reported an “infinite” amortization time period, essentially meaning it would never pay off its debts. So while 33 years is uncomfortably long, it also represents a step in the right direction from the previous years. The ERS also assumes an 8% return, which again isn’t conservative.

The two other big pension systems right now appear in healthier shape than either TRS or ERS. The Texas Municipal Retirement Systems (TMRS) scores higher than the first two, with a funded ratio of 85.8 percent, and an easier 17-year amortization. It’s 7 percent return assumption also means it has more room for error in its model, in case markets do not cooperate over the coming decades.

Meanwhile, the Texas County and District Retirement System (TCDRS) has a pretty comfortable 90.5 percent funded ratio, meaning estimated assets cover nine-tenths of estimated liabilities. In related news, actuaries estimate it will take only 9 years to amortize its debts. These levels for the TCDRS look good enough that the 8 percent return assumption feels less threatening.

Taken as a whole, these four systems indicate acceptable levels of risk as of now. They also mostly compare favorably with pension systems in other states.

Taken as a whole, these four systems indicate acceptable levels of risk as of now. They also mostly compare favorably with pension systems in other states.

A little panic

Ok, do you want to be a little bit scared? Fine, I’ll help you.

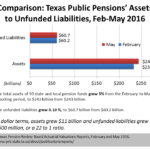

Josh McGee, Chairman of the Texas Pension Review Board, points out that these four big pension plans in general, and the Teachers Retirement System in particular, run an additional risk beyond the normal risk – simply based on their massive sizes.

You see, if a small pension plan goes bust, a responsible government entity has a problem of filling in the hole, but the hole might be, and hopefully is, manageable through belt-tightening, cutting future benefits, and higher taxes.

But the TRS, with an unfunded future liability a little more than $33 billion, is too big to fix, if something goes terribly wrong.

Just to attach a sense of scale to the $33 billion figure, the state of Texas spent about $112 billion on everything last year, so it’s not like a $33 billion hole can be solved by any reasonable measures. TRS looks fine-ish right now, but failure is too big a financial risk for the state to run, so extra caution is needed.

I still say “Don’t Panic” but I’d also say don’t get too comfortable either. A little bit afraid might be just right.

A version of this post ran in the San Antonio Express News

Please see related posts:

Public Pensions – Don’t Panic, Use Heuristics

Public Pensions – Dallas Police and Fire Pension System Clusterfck

Public Pensions – Houston Might Have a Problem

Post read (473) times.