Editor’s Note: A version of this post appeared in the San Antonio Express News “So…Money” column.

The only “C” I got in college was in Intermediate Macroeconomics, but I remember one economics term that I really loved — the “Giffen Good.”

With ordinary, rational, economic behavior, we expect that when prices go up, people buy less, and when prices go down, people buy more. We buy more things, for example, at Wal-Mart and Costco because of their low prices. We buy fewer things at Nordstrom because of their higher prices. Makes sense, right?

A Giffen Good — named for a 19th Century Scottish economist named Sir Robert Giffen — is an odd thing. It’s something that people buy more of as the price goes up. With a Giffen Good, people act in exactly the opposite way we would normally expect them to in response to the price of things.

When you look up Giffen Good in Wikipedia — as I just did to refresh my memory — you read that little evidence exists for Giffen Goods in the real world, and people do not generally purchase more of something when the price goes up.

When it comes to our investments, however, I totally disagree with Wikipedia.

Ever since learning about Giffen Goods, I see them everywhere, as well as what’s known by analogy as “Giffen Behavior.”

Outside of the investing world, I remember reading with much interest the story of a guy trying to get rid of his mattress. He posted a “Free Mattress, Used” notice on Craig’s List, and got no responses. When he posted “Mattress, used, just $10,” he had to turn away interested buyers who lined up with their trucks to try to take advantage of a great bargain. That’s a Giffen Good.

Here’s an example of a Giffen Good from the art world: Imagine if I landed on Earth knowing nothing about art and somebody offered me the Edvard Munch painting “The Scream” for $1,000 to hang in my living room.

I don’t know about you, but I might just think, “Whoa, that’s kind of a lot of money, and although there’s something neat about the painting, it’s still a bit creepy.”

And then I might think, “How about I give you $75 for it?” Because I love a bargain.

Of course, knowing that somebody else paid $120 million for it last year changes its attractiveness to me. Would I sell every single one of my worldly possessions right now to own “The Scream?”

Duh. I’m a finance guy. Of course I would. That painting is the ultimate Giffen Good.

Shifting from the absurd to the irrelevant, a concept like Bitcoin suddenly became everybody’s most desired tulip bulb last year when the price starting shooting upward, making it the Giffen Good of 2013.

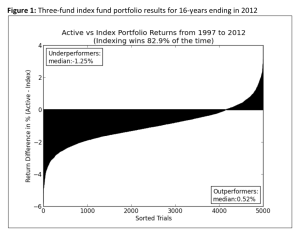

And now lets return to the core of ordinary investment behavior: Discretionarily-managed equity mutual funds typically charge 0.75 to 1.5 percent management fees, while equity index mutual funds typically charge one-third of that amount in management fees, despite offering the same long-term results, according to every academic study that’s ever been done. Like, ever.

Most investors figure — wrongly — that if the fees on the discretionarily managed equity funds are higher, they must be a better product. The lower-priced index mutual funds just seem less attractive. That’s a Giffen Good.

In fact, much of the time, the entire stock market is an example of a Giffen Good. We really don’t want to own stocks when they fall in price. On the other hand, we really, really, really get interested in stocks after they’ve jumped 10 to 15 percent a year for a couple years in a row. This is madness, of course, but it’s also exactly what drives much investing activity.

Beware of your own Giffen Behavior.

Final note: Real, live economists reading this may object to my imprecise adaptation of an economic term for the popular illustration of a personal finance concept. In anticipation of their objection, I can only show them my previously mentioned “C” on my college transcript. Also, lighten up, dismal scientists.

Please see related post: Guest Post by Lars Kroijer – Agnosticism over Edge

A book review of Investing Demystified by Lars Kroijer

Post read (4195) times.