My 5-year old daughter recently visited Disneyworld.[1] My main message to her, before she left, was to “make sure you do some financial due diligence while you’re there, maybe you want to buy some stock in Disney?”

My 5-year old daughter recently visited Disneyworld.[1] My main message to her, before she left, was to “make sure you do some financial due diligence while you’re there, maybe you want to buy some stock in Disney?”

What? Like you wouldn’t give the same message to the 5-year old in your life?

A week earlier, I’d asked her if she wanted to take all the money in her bank account – mostly earned by losing teeth plus birthday/holiday gifts – and buy stock in a company.

She replied with an enthusiastic “NO!” I breathed deeply and silently recalled to myself the Jack Handey classic “The face of a child can say it all, especially the mouth part of the face.” Kids are so funny sometimes. Also, easily ignored.

Anyway, as I prepared to help her buy her first stock, this Disney trip came up, which explains my due diligence request.

I had already forced my older daughter – now 10 years old – to invest her bank account in an individual stock two years ago, and she’s grown her money by about 20% since then. Not bad, not bad. I explained those long-term prospects to my youngest, and she began to get a bit more interested.

Her excitement

By the time she returned from Disney (as I had evilly predicted) she was ready to buy shares.

I asked her how the trip went. Was it magical? Did you meet any princesses? Can you update my forward projections for Q1 2016 EBITDA, based on weather-adjusted, retail foot-traffic model per square footage? (I kid, I kid.)

Then I asked my real question.

“Now that you’ve seen Disneyworld, do you want to buy a little piece of it?” I asked a few days ago.

“No Daddy, I want to buy all of it!” she replied. (Good girl! A touch of megalomania underpins many great investors.)

“Also, Daddy, I want grow my money” she added. (Yes! Internal Daddy fist pump!)

“Also, at night when nobody is there I want to ride the rides.” (Ok, we’ll see. I can’t promise that.)

DPPs, DRIPs

One thing I like about Disney stock for my daughter’s first stock purchase is that they offer – like many other megasize companies – simple conveniences for long-term buy-and-hold investors. Specifically, two things:

- The chance to purchase stock directly from the company via a DPP (Direct Purchase Plan) rather than through a broker.

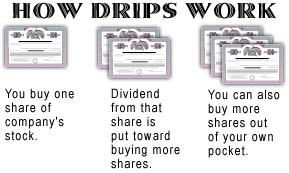

- A DRIP program (short for Dividend Reinvestment Plan) that purchases additional fractional amounts of shares with each quarterly dividend.

Many other companies besides Disney also offer DPPs and DRIPs, and I recommend visiting sites like Shareowner, Computershare, and Broadridge to see extensive choices in public companies offering DPPs and DRIPs.

When I began the process of setting up a direct purchase through Disney, another issues arises, namely the creation of a Custodial Account, known as an UTMA.

What the UTMA?

Children in Texas (where we live) may own stocks through an UTMA (Uniform Transfers to Minors Act) account, which means an adult in their life gets to make all the investment decisions, but that control of the money reverts to the child upon turning twenty-one years old. I mention this not because it’s interesting or relevant to my 5-year-old, but just for you old folks contemplating something like this and wondering about the mechanics of it all.

My priorities with investing

I will not show my daughter the price/earning ratio, the annual report, or review senior management, at least for a dozen more years. I will not show her a chart of stock prices, as I’m not going to teach her to ‘trade’ stocks. There is no ‘trading stocks’ in my universe.

Also, for the record, I don’t even think most adults should bother buying individual stocks, as a diversified stock mutual fund probably does a better job of growing our money in the long run. In that sense, I only recommend individual stocks for kids as a learning experience.

All I care about with this exercise is teaching her three things.

- You (little tiny you!) can be an owner of a small piece of big companies. Even (especially!) an owner of companies we buy stuff from.

- When you’re an owner, the company shares their profits with you every year.

- Over a long period of time your money can grow on your money, And that money-on-money growth is a lot easier than working!

The fine print

A couple of additional small-print notes: Kids, obviously, don’t deserve free money. A cooler way to do this would be via an IRA if your kid has legitimate outside-of-the-home income (mine doesn’t). I’m not a lawyer and this isn’t legal advice. I’m not a CPA and this isn’t tax advice. For that matter, I’m not even an investment professional and this isn’t investment advice. Disclosure: Outside of this $500 Disney investment for my kid I don’t own any Disney stock. Fuller disclosure: As a household we own dozens of princess dresses, mostly of Elsa.

A version of this ran in the San Antonio Express News.

Please see related post:

Daughter’s First Stock Investment – My terrible awful idea

[1] She traveled with the rest of my family – minus me – because I don’t do Disneyworld.

Post read (897) times.

2 Replies to “Tiny Person’s Tiny Piece of a Big Company”

I am actually a bigger fan of opening an IRA in my name, and designating it for the kid. My biggest issue with UTMA accounts is that if your kid goes through an idiot stage that encompasses their early 20s, you don’t want them to have the option of cashing out that account to pay for their idiocy.

If your kid struggles with something like alcoholism or drug addiction in their teens, you’ll definitely want to re-think the idea of a UTMA account. However, if you use an IRA, it is always under your control. Better yet, if you use a Roth IRA, you can withdraw the contributions to transfer them to your kid, while continuing to let the earnings grow tax free.

All good points!